Sugar #11 May’21

The weaker technical outlook and mildly weaker macro factors were painting a negative picture to start the week and as has been proved recently this market needs no second invitation to weaken with early selling sending May’21 back towards 15c once more. Despite some solid underlying buying the weight of selling final pushed through to register a 14 handle with an early low of 14.97 although the lack of follow on selling or sell stops will have been of disappointment to the specs so the easing of their selling that followed was probably to have been expected. A long part of the day was then spent consolidating the 15c area with the underling trade and consumer buying proving sufficient to provide support while funds have shown to be reluctant to close too much of their long holding as despite the net spec position reducing to 169,124 lots this is partially accounted for by new shots from shorter term traders. With the afternoon progressing calmly the situation became enlivened with an aggressive push down to new session lows and the spec shorts looked to keep the pressure on through until the close in recording a low mark at 14.84 during the final 20 minutes. Nearby spreads were also being hit aggressively on the downturn with May/Jul’21 trading in as far as 0.06 points premium while Jul/Oct’21 turned negative late in the session at -0.01 point. Though prices recovered during the closing stages a May’21 settlement price at 14.92 continues to send out negative technical signals which will not be disguised by some frantic late short covering that led May ’21 to be trading back to 15.04 at the very end.

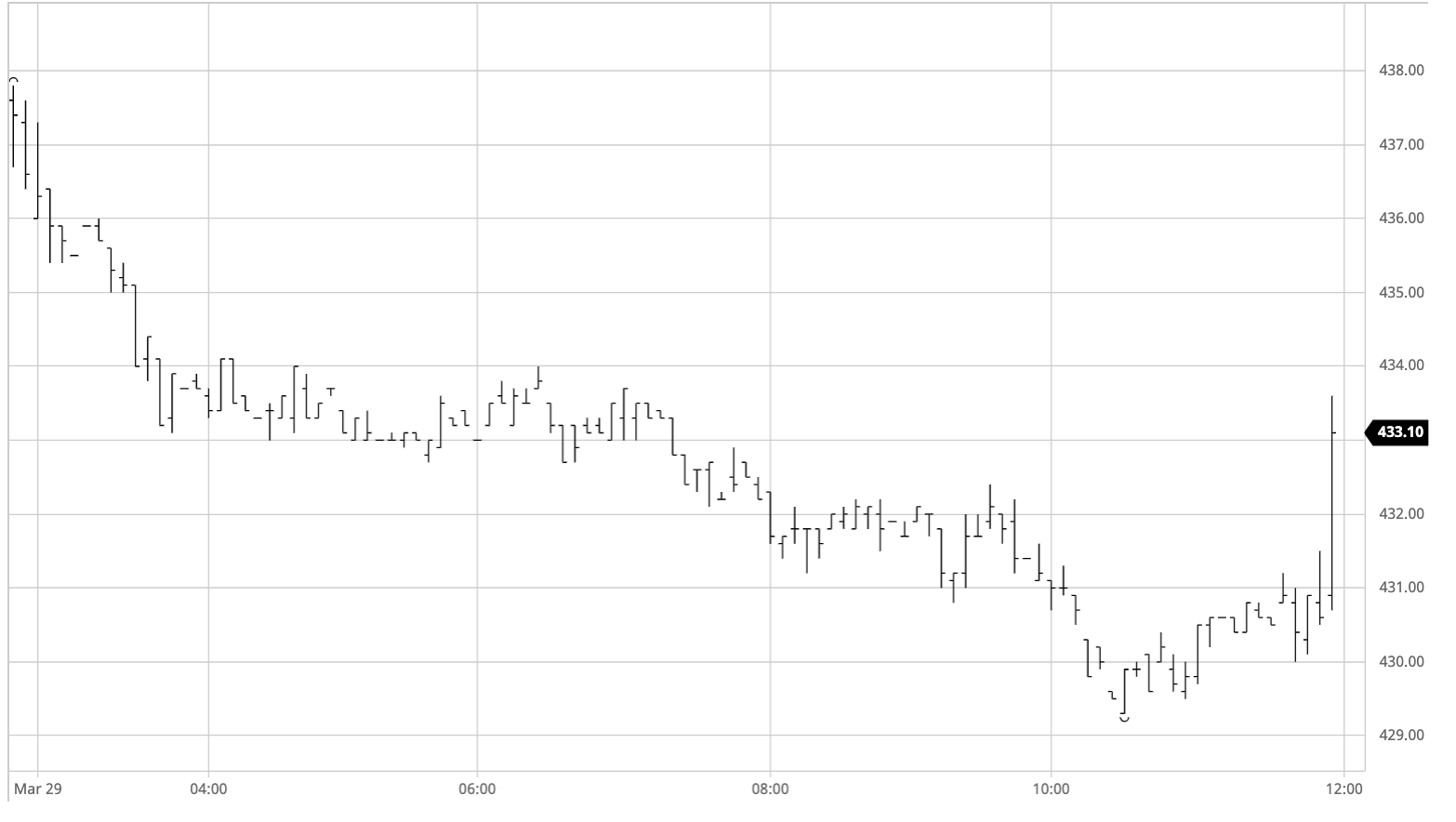

Sugar #5 May’21

The new week commenced with immediate selling hitting the nearby contracts to place the market firmly on the backfoot as May’21 traded down by $4 to $433.10 during the first hour. It was not just the outright that was coming under early pressure with the spread values also struggling to gain any kind of foothold and May/Aug’21 was soon printing in towards $7 as what looked to be spec rolling dictated the direction. Moving through the rest of the morning the market maintained above the recent $432.20 low mark, however the chances of holding started to decrease as the early afternoon saw increased volumes moving to the fore. When we did finally break beneath $432 the reaction was minimal with no sell stops on show but though this meant that the reaction was not severe we did continue to plug away at the downside to reach a session low of $429.30 later in the afternoon. While at the lower end we were also seeing new lows made for the May/Aug’21 spread at $5.70 while the sheer weakness of the spot month was dragging the May’21 white premium value down towards $100 despite no significant selling of the premium being apparent. Values did recover from these lows during the final 90 minutes as some short covering took place, action which highlighted the illiquidity of the white premium by returning May/May’21 back above $102, though it was fair to say the bounce lacked any other substance and so was limited. A mixed call left May’21 settling at 431.10 and although further position squaring on the post close sent May’21 back to $432.50 the technical picture continues to present negatively.

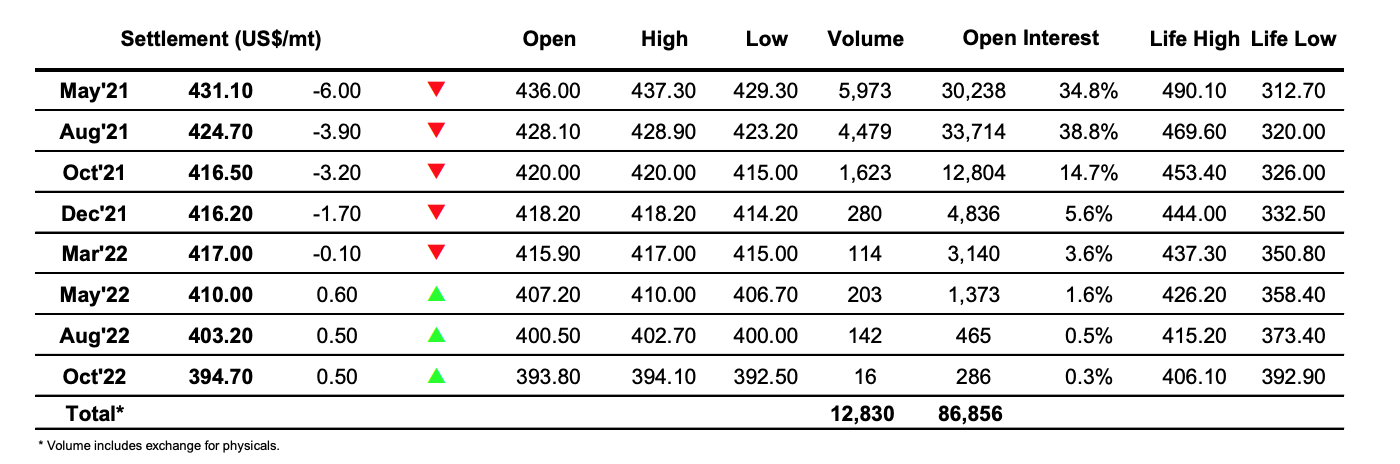

ICE Futures U.S. Sugar No.11 Contract

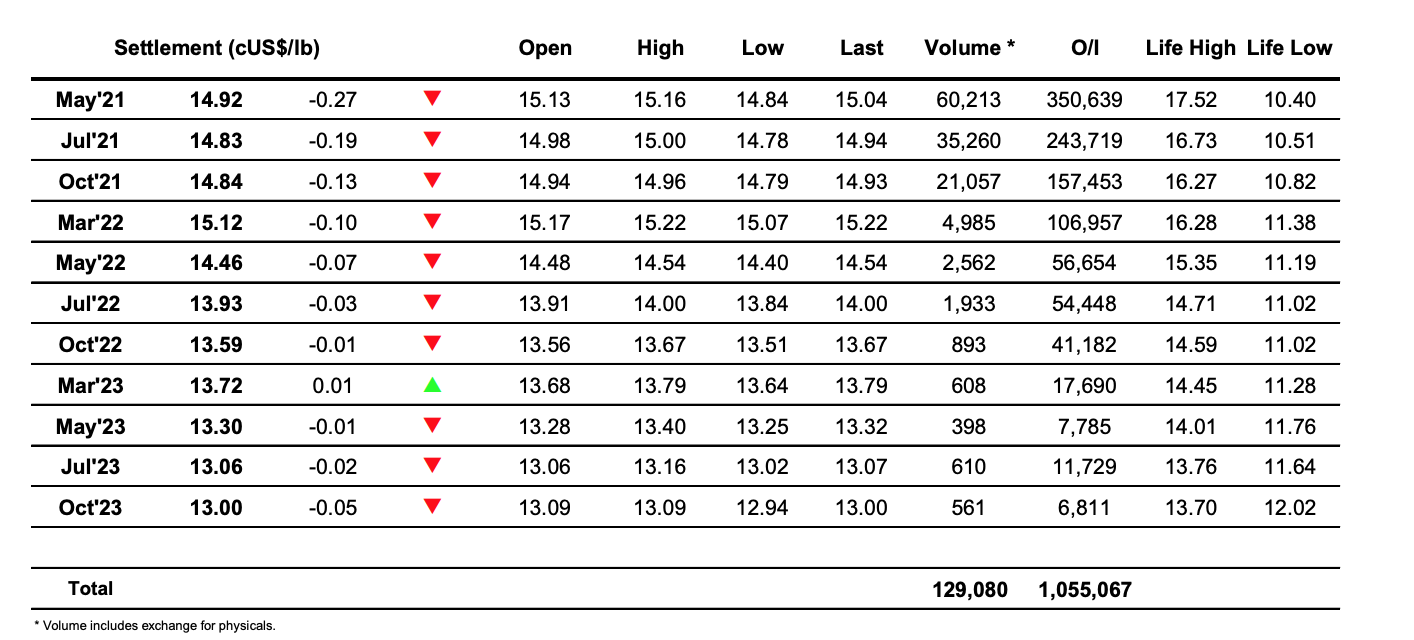

ICE Europe Whites Sugar Futures Contract