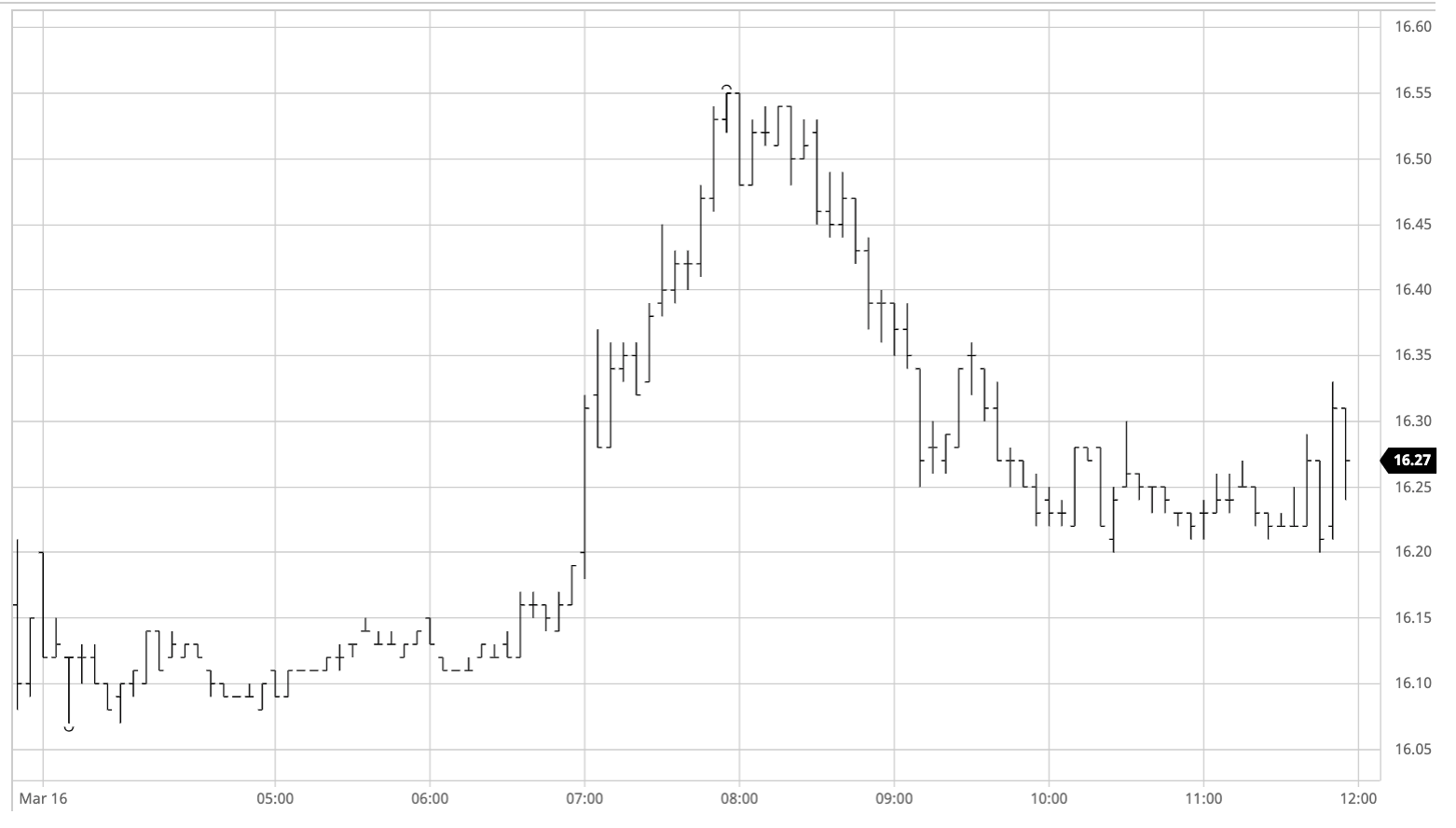

Sugar #11 May’21

Initial activities had May’21 ranging between 16.20 and 16.07 during the first 15 minutes of the session but any volume then fell away promptly and for the next three hours we saw barely any movement and continued within this narrow range. Everything then changed around midday with the arrival of US based specs bringing an unexpected burst of buying to the market which over the course of the next hour took May’21 up to challenge the congestion in the mid 16.50’s, but in many ways just adding further to it as we reached a daily high at 16.55. The determined nature of the buying was impressive given the lack of outside assistance with the recent macro allies in the softs and energy sectors mostly trading lower while the USDBRL was little changed in the 5.60 area so doing little to suggest any sudden change in policy. There were stories on the newswires that Brazilian millers have hedged 86% of this years crop and while nothing new to most participants this may have been the inspiration for the smaller specs to have pushed upwards as they did. A slide into the range followed once the buying had eased up as day traders did the only thing they could and closed out their longs, leading us back to a tighter band for the final couple of hours consolidating moderate net gains. May’21 spreads remained a little firmer in a sign that they are trying to recover from the 2021 lows seen yesterday, although the real test will be whether they show such resilience should we look downward once again. Closing values were positive with May’21 finding late buying to settle at 16.30, but having tested both beneath 16c and above 16.50 already this week without breaking in either direction it seems that continuing rangebound activity is likely for the short term.

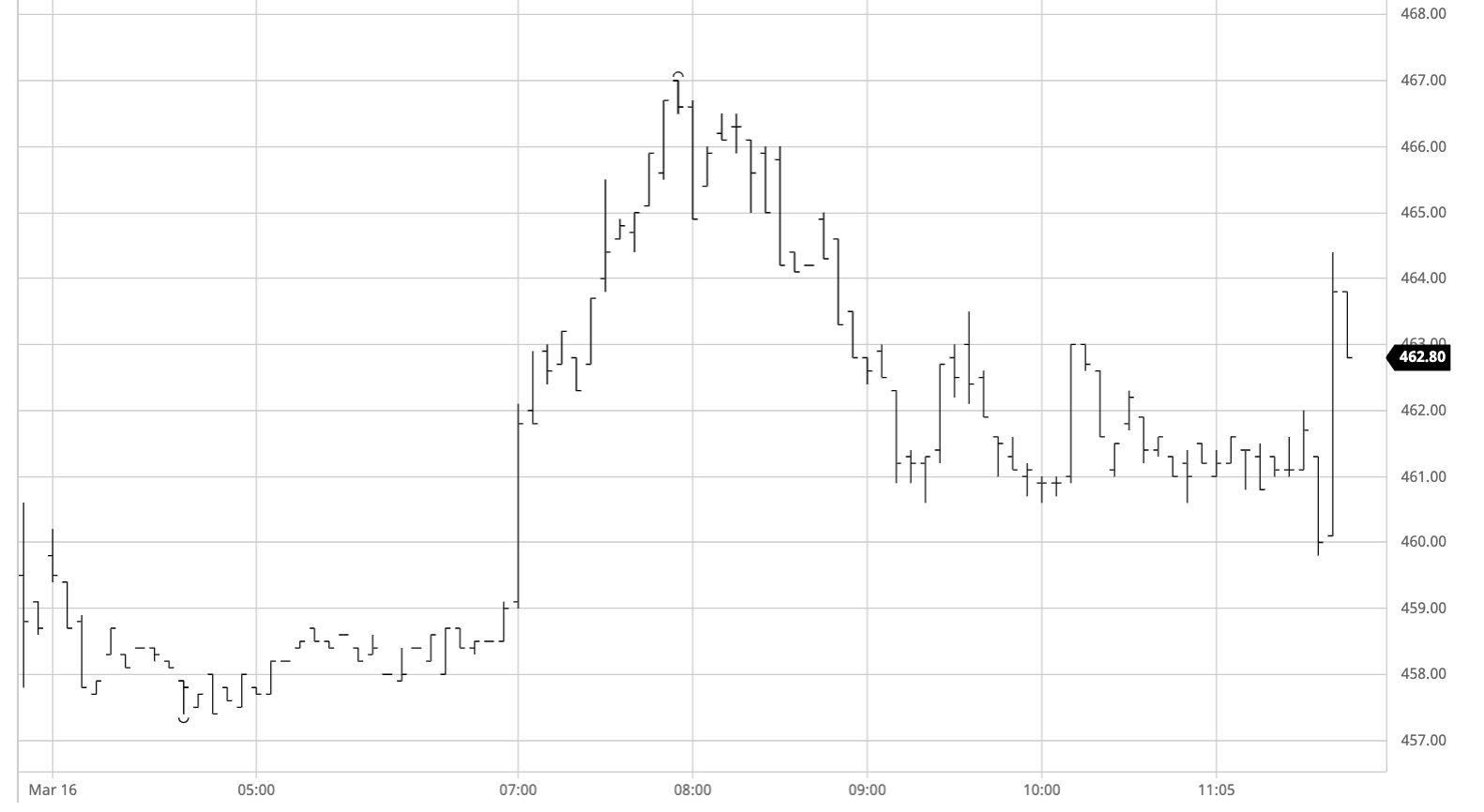

Sugar #5 May’21

A slow start to today’s session saw May’21 holding just beneath unchanged levels following a mixed opening on continuing low volumes, a situation which remained unchanged right through until noon. The arrival of the US morning then brought with it some fresh buying and having shot back up above $460 we were suddenly exuding positivity for the next hour with the climb continuing on up to $467.00 while at the same time pulling the May/Aug’21 spread out to $15 premium. This move placed May’21 into the resistance area ahead of this months $468.00 high but though we tried to hold and flirted with the idea of continuing onward for a while the market then began to ease and prompted some long liquidation from day traders, Having fallen back we encountered support at $460.60 on the intra day chats against the high on last nights call and this are consistently held through the second part of the afternoon as volume once more fell to a minimum. The calm was broken as we moved into the close with some defensive MOC buying seeing May’21 pushed back up to settle at $463.40, though we continue to be stuck within the broad range which is now extending into its third week.

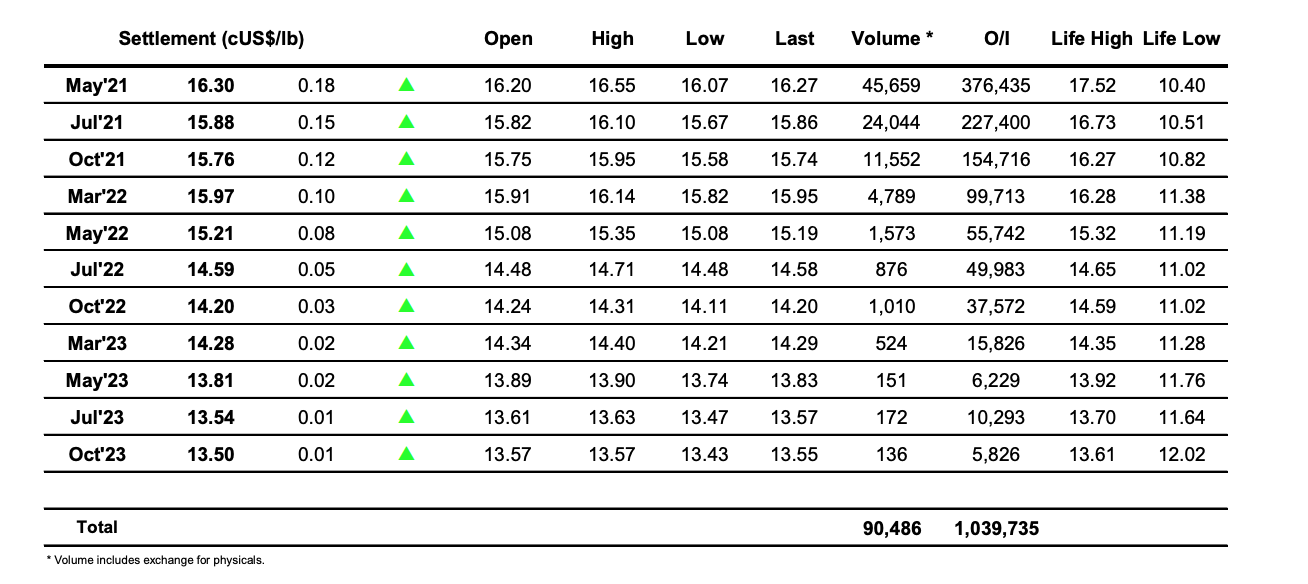

Nearby white premium values slipped during the course of the day when No.11 values surged ahead and May/May’21 was below $101 at one stage, however a calmer environment later on in the session allowed them to recover the lost ground with a strong finish at $104.00. The rest of the board did not fare quiet so well and we closed at $98.25 for Aug/Jul’21 and at $90.00 for the Oct/Oct’21.

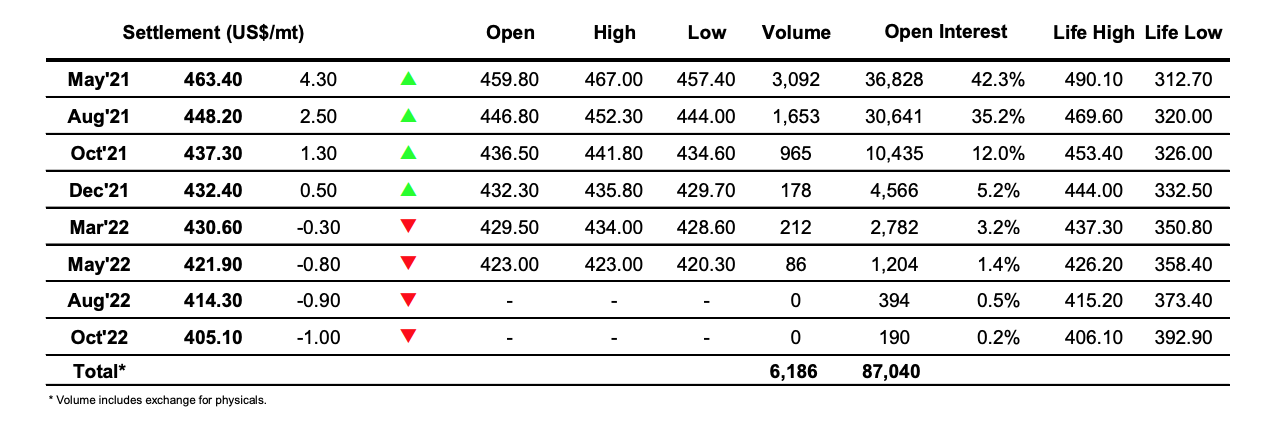

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract