Sugar #11 May’21

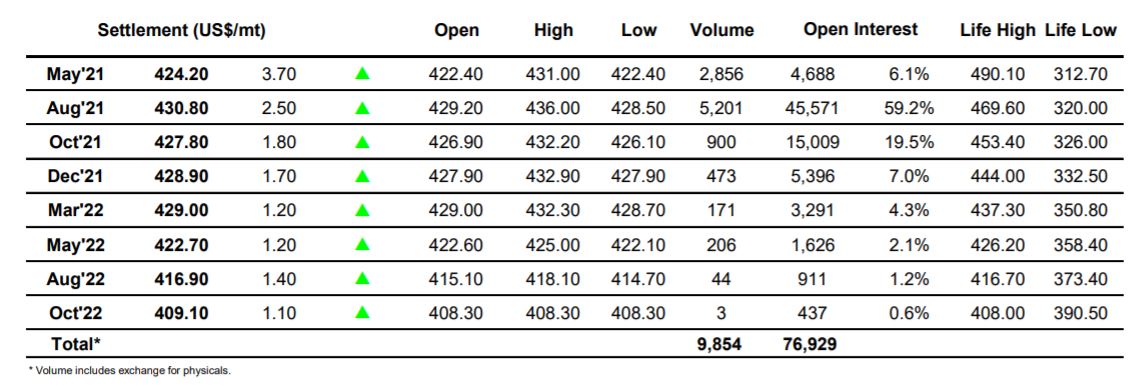

May’21 immediately pushed up above 15.40 on the opening but on an incredibly slow morning we then proceeded to flatline tediously with values holding a narrow band all the way through to mid-session. Even the positive macro was failing to lure much buying in over the course of the first few hours however the arrival of US based specs did at least provide a little more interest as they took the front month up to 15.64 over the course of a couple of hours, though their efforts were fairly minimal with only light buying required in the illiquid environment. As we moved through the afternoon it was the May/Jul’21 spread which once again attracted the largest portion of the activity as the index roll reaches its penultimate day and here we were widening out the discount with the differential moving to -0.05 points though strong volume remained to both sides. Outright values continued at the higher end of the range until the final hour when liquidation from day traders sent May’21 back down towards 15.40, though with no other significant selling showing up aside from this position squaring we bounced back to 15.50 on the post close. MOC selling for May/Jul’21 meanwhile sent the spread to a widest -0.09 points with a settlement level of -0.07 points as we head towards the end of the roll period.

Sugar #5 Aug’21

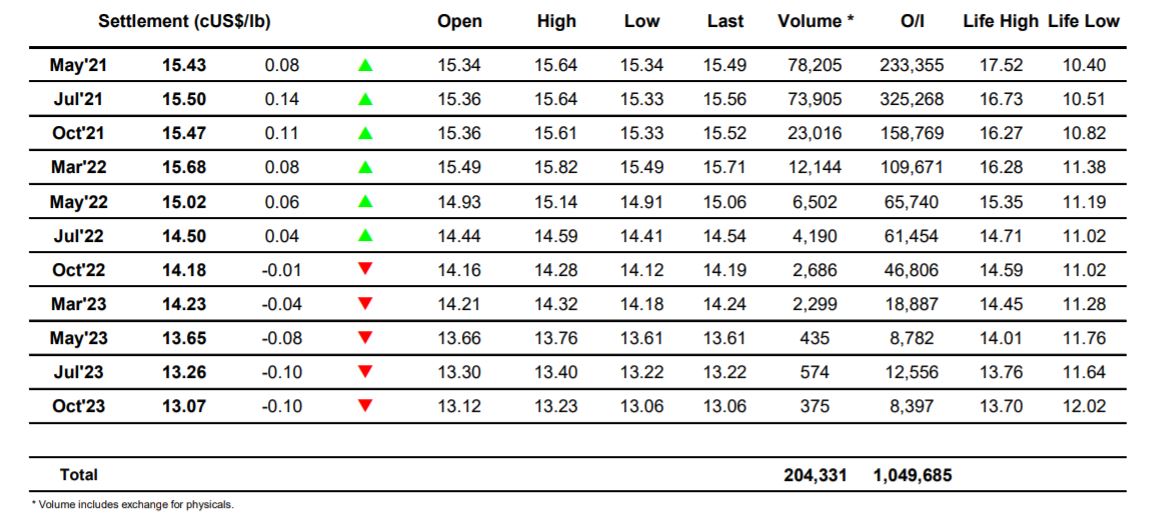

Despite a poor end to the session yesterday we found the market on the front foot immediately this morning, finding support against a broadly firmer macro with Aug’21 clambering back up above $430.00. Though we were climbing it was against remarkably low volume, with the only real excitement during the early stages seen for the May/Aug’21 spread which had shot up to -$1.90 initially though soon eased back to hold a narrower band centred around -$5. Continuing through the quietest session for some time the slow but steady climb extended to $436.00 by mid-afternoon, placing it within 0.70c of the previous two sessions highs before easing back a touch as the first signs of some more significant selling started to emerge. We settled back into the range to consolidate the $433 area and with the wider macro remaining positive there seemed no despite to knock the market back any further. May/Aug’21 continued near to -$5 with spread activity making up the lions share of the day’s May’21 volume, activity which may further reduce the open interest that has already shrunk to 4,688 lots with three session remaining until expiry. Closing selling sent Aug’21 all the way back to settle at $430.80 while May/Aug’21 traded to -$8.10 discount, rather uninspiring and suggesting that we may see further range bound activity for the near term.

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract