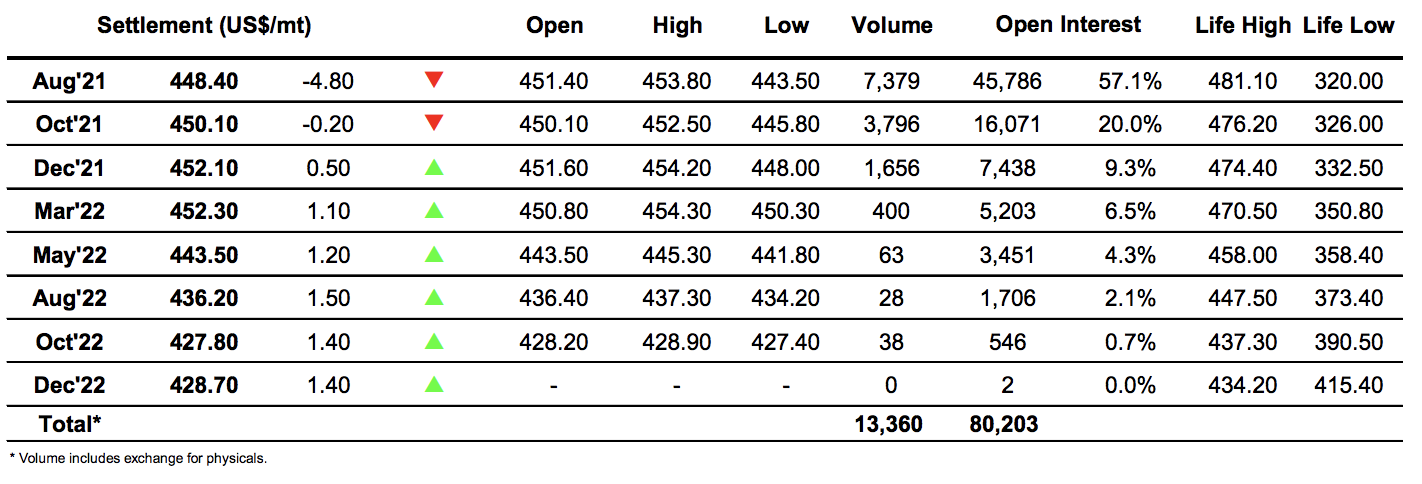

Sugar #11 Jul’21

There was some early selling around for Jul’21 which pushed us initially down to 16.80 and then on further to 16.71 to test the area which had provided support during the latter stages of yesterday’s session. Support was relatively flimsy at the lower levels and in within a sideways pattern this allowed the lows to extend as far as 16.63 by late morning, though within the confines of yesterdays band it was fair to say that the selling was rather thin on the ground also. With several higher priced longs likely still involved in the market we found some defensive buying emerge in one with the start of the US morning to slowly but surely pull values back upward, however the move came to abrupt end when just a single point shy of the opening 16.92 high and long liquidation dropped the price back to 16.70. Values then sat comfortably within the range as we moved through the afternoon, pulling up towards unchanged levels on a couple of occasions but failing to break beyond. May’21 was edging quietly towards expiry at a small premium to Jul’21 but the closing stages saw it spring to life as aggressive spread buying (receiver dressing the value?) sent May/Jul’21 to a widest 0.83 points on the close, eventually settling at 0.46 points premium once the weight average was considered. Jul’21 meanwhile hauled up to a session high 17.08 in amongst the chaos with settlement still beneath 17c at 16.98. Monday sees a late market opening due to the UK holiday as we await the next move in this volatile ride.

The May’21 expiry is expected to see 11,351 lots (576,659t) tendered though details are still emerging. The exchange will publish the full delivery notice on Monday.

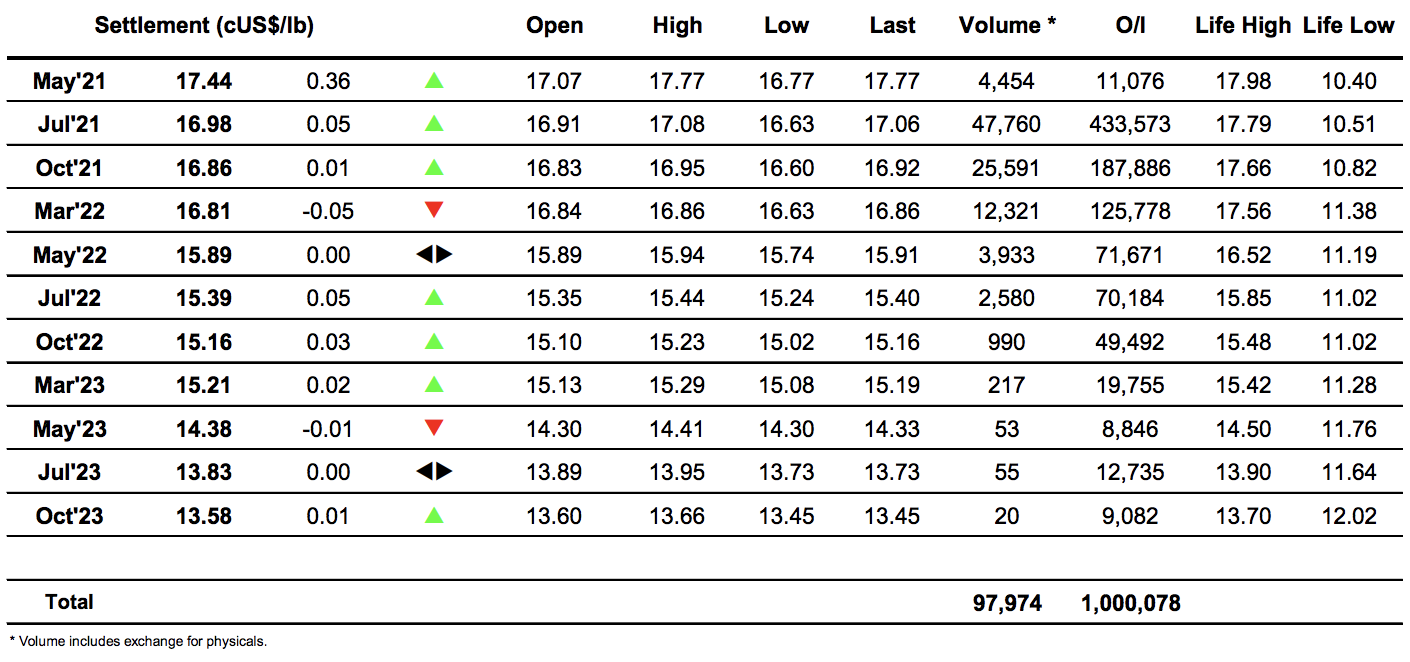

Sugar #5 Aug’21

The whites market commenced positively in contrast to the No.11, buoyed by some early support for the white premiums which saw Aug/Jul’21 printing up above $83 while Oct/Ot’21 was above $82, making back a good deal of the ground lost yesterday afternoon. Once the initial buying had concluded however it became apparent that this recovery was merely a blip and over the course of the next hour the Aug’21 contract haemorrhaged back down to the $444 area with the Aug/Jul’21 losing the gains quickly to be back in the upper $70’s once again. A prolonged period of calm then ensued in stark contrast to some of the recent volatility with the flat price holding a range basis the mid $440’s for several hours with a good deal of the volume now being generated by the Aug/Oct’21 spread. Here we have seen weakness which has been contrarian to the flat price movements over the past two week’s as the differential decline from $10 premium and today with little support on offer we moved to an inverse with a narrowest trade at -$2.50 before finding moderate support. The see-saw action within the range continued through the afternoon and though some late defensive buying emerged we remained lower for the day, heading into the 3 day holiday weekend with Aug’21 settling at $448.40.

Nearby white premium weakness continued following the early recovery and we head into the weekend with Aug/Jul’21 at $74.00, Oct/Oct’21 at $78.50 and March/March’22 at $81.50.

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract