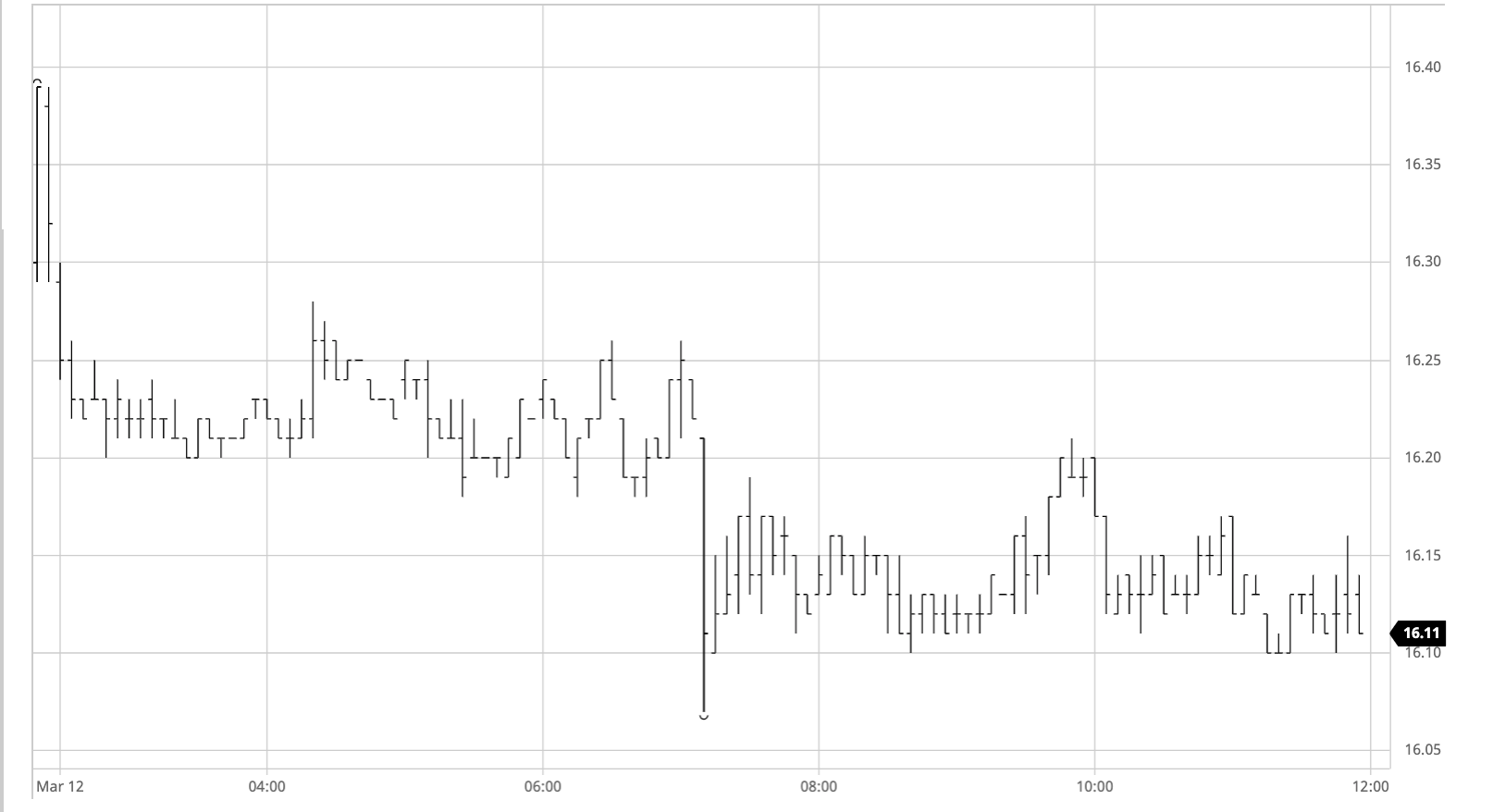

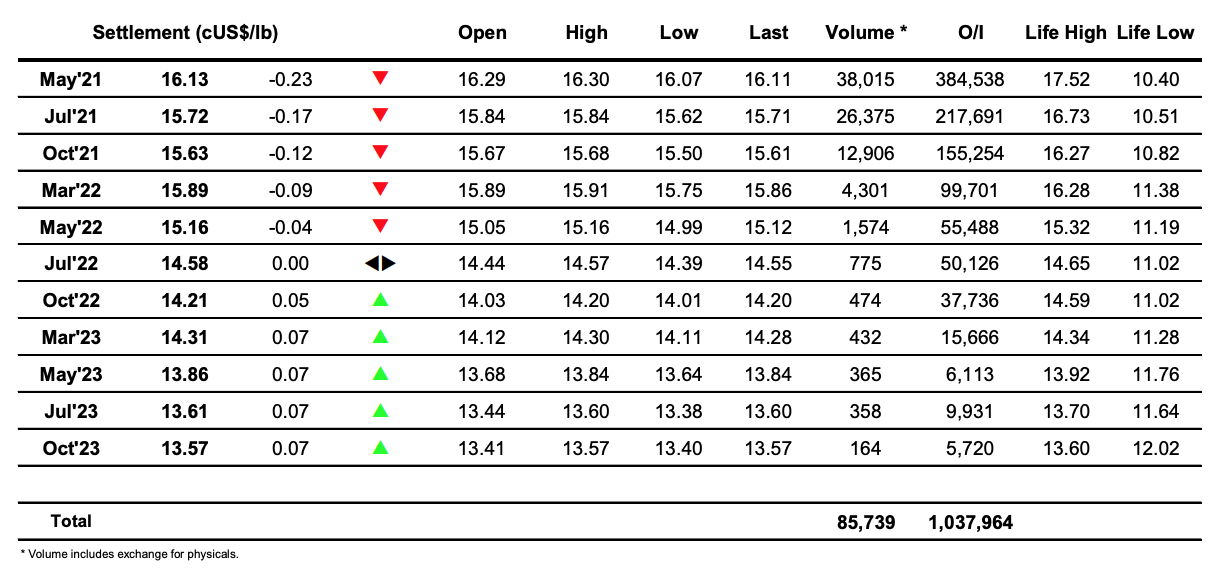

Sugar #11 May’21

We observed the significance of the macro movements to short term direction yesterday and today was in no way different as a cooling of yesterday’s strength led us to a lower start with May’21 easing back down into the range and holding in the vicinity of 16.20. There was no change to the picture until the early afternoon when a sudden burst of selling sent May’21 quickly down to a low of 16.07, however rather than being the start of a fresh look toward the recent lows we instead pulled back up slightly to enter another period of sideways trading a few points lower than this mornings narrow band. With the flat price continuing to show very little movement we did see selling emerge into the May/Jul’21 spread with trades as low as 0.40 points seen late in the afternoon, just a single point above the spreads first support level. The close was as quiet as the day that went before which led May’21 to a settlement at 16.13 as we concluded an inside day and leaving the market still trapped within the recent trading band.

Sugar #5 May’21

