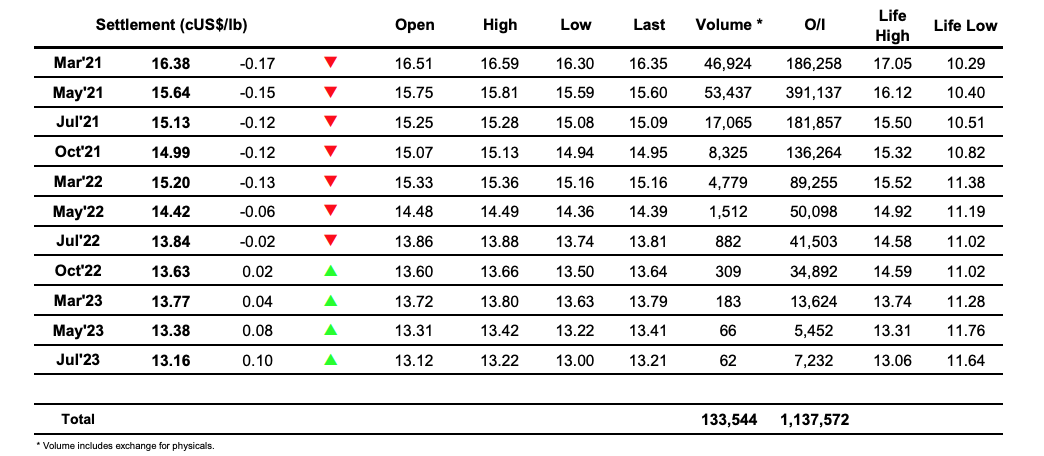

Sugar #11 Mar ’21

A slow start to the day saw nearby values trading lower over the first couple of hours but with so little volume changing hands it all felt rather meaningless. A brief pull into positive ground midway through the morning then failed to achieve anything other than to extend the meagre range and values soon resumed the quiet downward path once more. Despite having concluded the index roll window yesterday there remained some steady roiling which again made the March/May’21 spread the most actively traded position and as the market continued to quietly edge downwards over the afternoon we saw the spread narrow to 0.68 points with flat price lows recorded for March’21 at 16.30 and May’21 at 15.60. With a holiday weekend ahead for No.11 it seemed that many had switched their machines off and headed away early as we continued to meander within the range for the rest of the day with the only moment of note being a push back towards 16.50 which soon petered out. By the close we were back towards the bottom of the range with May’21 actually recording a marginal session low mark of 15.69 in the final seconds with the spread firmer at 0.76 points. Overall a disappointing performance that will leave many disappointed and if this is a sign of things to come having failed to build upon Wednesdays strength it will leave many disappointed that the weekend will only be three days long.

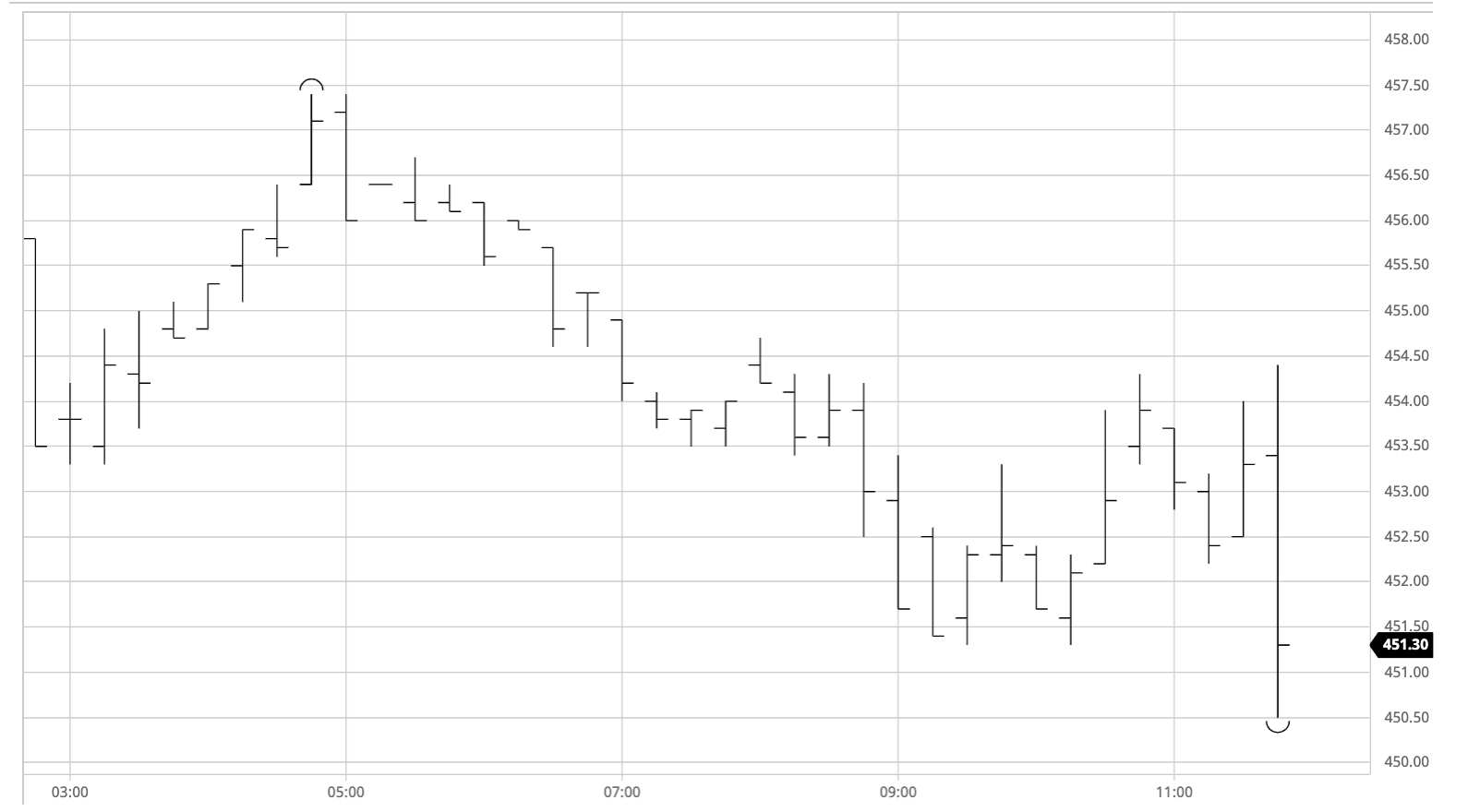

Sugar #5 May ’21

There was an immediate dip for the May’21 contract today with buyers few and far between and though this was picked back up with some steady buying taking May’21 to a high of $457.40 later on in the morning the highs proved rather short-lives and in thin conditions we eased downward once again. All eyes were tuned to the March’21 contract ahead of tonight’s expiry where today’s open interest figure of 10,958 lots suggests that we will see around 500,000mt tendered, and there was some choppiness for the March/May’21 spread as it ranged between $11 and $17.20 with both ends of this range seeing more sizable bids/offers as those involved in the tape looked to fine tune their involvement. Moving through the afternoon the market remained weaker with the dips picked up on each occasion though with activity remaining light there was no prospect of any kind of turnaround to reinvestigate the upside. It seemed as though we would end within the range until some end of week position squaring sent May’21 down to a new session low at $450.50 though settlement was a couple of dollars above at $452.60.

Tonight’s March’21 expiry has seen 10,235 lots (511,750 mt) tendered with Indian, Central American and North African sugars believed to be in the mix though full details of participants are still emerging.

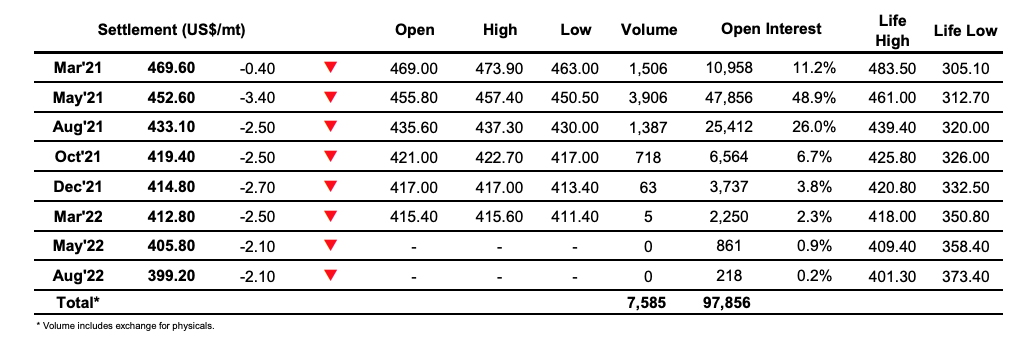

ICE Futures U.S. Sugar No.11 Contract

ICE Europe White Sugar Futures Contract