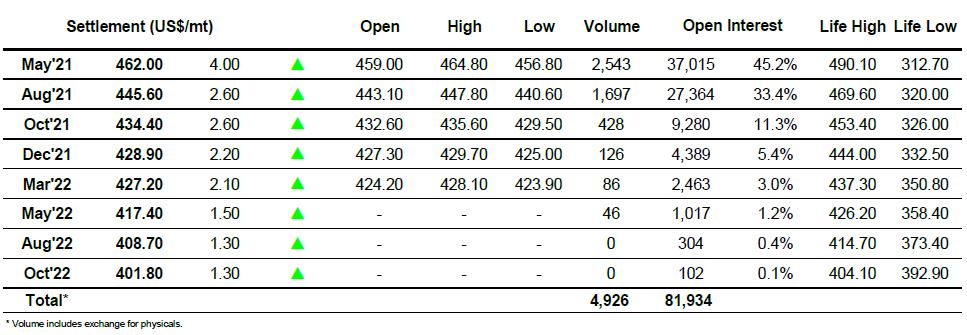

Sugar #11 May’21

The day began with prices on the backfoot as the hangover from yesterday’s performance encouraged sellers to push down towards 16c and having worked through the initial support we saw a couple of stops triggered as the price pushed through to a new recent low mark of 15.96. Selling continued to place nearby values under pressure for a while however the 15.96 level held firm and as the price lifted so some short covering from day traders took prices up to new session highs . With values now established firmly back above 16c activity settled down and for a period we simply meandered either side of 16.20 in a rather featureless environment. The macro had been relatively quiet though Crude led the way on news that OPEC would roll its production cuts into April, and this seemed to draw in some long interest from day traders as we pushed up to 16.41, but here too we were unable to break from the range and prices again came back into the range. Producer action was non-existent with the USDBRL recovering to be trading either side of 5.60 and we headed quietly into the close. Some defensive buying and position squaring from day traders was the only action to bring a relatively slow day to a conclusion, one that suggests a continuation of broadly sideways action is the most likely route forward for the near term.

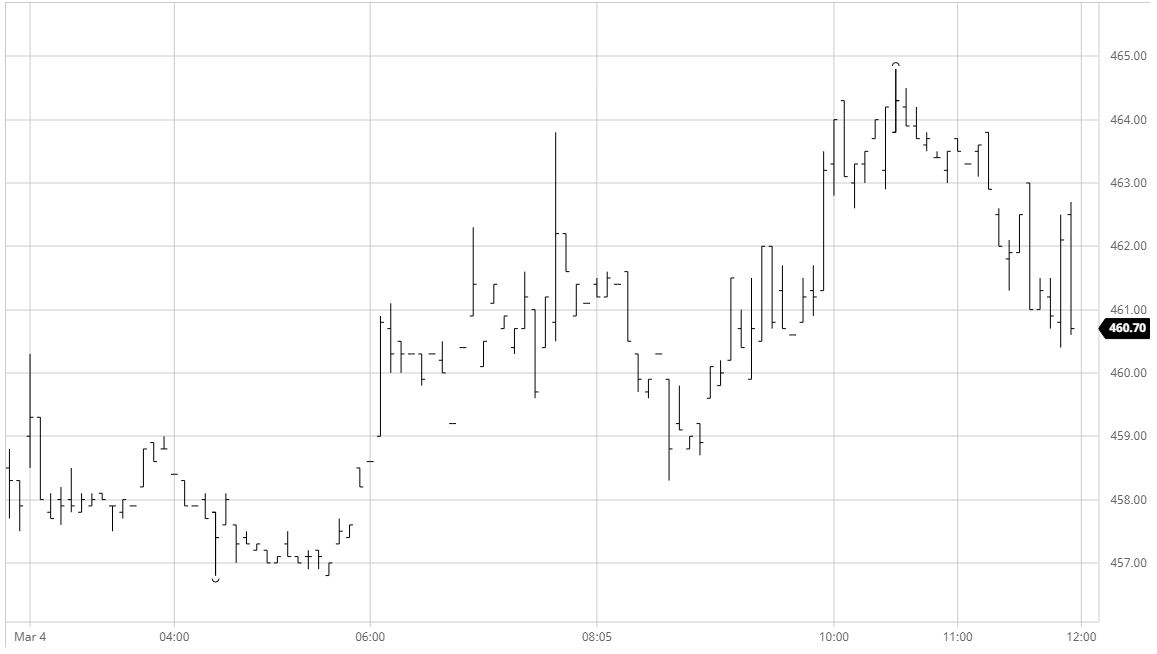

Sugar #5 May’21

The negative sentiment of last nights close was maintained during early trading and over the course of the first three hours we saw May’21 edge downward to $456.80 though finding some support against buying placed in front of the $454.50 recent low mark. The malaise was then broken with a sharp jump upward around noon which provided some fresh impetus to longs, and while there was limited upside to the moves we did at least see May’21 trying to build a higher base in the vicinity of $460. With crude trading upwards on talk (later confirmed) that OPEC would roll its production cuts into April there was a little more spec buying in place and this enabled another push up to $464.80, however in a week where we have flitted around the range so often we proved unable to maintain the highs and slipped back towards $460 once again on some long liquidation. In amongst the choppiness the white premium values saw another day of wide ranges as May/May’21 swung between $102 and $106.25 while Aug/Jul’21 ranged from $98.50 to $102, with both holding towards the centre of these bands as the close approached. The call was mixed with some defensive buying meeting with end of day position squaring as May’21 settled at $462.00.

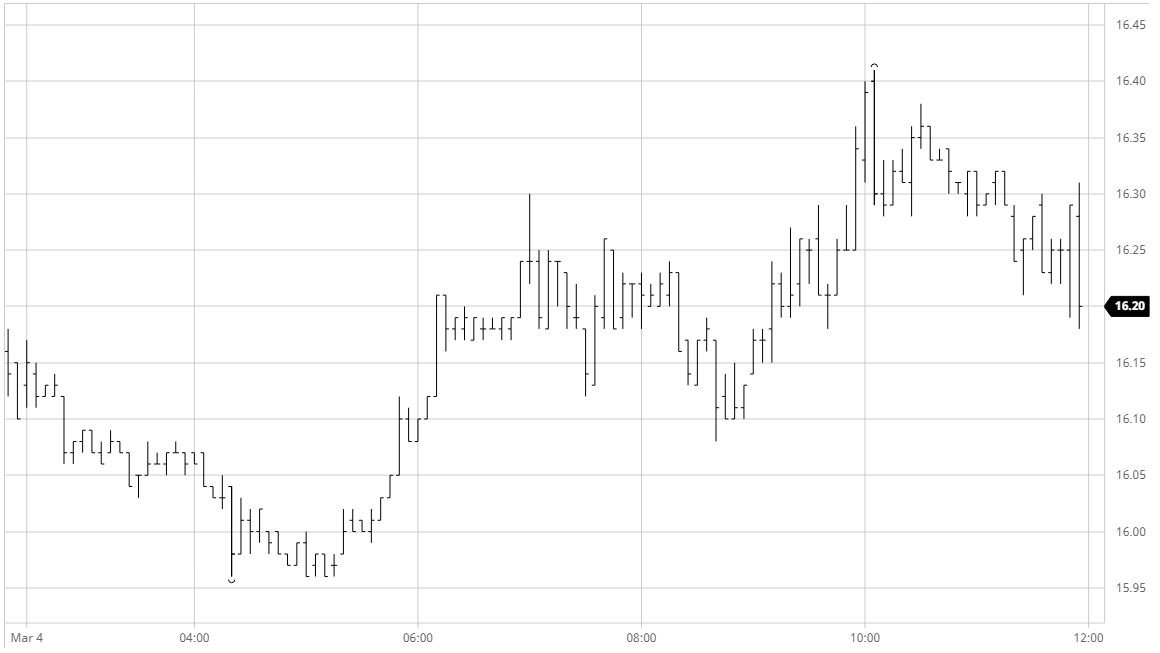

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract