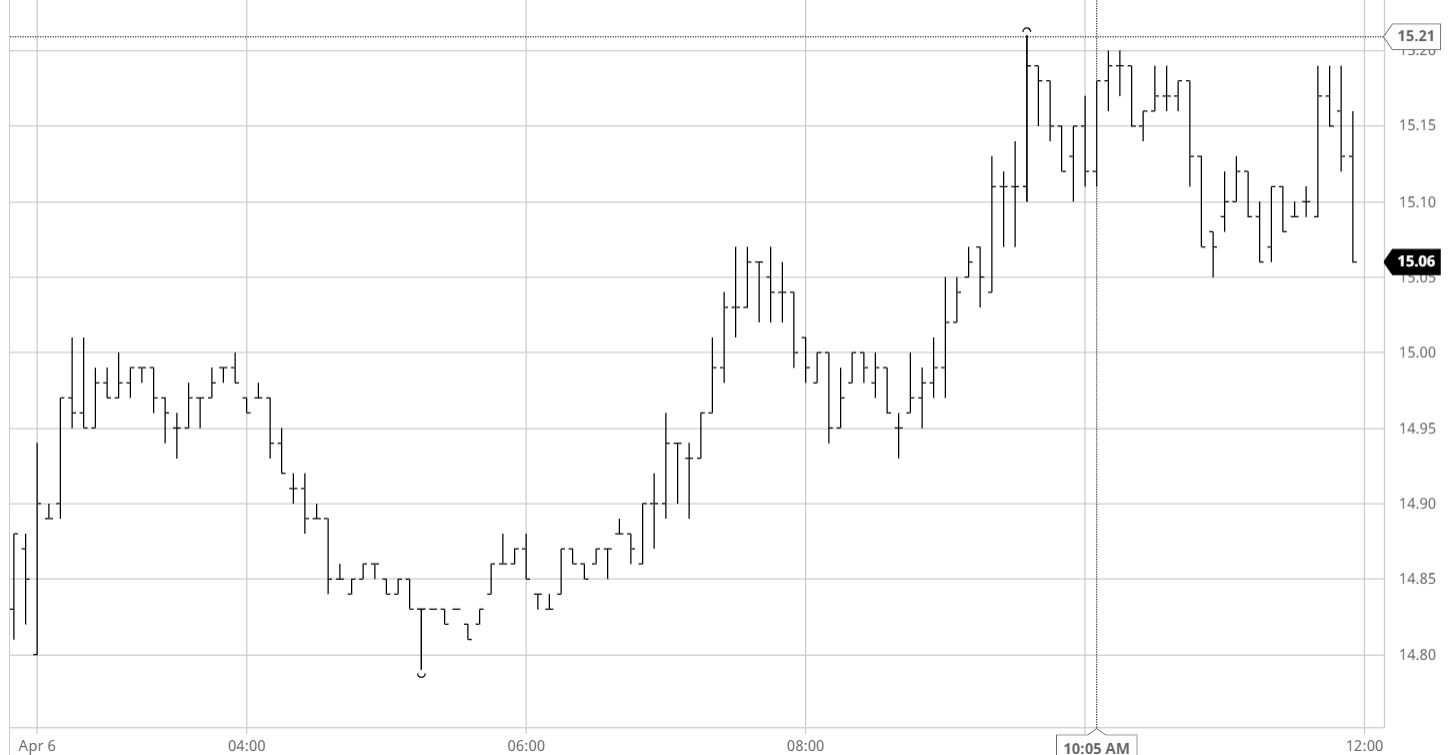

Sugar #11 May’21

The day began positively with May’21 pushing up towards 15c and looking to try and further consolidate following the small recovery made by the May’21 spreads during yesterdays shortened session. For a while the market was able to consolidate the 15c area however questions remain as to the sustainability of any recovery following several failed attempts to get something going across recent sessions and by late morning we had slipped to be holding near to unchanged levels. With the macro environment broadly positive (though admittedly in many cases this was simply redressing losses incurred yesterday) we found some desire from the day traders and algos to pursue the long side, a view that was likely influenced by the continuing oversold nature of short term indicators which will make it tough to gain much downward momentum without outside assistance. While the efforts to play the upside did not lead to any sharp surges the movement was broadly positive throughout the afternoon and may be just the kind of steady but solid action that will be required if we are to cement some kind of bottom from which the market can look to rebuild more significantly. By the final couple of hours May’21 had reached a session high 15.21 with May/Jul’21 reaching back to 0.15 points premium in the process, and though both eased away from these levels as we entered the latter stages we saw May’21 remaining positive above 15c which in itself will give encouragement to the bulls. A choppy close concluded with a May’21 settlement level at 15.16, and though it fell back on the post close against position squaring this represents the strongest daily performance in more than three weeks.

Sugar #5 May’21

Returning from the extended 4-day holiday weekend we saw May’21 commence above $427 however the gains were quickly erased with the market settling into a quiet pattern of trading that saw prices edge downward to be holding with side of unchanged values by the end of the morning. Pressure was then brought to bear upon the front of the board during the afternoon through some aggressive spread selling and this in turn had a significant impact upon both the flat price and also white premium values. With the May/Aug’21 being pressured in to a narrowest $1.80 premium as fund longs continue their roll ahead of next week’s May’21 contract expiry we saw the flat price as low as $420.30 while May/May’21 headed all the way in from its morning high at $97.50 to touch $90 and virtually match the early March lows. Choppy trading continued with a corrective move that was driven by Aug’21 buying taking the May’21 contract back up to $427.00 in quick time and in turn bringing the premium back above $93, though this movement had little impact upon the May’21 spreads where weakness remained. The flat price did at least maintain at the upper end of the days range as we worked towards the close where some volatile action saw May’21 ranging between 425.30 and $429.10 while Aug’21 was between $423.40 and $426.60. This provided positive settlement levels though with the May’21 spread making a new low at $1.20 it may remain trickly to mount a significant recovery in the very near term.

White premiums ended the day with May/May’21 away from its lows at $93.50, while away from expiring positions we saw Aug/Jul’21 holding at $94.50 and Oct/Oct’21 firmer at $89.00.

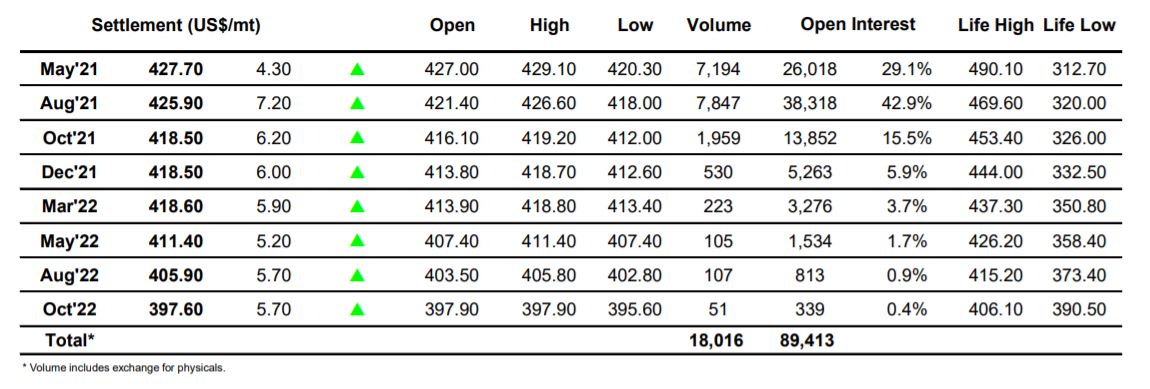

ICE Futures U.S. Sugar No.11 Contract

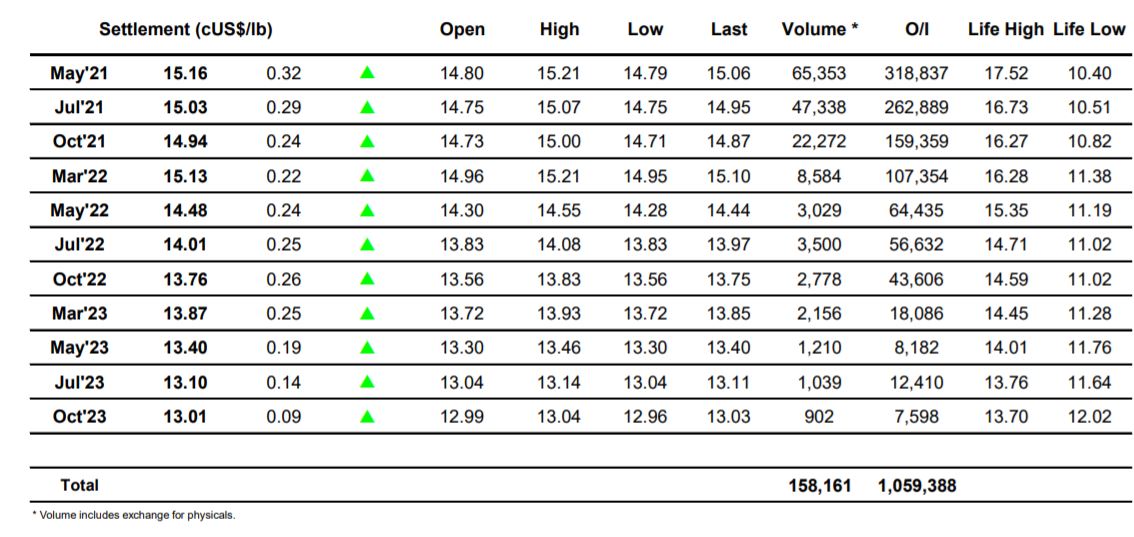

ICE Europe Whites Sugar Futures Contract