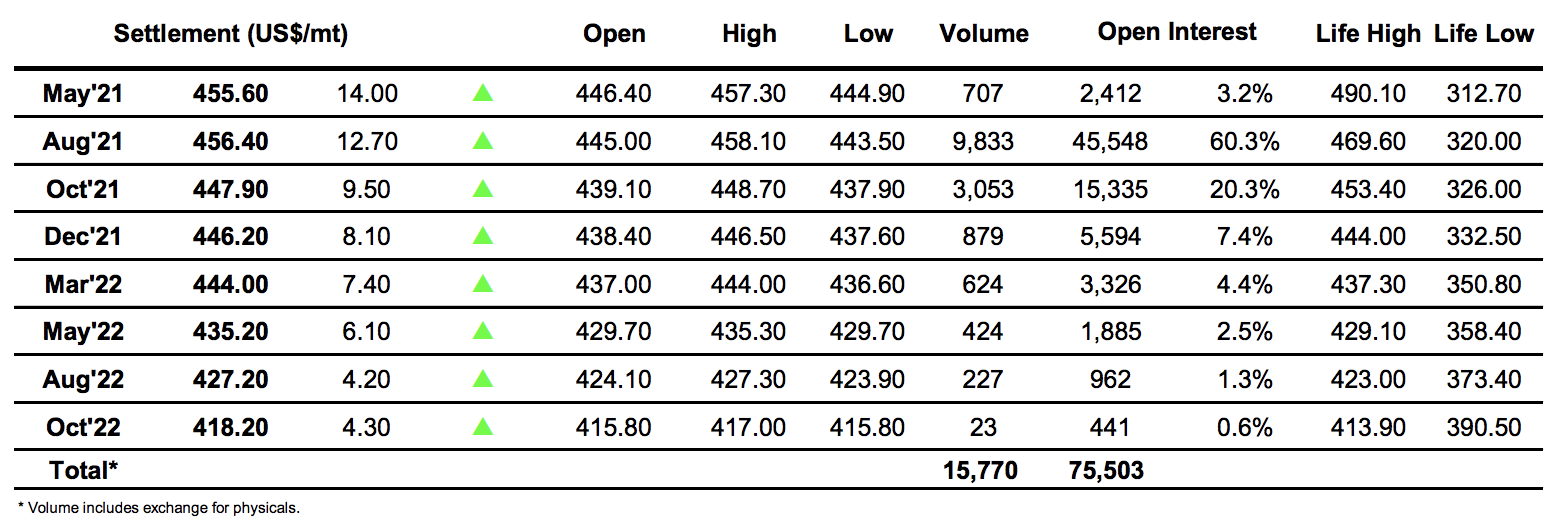

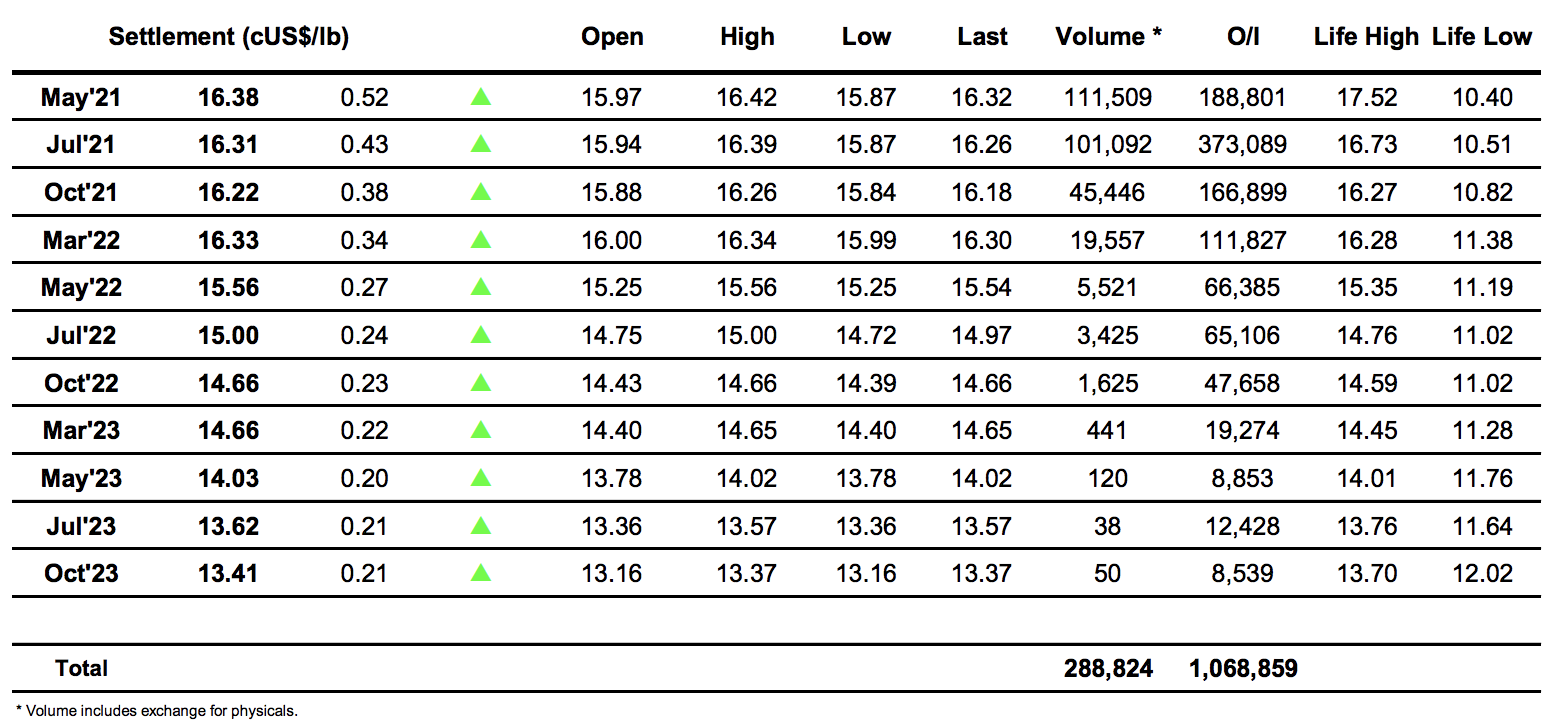

Sugar #11 Jul’21

There was immediate buying for Jul’21 this morning as specs looked to continue the momentum of yesterday but having traded to 16.02 the market soon turned back to consolidate in the 15.90’s. A very slow morning ensued as prices continued to sidestep in front of 16c and with the May’21 options expiring tonight many were speculating that this may lead to a similarly slow afternoon with traders looking to target the 16c strike for tonight’s close. The arrival of US based traders did nothing to change the environment and with the index roll now concluded activity remained very quiet moving through the early afternoon. All 16c theory was then blown out of the water midway through the afternoon as spec buyers pushed up through the May’21 50% retracement mark at 16.10, igniting additional buying that sent the price all the way to 16.42 over the next 30 minutes. With prices now 100 points above Tuesdays opening levels we finally saw a little more selling emerge from producers to cap things off, with profit taking/long liquidation following in as we pulled back towards 16.20 for the nearest two prompts. With the option expiry firmly in mind the question remained whether May’21 would head towards 16c, 16.25 or even 16.50 for the close though given what had already gone before and with the May/Jul’21 spread back out to a 0.05 point premium the 16c option appeared to be out of the running. Buying returned during the final hour to keep sugar at the top of the commodity basket for the day and though we see-sawed a little the close saw values at the top end of the range with May’21 settling at 16.38 while July’21 was at 16.31. Another technically strong day leaves the market looking positive with bulls already hoping for a return to February’s highs.

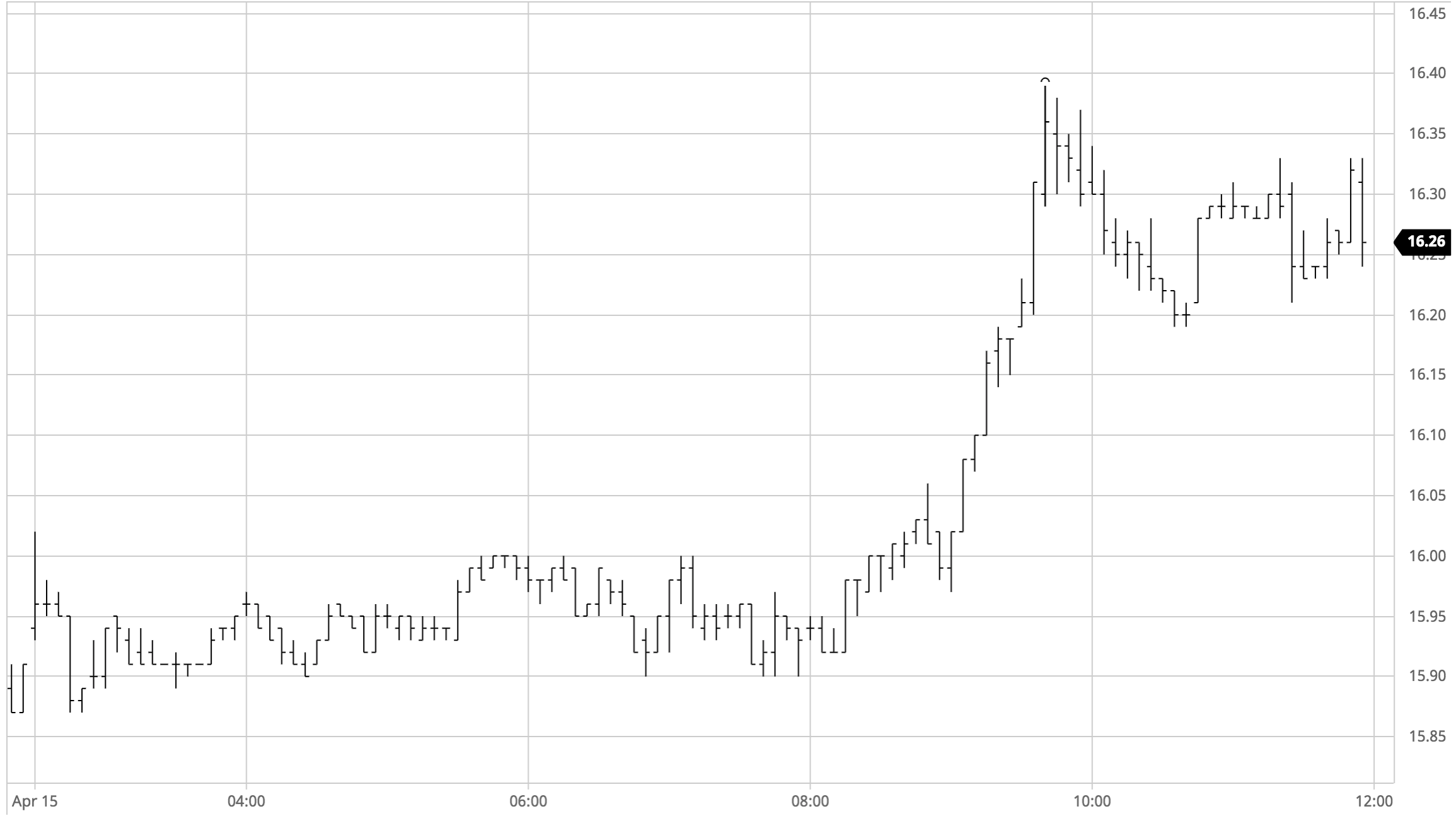

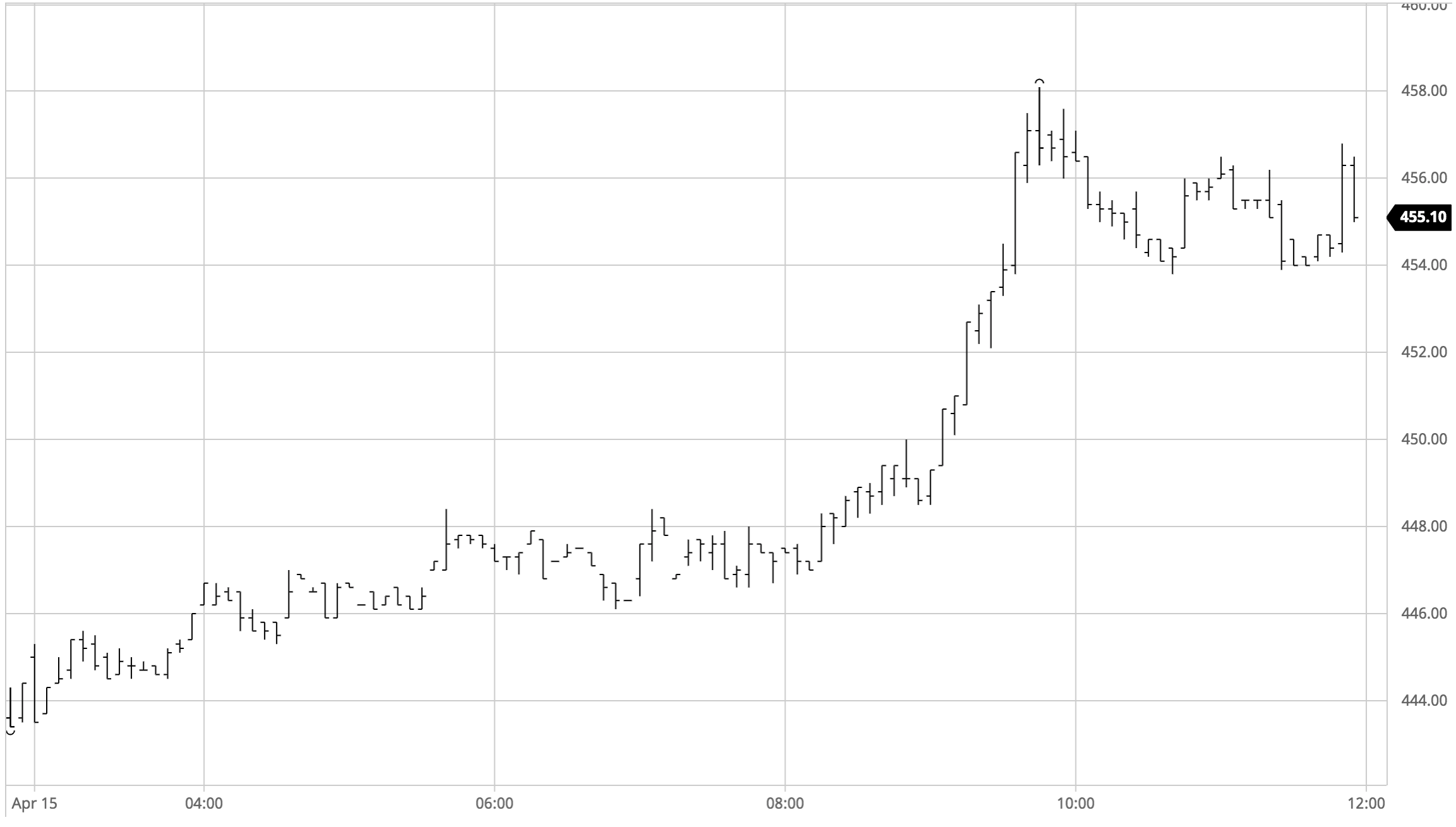

Sugar #5 Aug’21

Following on from a very strong performance yesterday the market found immediate buying to continue the move with Aug’21 trading to $445.60 during the early stages. Only very low volume was changing hands for the May’21 contract as some fine tuning took place ahead of tonight’s expiry and with Open Interest now reduced to 2,412 lots it is clear we will see a very small tender. For Aug’21 we saw continuing upward progress over the course of several hours however the rate of increase was rather sedate, taking until mid afternoon to extend as far as $450.00. It was from here that things became rather more interesting with a surge of spec led buying above $450 then taking the market on quickly to a high at $458.10, though admittedly there was very little selling in place to provide resistance as we pushed through. Through all of this excitement the May’21 contract remained very quiet and though we saw a brief move back to a premium for May/Aug’21 as it reached $1.00 it soon eased back to where it had been sitting this morning at a very small discount. The final couple of hours were spent at the upper end of the days range and though we did not revisit the earlier high a settlement level at $456.40 maintains a technical strength that the bulls will try to maintain.

Today saw a continuing recovery for white premium values, clawing back recent losses with Aug/Jul’21 reaching up to $97 intra -day. Closing values were near to the highs with Aug/Jul’21 ending at $96.75, Oct/Oct’21 at $90.20 while Mar/Mar’21 was valued at $84.00.

Tonight saw May’21 expire, closing at a $0.80 discount to Aug’21. Talk is that 2,583 lots (129,150 mt) will be tendered with both Brazilian and Indian sugars thought to be present. Full details will be published by the exchange tomorrow.

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract