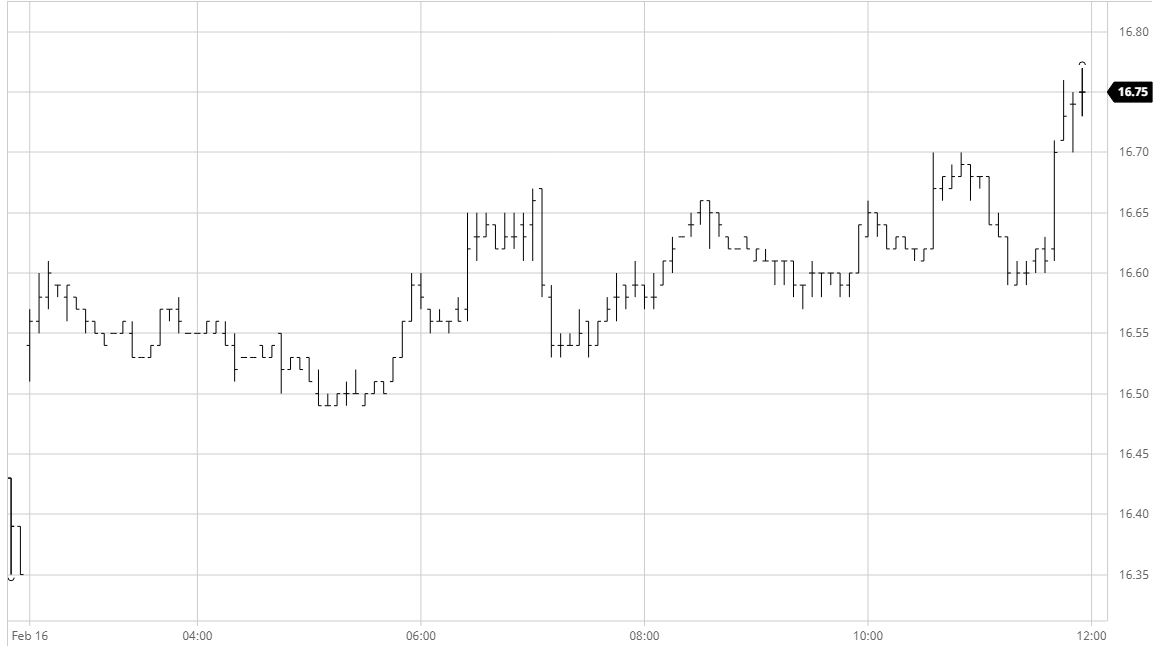

Sugar #11 Mar’21

The market was due higher as we returned from the extended holiday weekend to find that London whites had pushed ahead yesterday, and early buying duly emerged to send the May’21 contract up to 15.85 before pausing. What started a pause soon became a prolonged period of consolidation and over the course of the morning we eased back downwards though all the while remaining comfortably above Friday’s 15.64 settlement level. Increasingly we are seeing that the bulk of the daily activity is moving into the May’21 contract however that’s not to say that there is not still steady March’21 interest with a good volume remaining to be both priced or rolled forward ahead of the forthcoming expiry next week. Activity picked up a little as we moved in to the afternoon with a run of various new session highs over the course of several hours culminating in a highest mark of 15.97 during the closing stages as longs looked to rebuild the momentum lost since last Wednesday in the absence of Brazilian producers who are enjoying their carnival holiday at present. The close saw some position squaring and this selling kept May’21 from challenging the 16c area, though the same could not be said for the March’21 contract which itself went out trading a new session high of 16.77 with the March/May’21 spread recording a widest 0.83 points. May’21 settled at 15.92 to conclude a solid performance that has brought last weeks contract highs back into view.

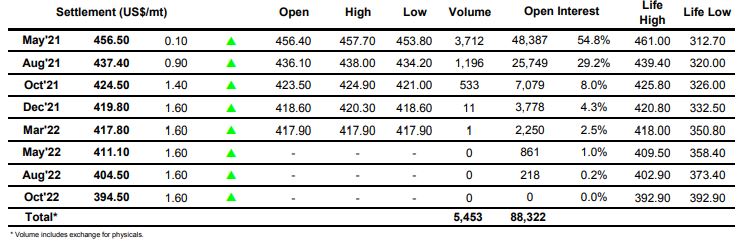

Sugar #5 May’21

The day began on a negative footing although this was in part due to the No.11 only partially matching the strong gains seen for the whites yesterday and the white premium values needing to realign now that both markets are open once again. Yesterday had represented a good opportunity to set the tone higher once again so it felt a little disappointing that the whites could not continue to lead the push today and better rebuild the momentum lost late last week as a lingering rangebound session developed, reflected in some lower white premium values with May/May’21 retreating back to $106 as the day progressed. Buying in reaction to the No.11 did take May’21 marginally above the opening high mark as we traded to $457.70 however with the May/Aug’21 spread narrowing in to $19 it was continuing to send out disappointing signals and by the close the new spot month was little changed while the May/May’21 premium value had given back more ground and was trading at $105.00. Overall it was a somewhat disappointing performance after yesterday though no significant harm has been incurred.

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract