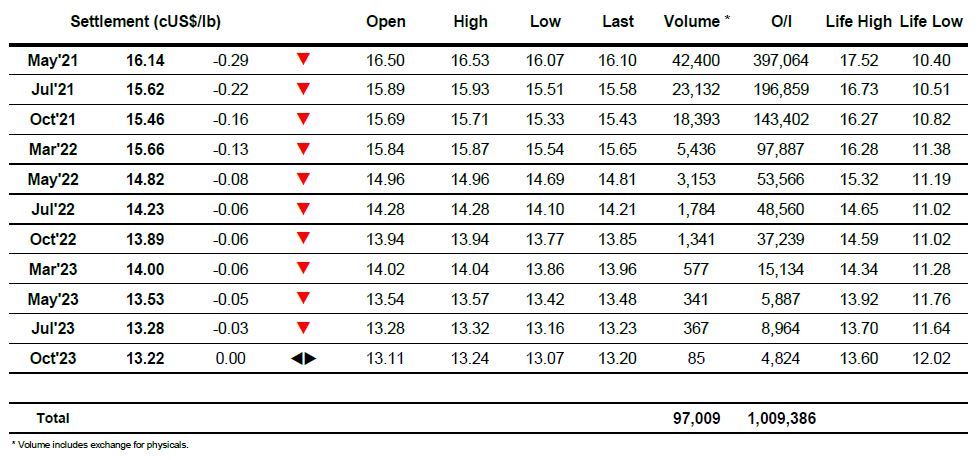

Sugar #11 May’21

The market began the day by immediately printing up at 16.53 however there was limited buying on show and so the price soon slipped back to the 16.30 area where a little more support emerged. In quiet conditions we edged sideways within a narrow band for the next three hours but with no fresh buying appearing to reignite the upward momentum of yesterday afternoon the support gave way and we began to track downward once more. A short but sharp decline led May’21 down to 16.07 but support soon reappeared and we rose back to 16.30 by mid afternoon as longs looked to maintain the positive momentum of yesterday. Spreads were increasingly starting to lose some ground which made it tough to maintain the rally and with external factors such as the USDBRL hurtling towards 5.80 also impacting upon sentiment we saw prices easing downward again. The earlier lows did not come under threat however by the time that we reached the close we were not far away as May’21 traded down to settle at 16.14 with the May/Jul’21 spread settling at 0.52 points. Suddenly yesterdays rally seems a distant memory and having pulled back do doon afterwards it seems as though a fresh look to 16c beckons unless the macro suddenly rides to the rescue.

Sugar #5 May’21

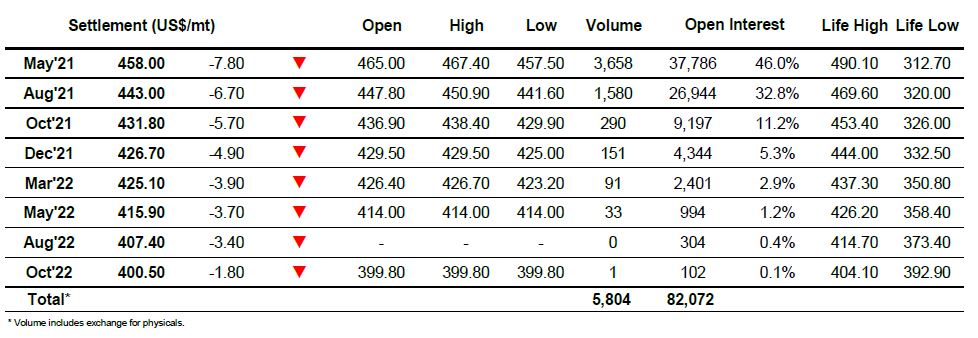

The market opened either side of unchanged levels and matched yesterday’s May’21 high mark of $467.40 before slipping as a lack of any buying led prices to drift back a touch. Volume was particularly low during the morning even when compared against other recent thin sessions, maybe due to the fact that consumers were not chasing higher and there were few fresh sales to hedge, and in this environment we continued to struggle to regain the upward trajectory of the past two sessions. By noon we had slipped to the $463.00 area and with so little buying to provide support we then slumped further to $459.00 on just a couple of hundred lots of volume. The market pulled back up during the early afternoon however the recovery petered out before we got close to revisiting unchanged levels and in disappointing action we started downward once more and were near to session lows once more as we entered the final hour. There was to be no repeat of yesterdays sensational close as instead values remained weak, reaching a low of $457.50 late on while the spreads also made new lows with May/Aug’21 trading at $15 on the call. Settlement was reached at $458.00 leaving the market appearing vulnerable once again. White premiums were calmer today though still saw reasonable movement with May/May’21 ranging between $102 and $105.75 before ending at the lower end of the range near to $102.50. Aug/Jul’21 ended the day at the lower end of its range around $99 while Oct/Oct’21 closed at $91.

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract