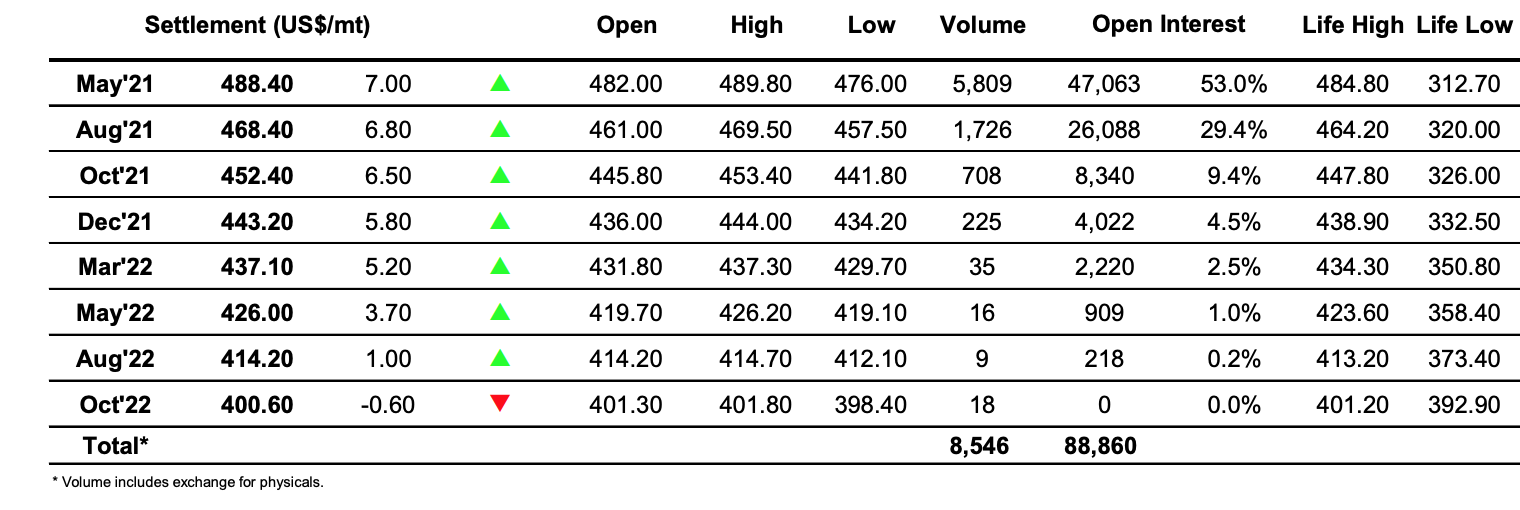

Sugar #11 May’21

The market began rather calmly following on from the sharp rise in values seen during the second half of last week and with the rally on hold there was a mid-morning dip to 16.71 for the May’21 contract. It was a mere blip however and no significant selling followed so in continuing moderate to low volume the market slowly began to edge back upwards to be back around the opening high as the Americas came online to begin their day. While the climb from the lows had been unspectacular it provided a decent platform from which the bulls could begin to push once again and the afternoon developed in a way that could not have been foreseen just a short while previously. Led by outright buying for the May’21 contract the pace at which we rallied increased quickly as seen by the spikes to reach first 17.21 and then 17.44, while alongside the soon to expire March’21 contract surged in an increasingly thin environment to trade 18.73 as the March/May’21 spread widened out from 1.00 points to 1.30 points in a matter of minutes. Aiding the bulls was the fact that there was so little overhead selling in place despite many beneficial factors to their pricing opportunities, with not just contract highs down the board for them to take advantage of but also for the Brazilians a significant currency opportunity with the USDBRL weakening to trade either side of 5.50 on concerns following Bolsanaro’s removal of the CEO of Petrobras. It was no surprise that the closing stages saw a further push upwards to record a new front month high of 18.89, the highest level seen since March 2017, while May’21 reached 17.50 with the settlement price just a small way below at 17.44. This keeps the technical picture extremely positive though the spike over the last four session leaves near term indications heavily overbought which potentially makes it difficult to continue in the same way over the coming days.

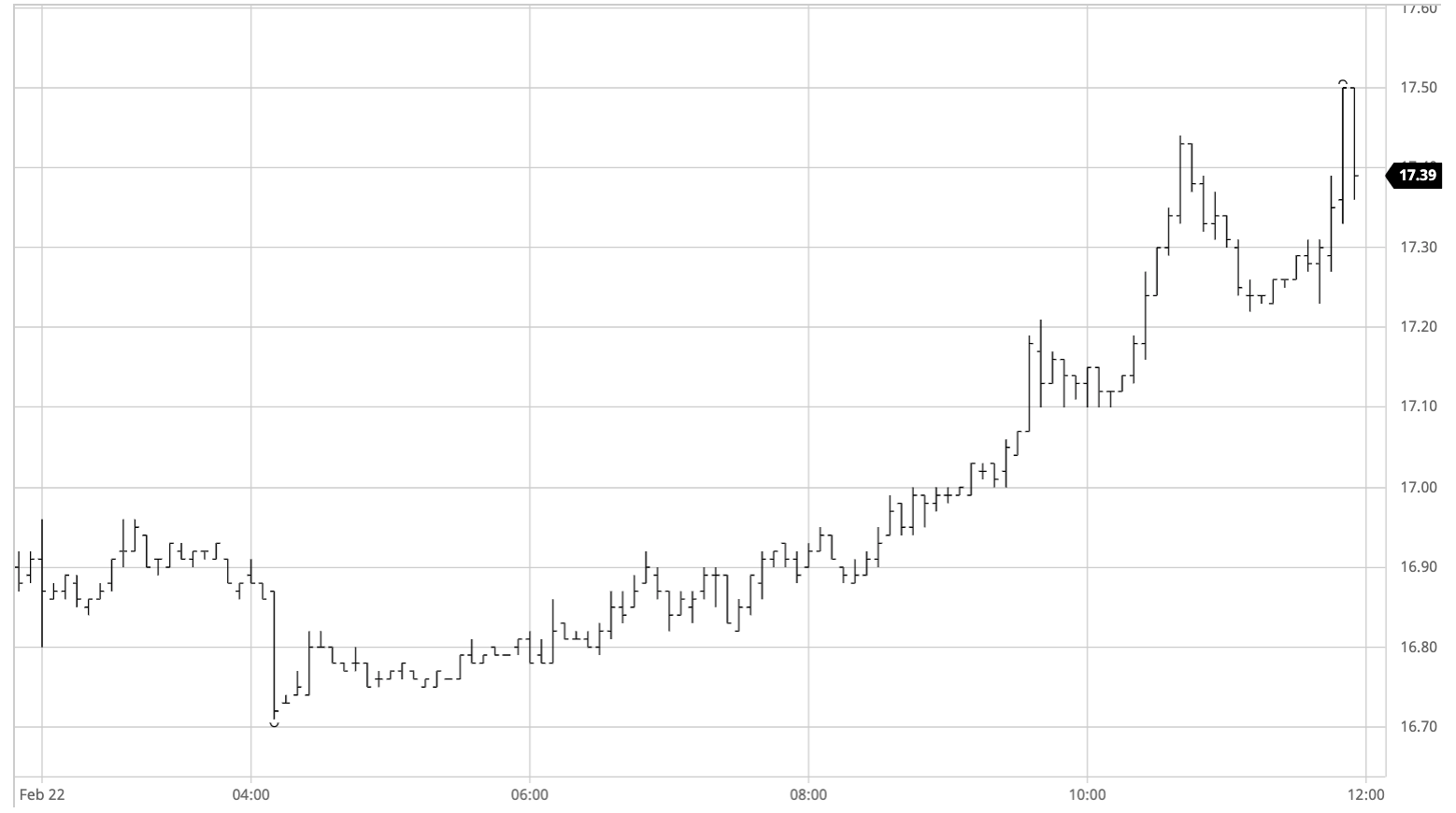

Sugar #5 May’21

A rather mixed start to the week saw May’21 trading either side of Fridays closing level initially before coming under a little pressure which caused values to retreat to $476 before gradually starting to edge higher once again. Much of the support was being generated against the No.11 which was looking far more vibrant that the whites today, and though it was pulling us slowly upward the moves were happening at the expense of white premium values which came under the most pressure seen for some time. A sharp rally in the No.11 market as the afternoon progressed was the catalyst for a spike in the May’21 value to $487.70 while also further weakening the white premium as we saw May/May’21 trading all the way in to $102, Aug/Jul’21 down to $99 and Oct/Oct reaching $92. Some long liquidation that caused values to slip back from this high proved short-lived and the closing stages saw the latest spike upward that led us to our daily new contract high mark with May’21 trading to $489.80 and the May/Aug’21 reaching a widest $20.50. This settlement provides further technical strength and the lack of any sizable overhead selling suggests that this could continue although increasingly overbought short term indicators may persuade buyers ease back in case a heavily overbought market leads to whip saw correction

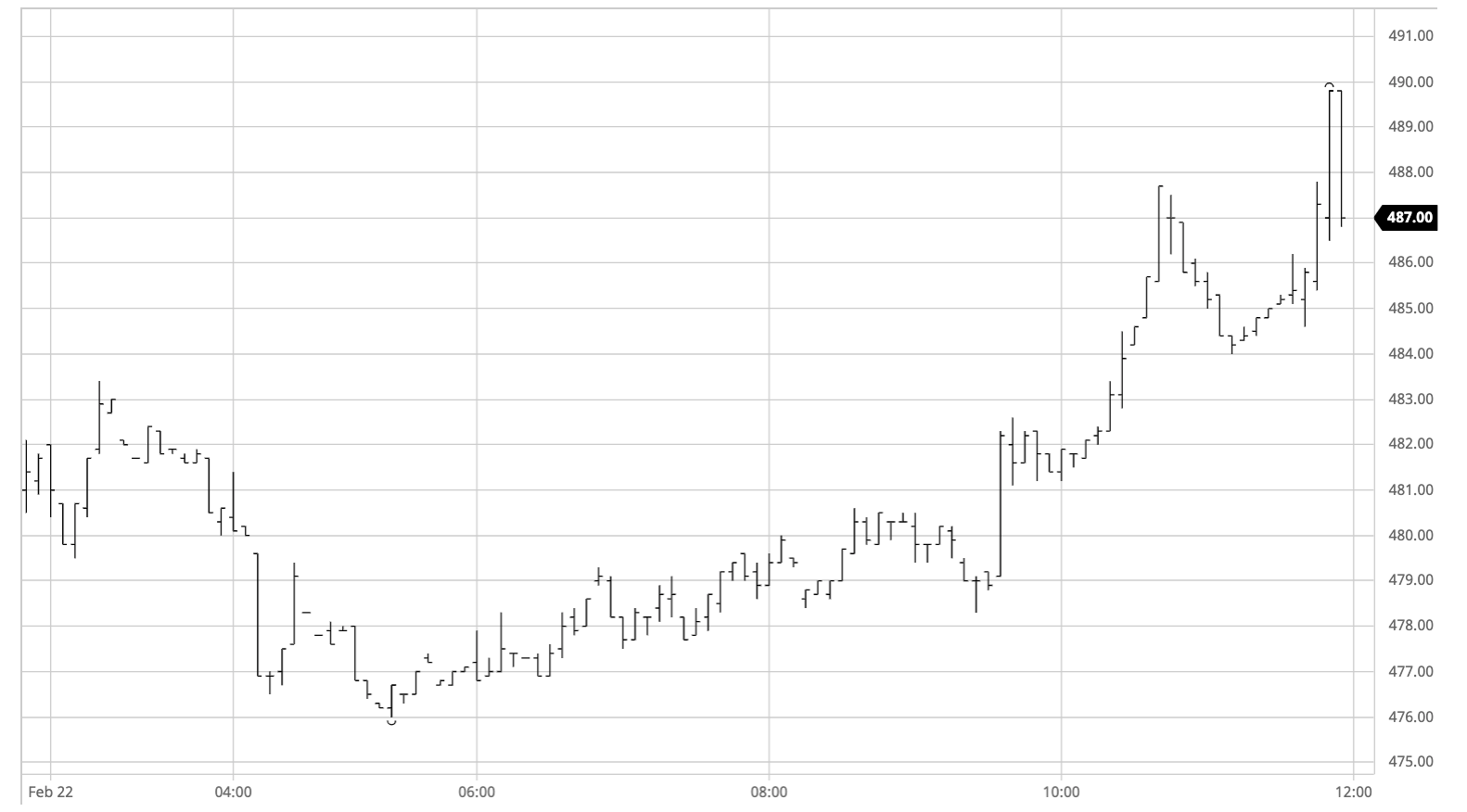

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract