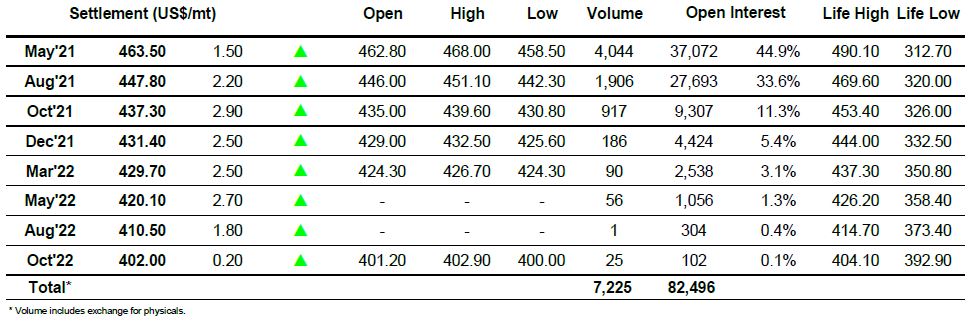

Sugar #11 May’21

The quietest start to a day for some time saw the May’21 contract holding near to unchanged levels for more than an hour before encountering some light selling which pushed the price downward to the 16.10 area where some buying was uncovered to provide support. Activity remained light through the rest of the morning and into the early afternoon during which time we simply edged slowly back up into the low 16.20’s so it came as something of a surprise when the monotony was broken with a short sharp push upwards to reach 16.49. The move appeared to be based on some light spec buying in reaction to the macro which was seeing 2 year highs for crude following yesterday’s OPEC announcement and with values now firmly in the green we saw more buying filter in behind as longs sensed the opportunity to pull prices more convincingly away from the 16c area. Of course this did not mean a continuing surge and instead we returned to a sideways pattern of activity only on this occasion we were doing so at the upper end of the range. It seemed that the market was being primed to push upward once more on the close however when the time came there was not the buying that may have been anticipated and instead we settled away from the highs at 16.40 following some end of week position squaring, providing a rather appropriate conclusion to a rangebound week that suggests there may be similar to follow.

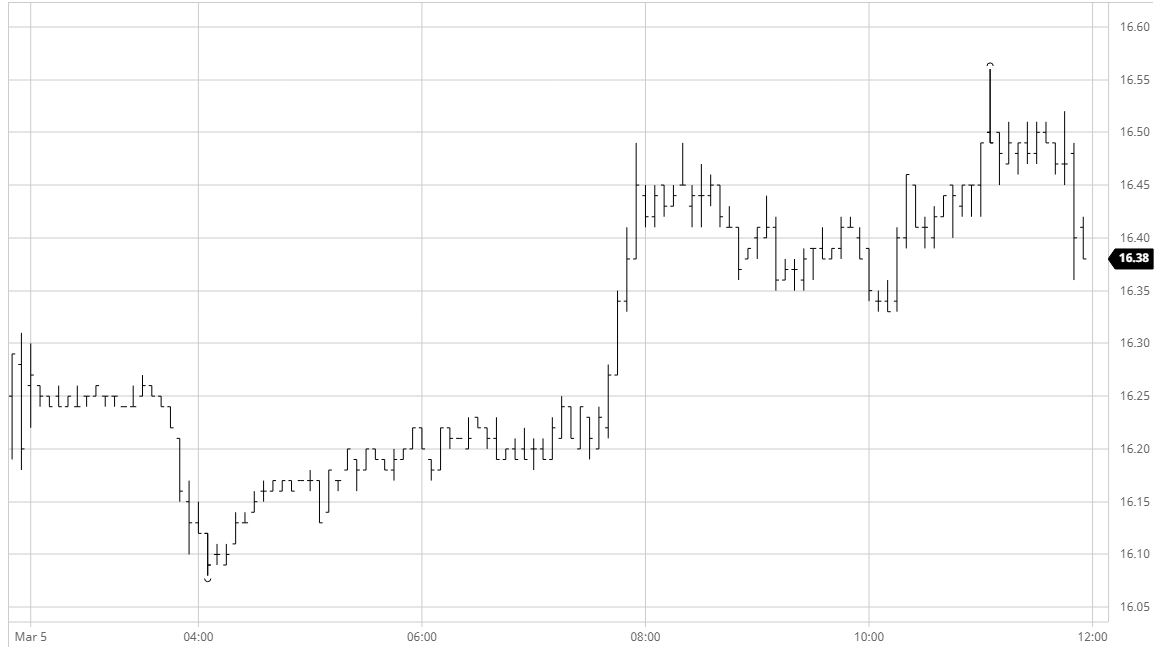

Sugar #5 May’21

A day of two halves started rather quietly with May’21 initially holding just beneath unchanged before finding some selling that pushed the price down to a session low 458.50. There was little activity being seen from either side as we then edged along in front of session lows however the underlying support clearly outweighed the lack of selling and so prices gradually recovered to be touching unchanged levels once again by the early afternoon. A price spike then followed with May’21 pushing above $467 on just a few hundred lots of volume and this set the tone for the second half of the session during which prices remained firm at the upper end of the days range. Impetus for the recovery was clearly generated by the macro sentiment of higher crude prices however this alone is not enough to get prices running all the way back to the recent highs so consolidation at the upper end of the range became the theme as longs looked to set things up for a positive close that may reinvigorate the technical picture. In the end this was not achievable as some end of week book squaring sent values back to mid-range which suggests we may see a continuation of the recent quiet activity for the coming days. White premiums saw little change having played within a similar range to the last couple of sessions, ending the week with May/May’21 at $102, Aug/Jul’21 $98.50 at and Oct/Oct’21 at $91.50.

ICE Futures U.S. Sugar No.11 Contract

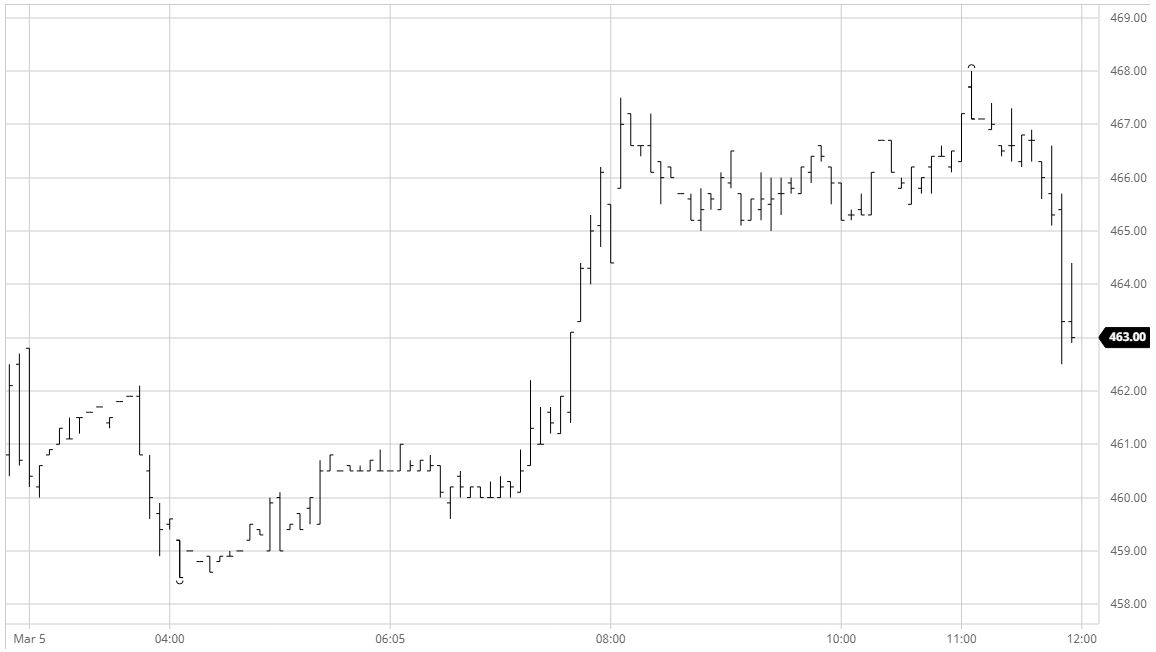

ICE Europe Whites Sugar Futures Contract