The impact of the macro was immediately visible this morning as May’21 quickly slipped back to the $460 area on the back of a slightly lower picture before proceeding to hold a very tight range on minimal volume throughout a featureless morning. A small push downward early in the afternoon sent the price back to $457.70 but the selling eased almost as quickly as it had arrived and we returned back to hold within the range. The illiquidity was particularly noticeable today and the first five hours of trading yielded a mere 797 lots of volume from the front month, and this despite the fact that the May/Aug’21 spread was flying in the face of market direction with its best performance in several days as it firmed to $14.20. The afternoon saw ongoing low volume conditions with the only real change to the picture being in the May’21 spreads which gave up the earlier gains in the face of the lower outright values to record a May/Aug’21 low at $12.20 ahead of the close. Light MOC buying pulled May’21 up to close at $459.50 as we ended the quietest week of the year so far.

White premiums firmed up a little despite the narrow trading range and we head into the weekend with May/May’21 just below $104, Aug/Jul’21 at $100.00 and Oct/Oct’21 at 91.50.

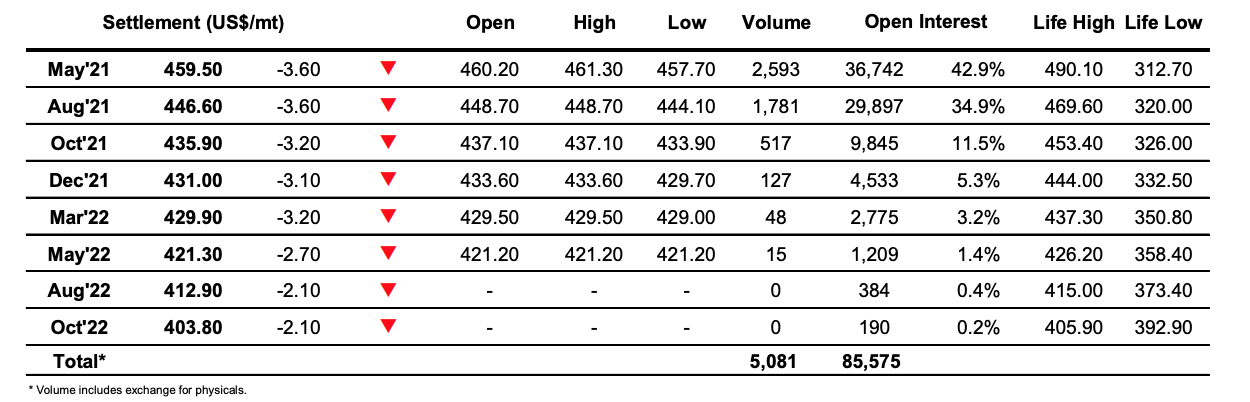

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract