Sugar #11 Jul’21

Yesterday’s shortened session had seen early gains eradicated to finish lower however that was quickly forgotten with a steady stream of buying pushing into the Jul’21 over the course of the morning to pull the value back above 17c with an initial high recorded at 17.13. Selling remains thin on the ground and this factor naturally aided the push upward though things then stalled and for a few hours we struggled to work beyond the morning highs, raising questions as to how much more the specs are likely to buy in the near term with the most recent COT report showing that the net long has grown to 250,125 lots, the largest figure reported this year. The relative calm that had now developed for the market was maintained through the afternoon and though a few upward pushes extended the range a little to 17.27 it lacked the necessary drive to continue and the price eased back once more to sit at the upper end of the range once again. Nearby spreads showed little movement throughout the day and reaching the close we found defensive buying to ensure that Jul’21 was held above 17c, ultimately positing a positive settlement at 17.12. Where we head next is open to question, many have interpreted the May’21 tenders as negative despite the push to expire it more positively on Friday night, though in reality we are likely reliant upon the specs to instigate the direction while both producers and consumers remain so passive.

Sugar #5 Aug’21

A mixed opening soon gathered some buying and resuming from the long weekend the Aug’21 contract was quickly trading upwards into the lower $450’s where some consolidation ensued. While on the surface this represented a solid gain and platform from which to continue in reality we were again losing ground relative to the No.11 with white premium values continuing to be under pressure, while the same could be said for the nearby spreads which saw the Aug/Oct’21 discount widening. The pattern did not change as we moved into the afternoon with the flat price continuing to swing between $450 and $454, but given the volatility was lower than many recent days the front month volume was actually fairly decent. This volume was not matched further down the board where thing remained rather illiquid, though here too we were weakening versus the No.11 as the lack of support took its toll. The Aug’21 trading band was only broken as we approached the close with sellers pushing the price back below $448 until some defensive MOC interest arrived to ensure a marginally higher settlement level at $449.80.

As stated above the white premium weakness continues and we reached today’s lows late on with weak closing values at $72.25 for Aug/Jul’21, $77.25 for Oct/Oct’21 and at $80.00 for March/March’22.

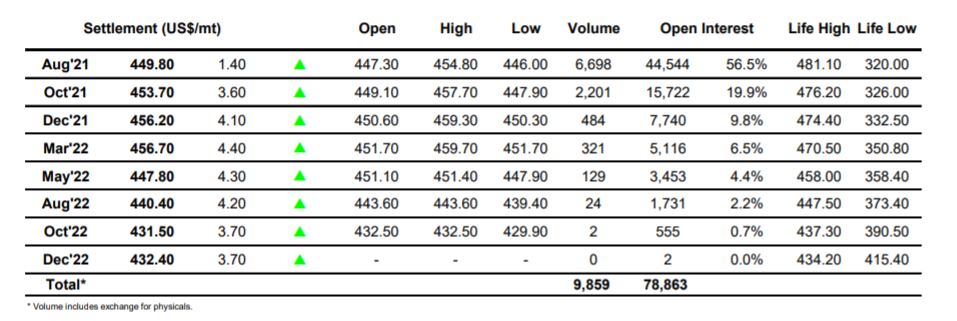

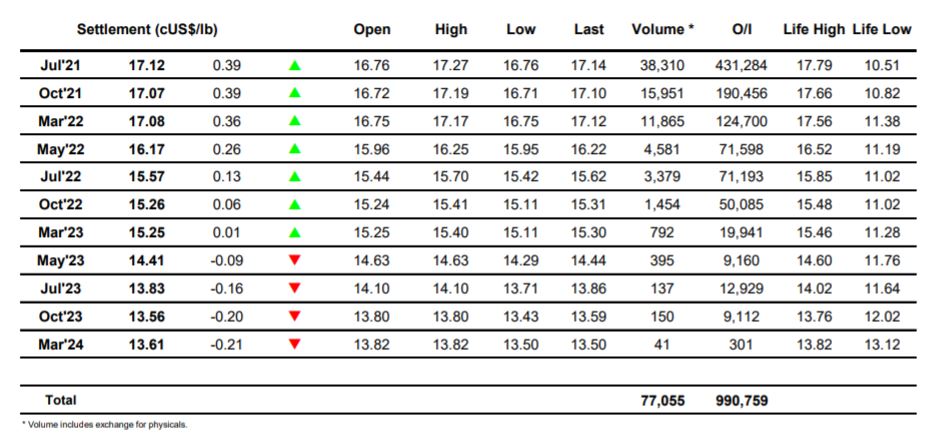

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract