Sugar #11 May’21

Early buying against physical interest reversed last night’s closing decline and took May’21 up to 14.94 during the first couple of hours, however once this hedging had been concluded there was no sign of any follow on interest and values settled down near to the highs. A small burst of selling pushed values back to unchanged levels as the US morning dawned but whether due to the oversold situation of a lack of desire to commit ahead of the extended Easter holiday weekend the specs were not showing in and significance and so a covering rally back towards the morning highs ensued. Moving through the afternoon we did not threaten to break outside of the morning parameters with the same pattern continuing for outright prompts as a second spike downward was quickly gathered up to leave values drifting along rather tediously. Nearby spreads were at least holding following the recent heavy losses but were also only seeing relatively low volumes, May/Jul’21 trading either side of parity through the session ahead of the larger volumes that will come from the index roll which gets underway during the second half of next week. Despite some signs of recovery in the macro sugar continued to drift and the action culminated in a return to session lows for the closing call. Though we remained just ahead of yesterdays low mark of 14.67, a settlement level at 14.71 paints a continuing negative outlook for the charts as we head into the extended 3-day weekend with a late opening to follow on Monday due to the UK holiday.

Sugar #5 May’21

A mixed first hour saw May’21 trading either side of unchanged however any hopes that this may lead to a firmer session soon dissipated as selling returned to the May/Aug’21 spread and in so doing impacting significantly on the front month. Over the course of the morning the price eroded down to the $424.00 area with May/Aug’21 trading in to $4 and though we then saw a period of stability there was again no sign of correction. The start of the US morning brought with it a brief bust of short covering which pulled prices back up by $3 but it was short-lived and we soon slipped back once again to resume the downward path. The continuing impact of the spread selling upon was knocking nearby white premiums values in addition to the flat price with No.11 proving more resilient, and as we moved through the afternoon we had May/May’21 trading in below $95, Aug/Jul’21 into $91.50 and Oct/Oct’21 working down to $85.50. Having reached a low of $421.20 as we approached the final hour it seemed as though we would conclude negatively once again, however the one this the market has in its armoury at present is the oversold nature of the technicals which will be of concern to shorts. Maybe it was this that triggered the sharp correction to $425.50 that followed but whatever the catalyst it did at least show the potential for sudden spikes with a $4 move on very limited volume due to the illiquidity within the range. As with the earlier correction we again topped out quickly and an aggressive closing period saw May’21 trade all the way down to $419.10, seemingly showing that the trend is not yet ready to reverse no matter how oversold we may be becoming.

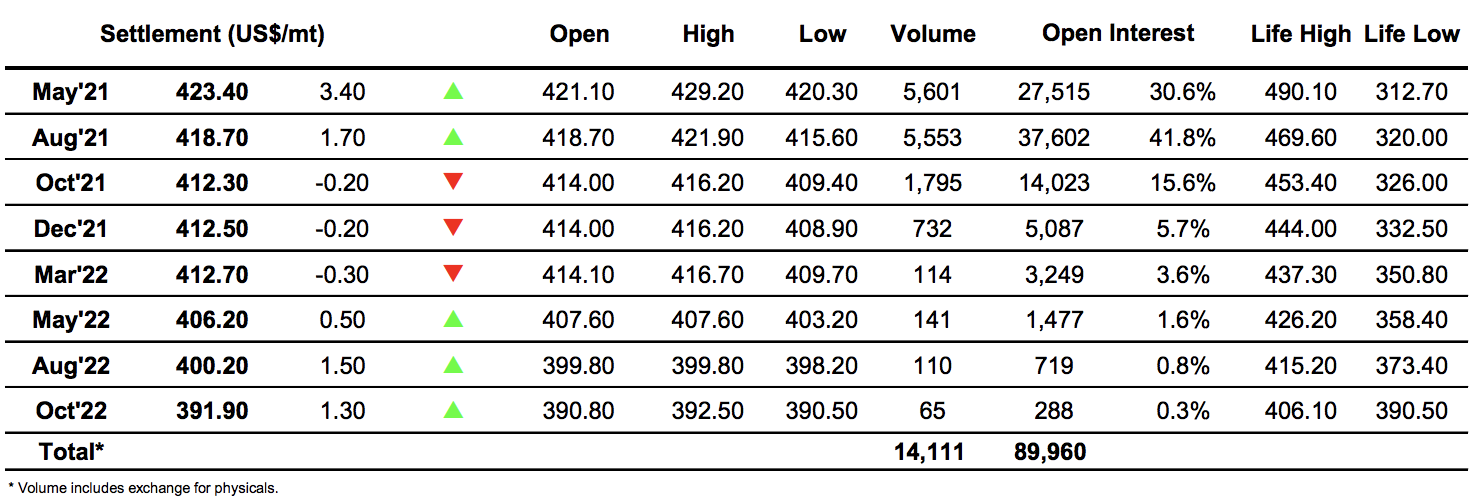

ICE Futures U.S. Sugar No.11 Contract

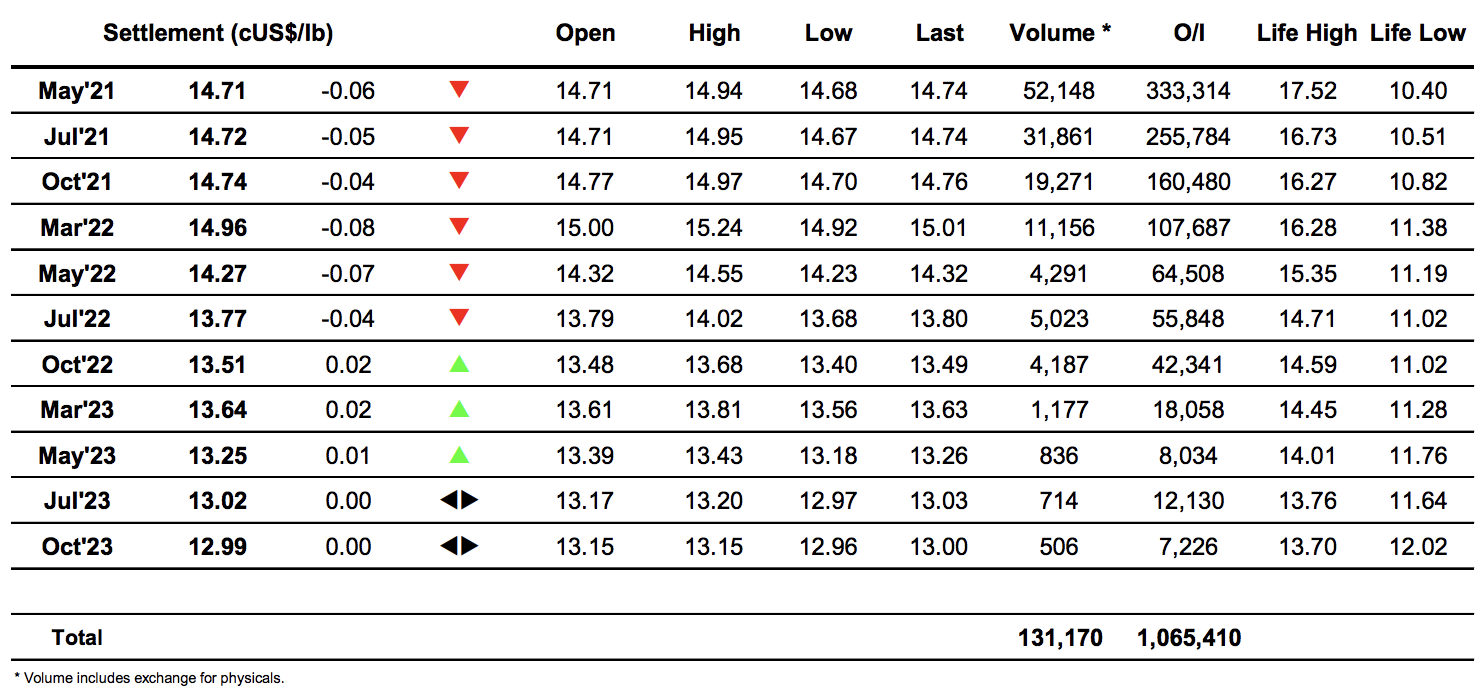

ICE Europe Whites Sugar Futures Contract