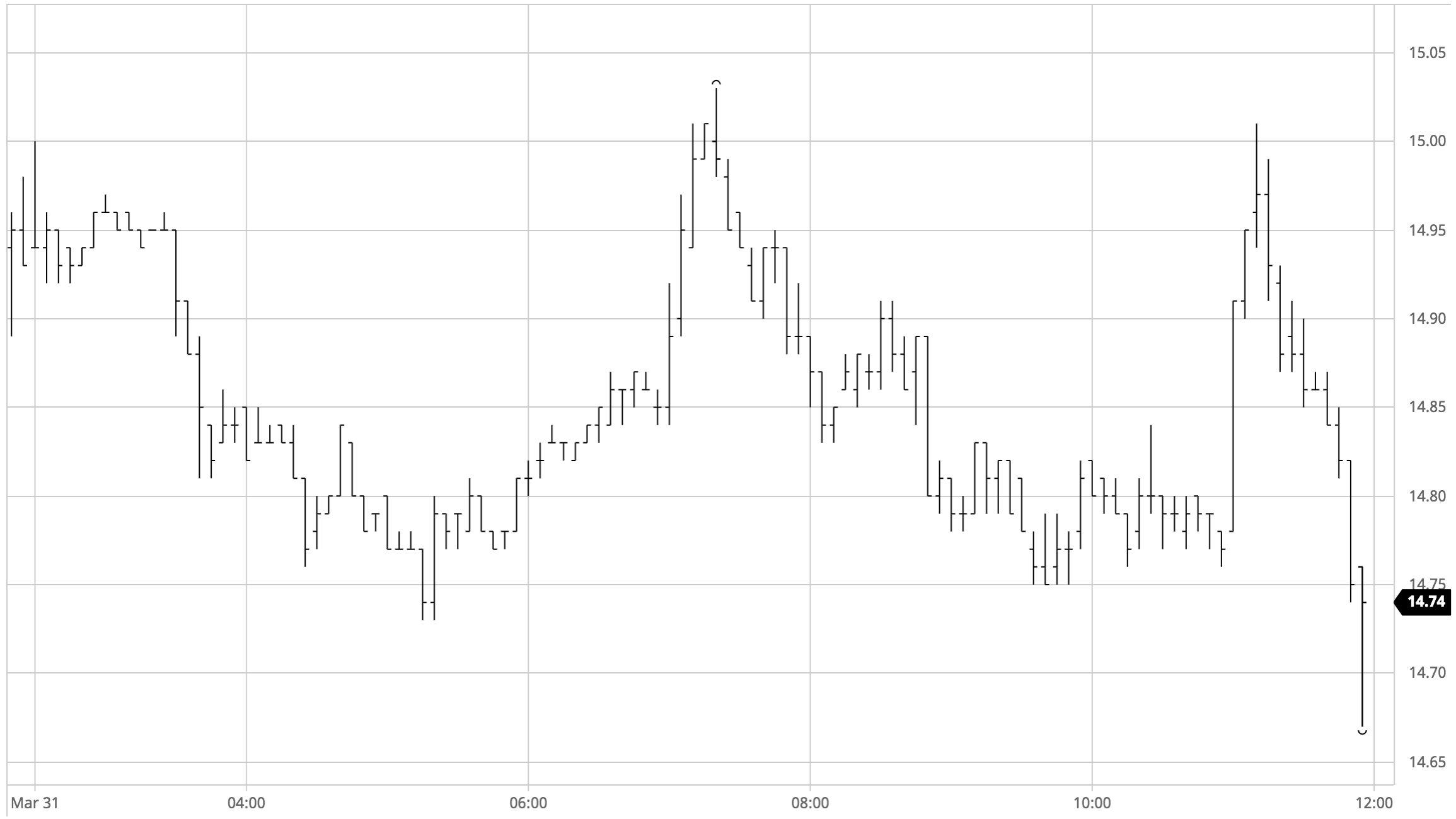

Sugar #11 May’21

Light early buying provided a degree of support during the first hour but once concluded the market quickly resumed the downward path to push below 14.84 and on to a new recent low at 14.73 before the morning was out. While technically weak at present the market has also become increasingly oversold and this may well be contributing towards the nervousness of the specs and day traders as seen by the short covering rally to 15.03 that followed during the early afternoon. This surge of May’21 covering contributed to a small recovery in the May/Jul’21 spread value which had been trading as lows as -0.03 points discount this morning, an incredible fall from its widest trade of 0.83 points premium on 23rd February. The recovery if we can call it that merely stretched to 0.06 points and with the flat price coming under pressure once more during the afternoon so we saw the differential head back to parity. Despite a mildly positive macro picture which showed the energy sector in credit and also a much firmer USDBRL at 5.65 we seemed to be stuck in the path of our own technical picture for the rest of the day, something that could not be broken by a second short covering spike which in a repeat of earlier action topped out just above 15c. The final hour saw prices back under pressure to make a new low at 14.67 on the closing call, and with May’21 ending at 14.77 it seems that despite the oversold nature there is no sign of any respite from the spec pressure just yet.

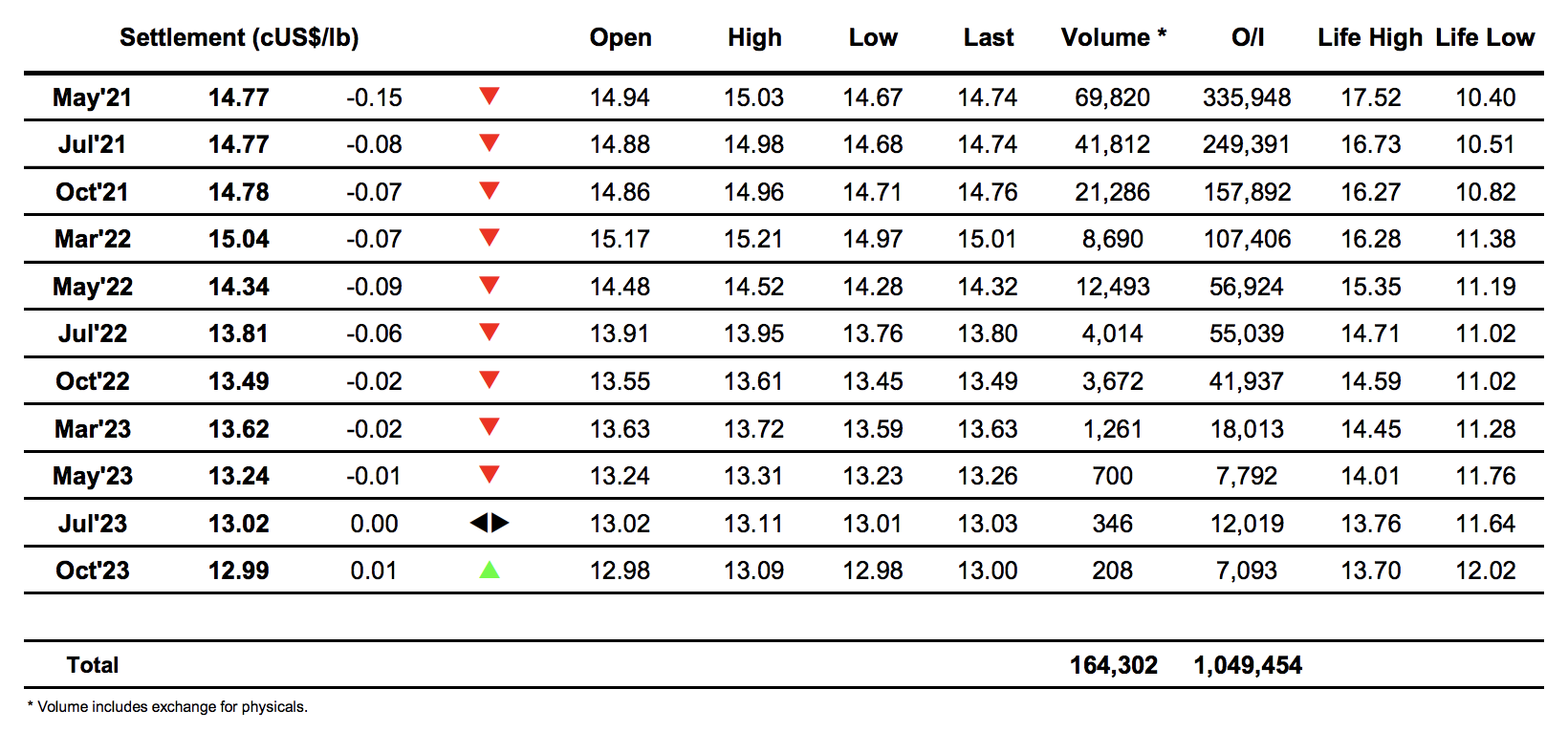

Sugar #5 May’21

A mixed first hour saw May’21 trading either side of unchanged however any hopes that this may lead to a firmer session soon dissipated as selling returned to the May/Aug’21 spread and in so doing impacting significantly on the front month. Over the course of the morning the price eroded down to the $424.00 area with May/Aug’21 trading in to $4 and though we then saw a period of stability there was again no sign of correction. The start of the US morning brought with it a brief bust of short covering which pulled prices back up by $3 but it was short-lived and we soon slipped back once again to resume the downward path. The continuing impact of the spread selling upon was knocking nearby white premiums values in addition to the flat price with No.11 proving more resilient, and as we moved through the afternoon we had May/May’21 trading in below $95, Aug/Jul’21 into $91.50 and Oct/Oct’21 working down to $85.50. Having reached a low of $421.20 as we approached the final hour it seemed as though we would conclude negatively once again, however the one this the market has in its armoury at present is the oversold nature of the technicals which will be of concern to shorts. Maybe it was this that triggered the sharp correction to $425.50 that followed but whatever the catalyst it did at least show the potential for sudden spikes with a $4 move on very limited volume due to the illiquidity within the range. As with the earlier correction we again topped out quickly and an aggressive closing period saw May’21 trade all the way down to $419.10, seemingly showing that the trend is not yet ready to reverse no matter how oversold we may be becoming.

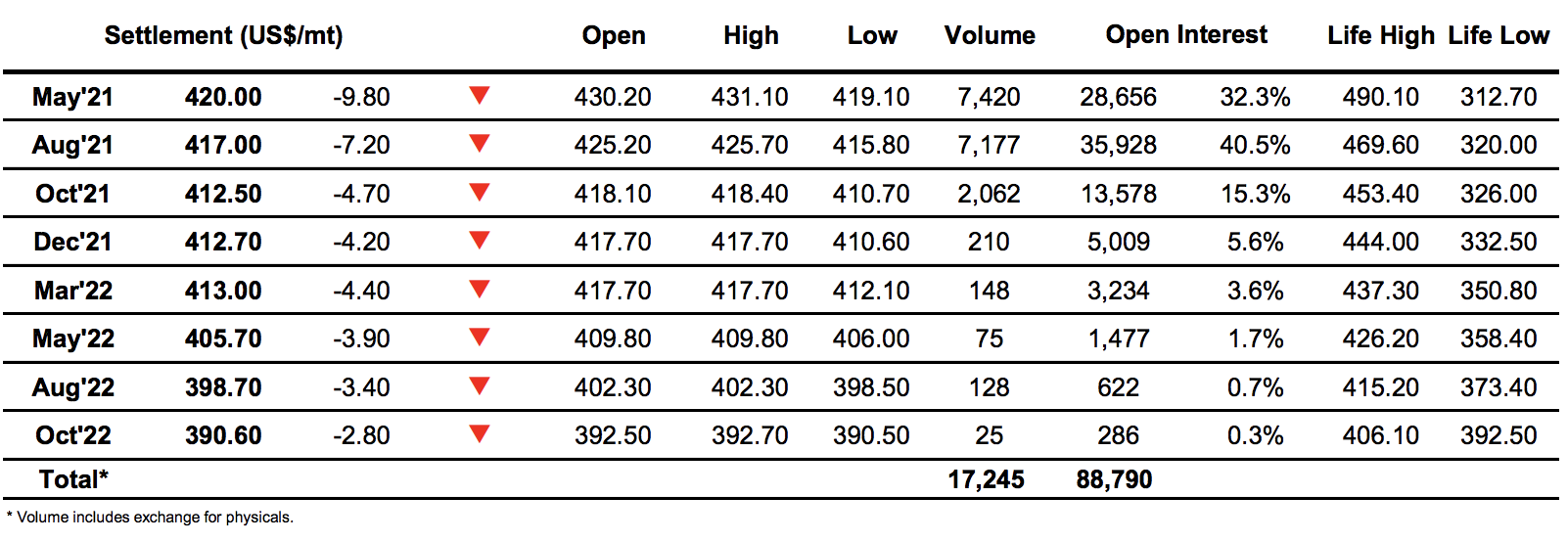

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract