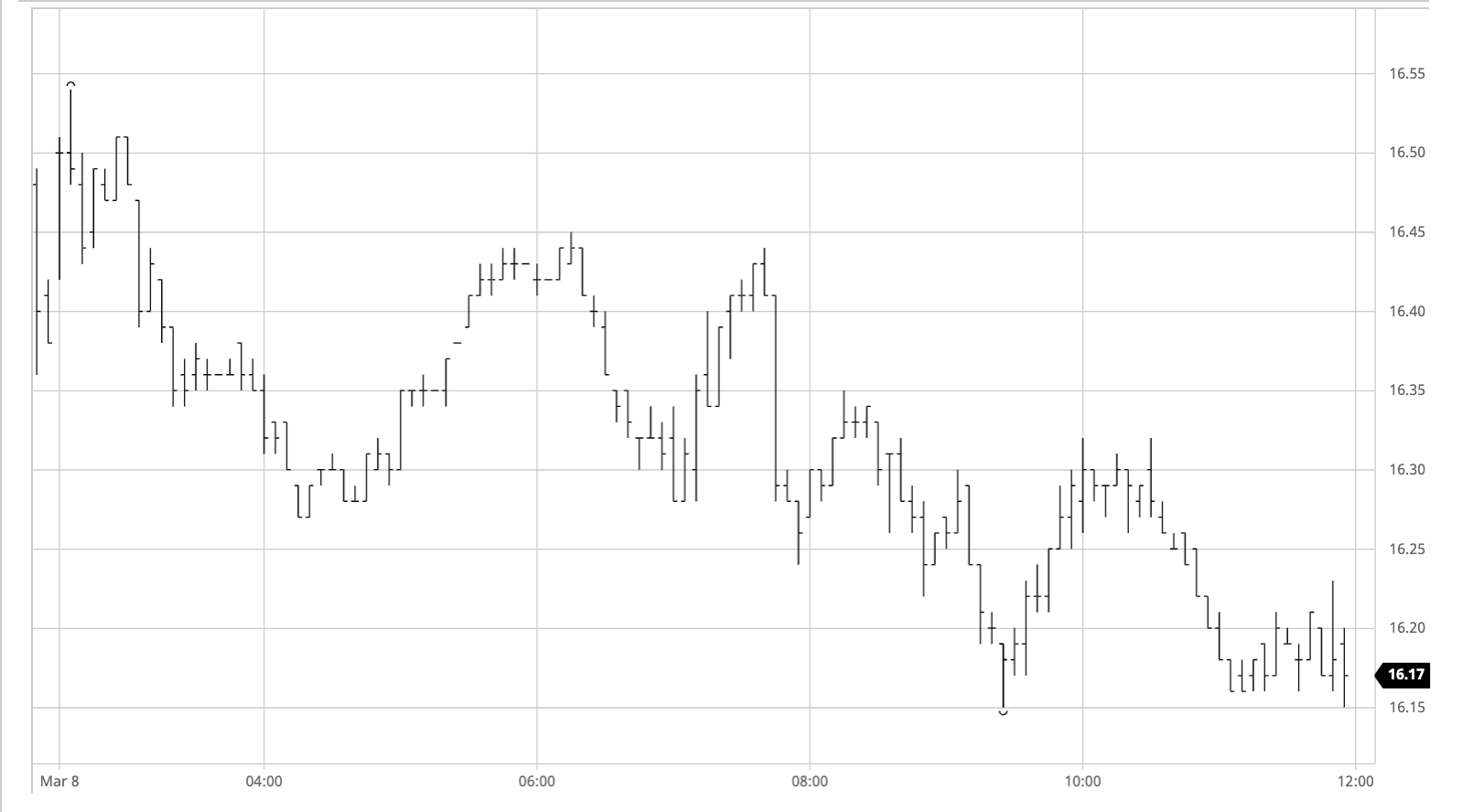

Sugar #11 May’21

A new week commenced with a very familiar scenario as the market saw low volume conditions through the morning. Initially there had been a push up to 16.54 in May’21 which placed the price just 2 points beneath Fridays highs, however with so little buying on show we eased back into the upper 16.20’s before finding a modicum of support. With so little volume changing hands this support proved sufficient to hold prices through the middle part of the day and into the afternoon, though as time moved onward so macro factors came into play to widened out the days range. The prime factors behind the lower sentiment were the return to weakness of the USDBRL which was once more in the 5.70’s while the recently strong crude prices was giving back some ground which in the absence of any other fundamental news is providing the prime source of directional inspiration for the specs/day traders. During the course of the afternoon this led the price as low as 16.15 while the nearby spreads also attracted some selling which pushed the May/Jul’21 in towards 0.50 points. While the recent lows were never under threat we struggled to climb away from the bottom end of the range during the final couple of hours, ultimately matching the session low on the post close with settlement just a small way above at 16.20. While today represented an inside day on the charts it will do little to reinstall confidence for the bulls and suggests further near term consolidation in the 16c area.

Sugar #5 May’21

Initial buying pushed May’21 upward to $467.00 however it lacked substance and once concluded we soon edged back downward towards overnight levels. Volume was sparse as we continued through the morning with very little volume traded as we continued within the lower $460’s, while spreads were also very quiet leading to one of the lowest volumes seen for some time. Given the lack of outright activity it was no surprise that white premiums were also seeing little interest though values did decline as we moved into the afternoon and May/May’21 touching near to $100 though this seemed more to do with the lack of whites support as the flat price traded below $460 than any significant selling. There was no hint of recovery as macro factors discouraged specs from any involvement on the long side though by the latter stages we were faring marginally better in relation to No.11 than had been the case earlier on which returned premiums back towards their starting values, May/May’21 at $102.50, Aug/Jul’21 at $98.75 and Oct/Oct’21 at $91.50. Closing values were a small way above session lows with May’21 at $460.00 and Aug’21 at $444.60 to conclude a quiet inside day.

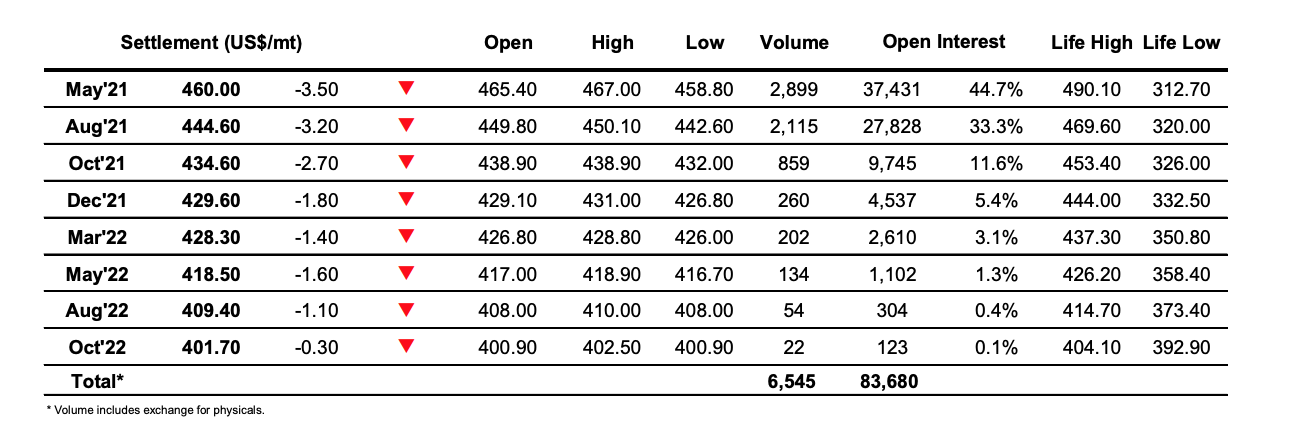

ICE Futures U.S. Sugar No.11 Contract

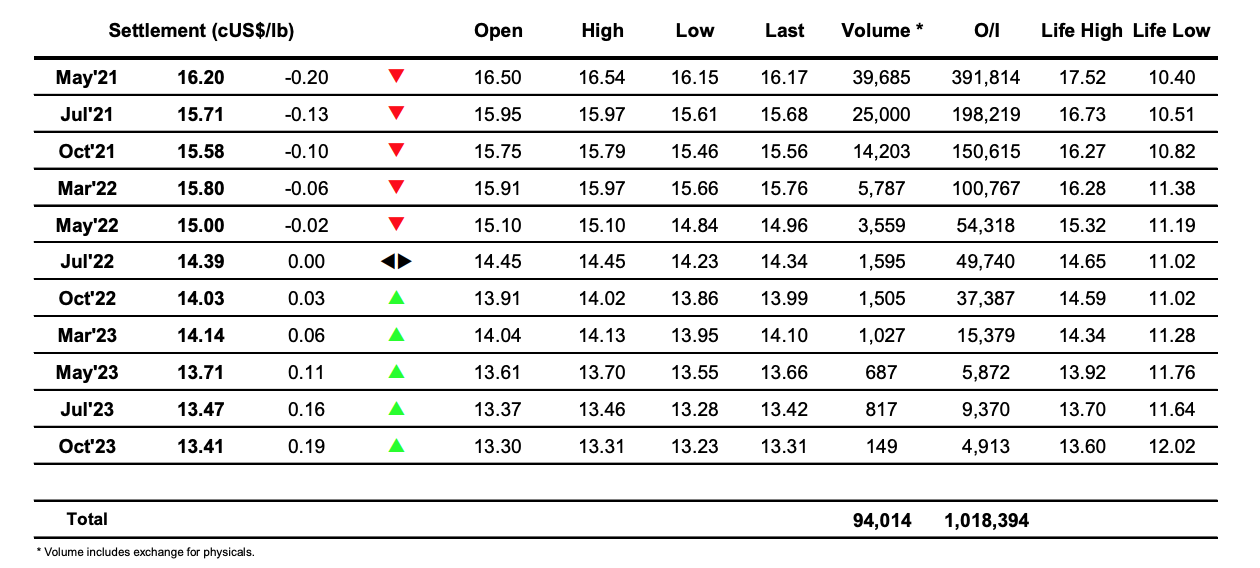

ICE Europe Whites Sugar Futures Contract