Sugar #11 May’21

The day began on a positive footing once again with early buying taking values upwards to steadily climb to a high of 17.36 over the course of the first 90 minutes. The pace of buying then eased which led values to pull back once again and though we saw a bit of a washout from day traders the May’21 value held comfortably ahead of 17c as we moved into the busier afternoon period. With the market still struggling to restart the strong recent upward momentum we found ourselves testing the lows once again and in a fresh round of long liquidation May’21 saw a quick fall to trade below yesterdays 16.85 low mark. The lower levels brought in some initial buying but as that concluded a further burst of albeit light selling sent the price to a fresh low mark of 16.68 before repeating the pattern and attempting to consolidate/build once again. Much of the action was coming from long liquidation/profit taking with algos and day traders reacting to this in their usual way as again producers kept a low profile while to the downside consumers were light buyers as they locked in some pricing. Though we lifted off of the highs we remained toward the lower end of the range through the rest of the afternoon, with some cooling of the macro possibly discouraging smaller specs/day traders from pushing upwards again at this stage. A mixed close resulted in a May’21 settlement level at 16.84 and though todays outside day was not what the bulls would have been looking for the continuing thin and volatile environment means that it remains tricky to predict the next move. March/May’21 was calmer today as volume diminishes ahead of the March’21 expiry tomorrow, though still saw a reasonably wide range between 1.09 points and 0.85 points. Open Interest fell sharply to 26,346 lots (down 25,140 lots) which suggest that we now have only fine tuning to conclude ahead of the tender.

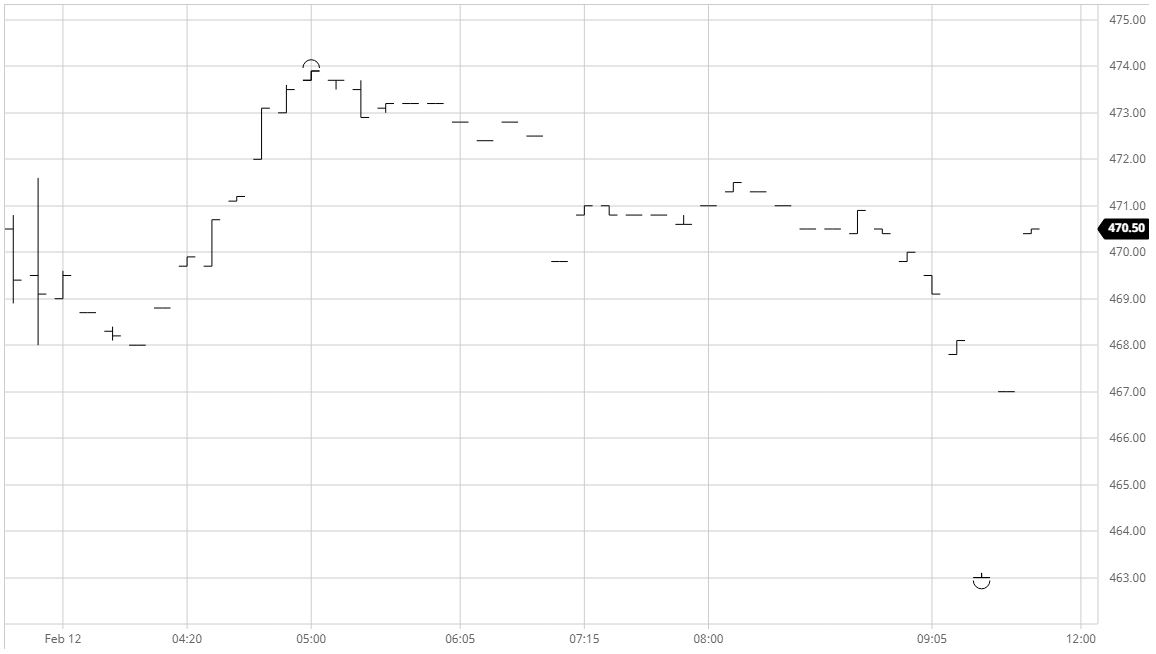

Sugar #5 May’21

Continuing on from the higher close last night the May’21 contract started on the front foot today with a push upwards to reach $484.90 over the first hour or so before pausing as the initial buying eased. Initially this only led to a small drift backwards however a little more selling then began to creep in later in the morning which brought values to overnight values once again where a little more underlying buying could be found. Moving into the afternoon volume continued to be fairly light however that changed when a dip below $476.00 encouraged some long liquidation that sent the price quickly towards $470 and then onward to $468.40 before finding a little more traction. This move did serve to meet the first downside technical target as we filled the recently established $473.70/$475.00 gap but despite this there seemed to be no coming back today with further lows recorded at $466.50 as we remained weaker throughout the rest of the afternoon. White premium values had proved initially steady today however the afternoon slide caused them to give back another large chunk of the recent gains with May/May’21 slipping from a morning high at $102.50 to be trading around $97.00 late in the afternoon while Aug/Jul’21 saw an similarly large range it fell to $95 having been around $99.50 early on. Nearby spreads were also showing losses as the weight of nearby selling took its toll and we saw May/Aug’21 record a low of $15 while Aug/Oct’21 slipped to $11.50. Heading into the close it was selling that remained dominant with May’21 recording a session low mark at $466.00 on the call while May/May’21 touched $96 to send us out weakly.

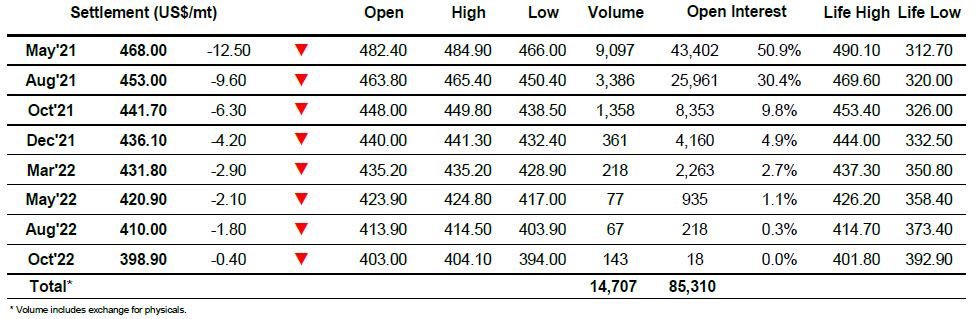

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract