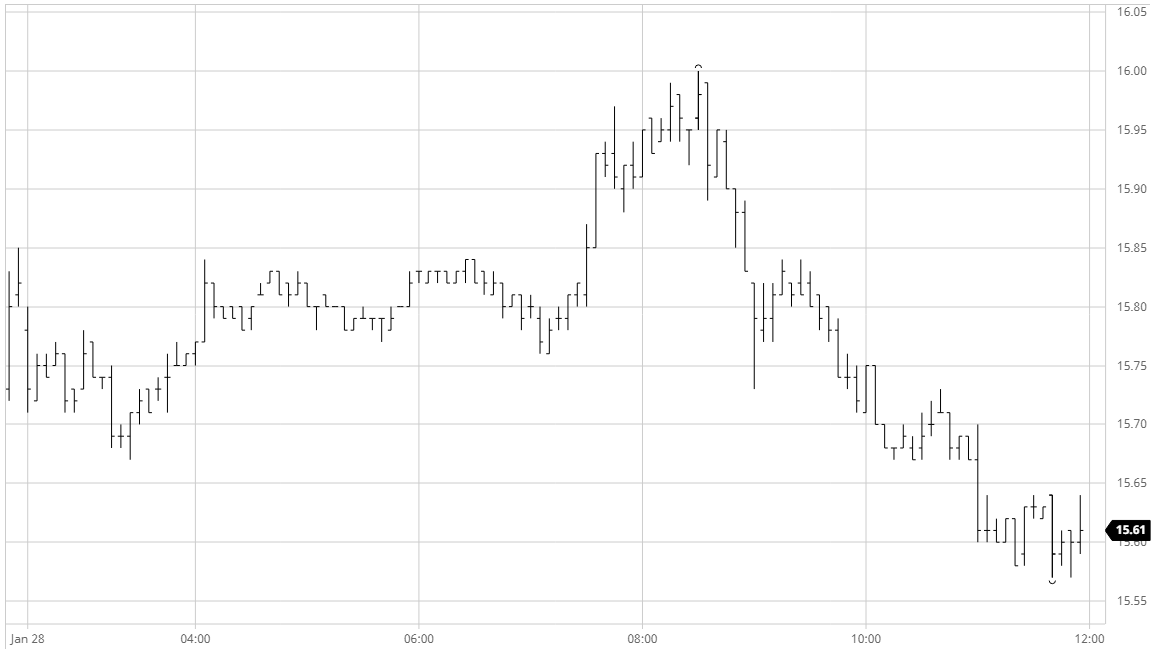

Sugar #11 Mar ’21

No.11 experienced another rollercoaster day with smaller specs continuing to dictate the movement within the confines of the recent trading range. Having found support below 15.70 once again this morning the market consolidated on very low volumes for several hours and it was not until we moved into the afternoon that the specs and algo’s lifted their heads and began to push the market once again. Todays effort saw the March’21 contract rise to 16c before running out of steam, and it is feeling as though this pattern of action is now becoming rather tired with the specs crashing the price back down to 15.73 soon afterwards as their liquidation took place. This failure set the tone for the rest of the afternoon and we continued down at a slower pace to work through the scale buying and record a session low at 15.57 during the final 30 minutes. The decline inflicted some damage on the nearby spreads which had been trading firmer from very early on today and March/May’21 reached a narrowest 0.64 points having been at 0.72 points during the morning. Closing activity saw decent volume but within a tight range, leaving a weak March’21 settlement price at 15.59 and keeping the years low mark of 15.40 in view should the specs decide upon a new approach.

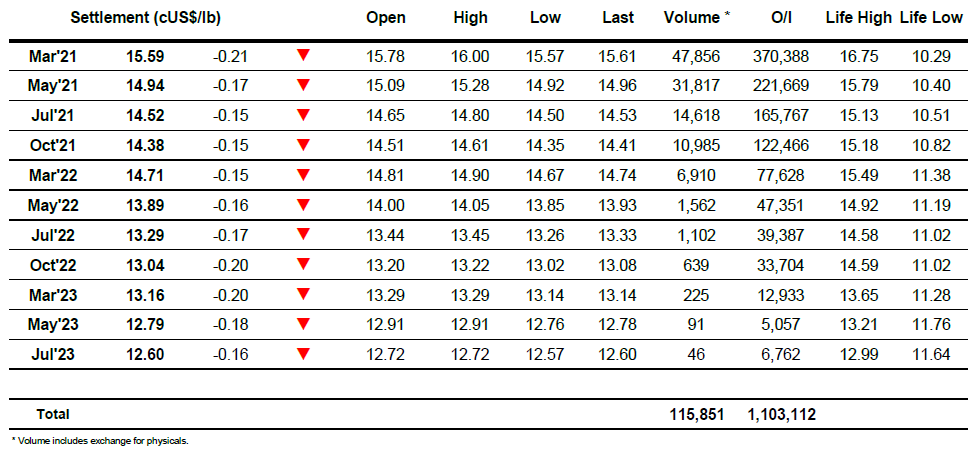

Sugar #5 Mar ’21

We commenced the day trading a little lower on very low volumes with the lack of substantial buying continuing to impact on prices and ensuring that we remain near to recent lows. Gradually we then began to pick up a little as some light buying pushed through the ever present market vacuum and led March’21 back up to consolidate around unchanged levels for the rest of the morning. The early afternoon saw volumes pick up a little aided in no small part by the March/May’21 spread which was finding some support to make back yesterdays losses, with the differential heading back out towards $15 while the March’21 flat price headed on to $449.50. In a repeat of recent days we again faced the issue that there is no follow up support for the market when the specs step back and the second half of the afternoon saw all of the gains reversed to leave values back near to morning lows as we headed into the closing stages. The flat price movements also conveyed some volatility into the white premiums which saw bot the March/March’21 and May/May21 touching $100 intra-day, a particular gain for the March/March’21 which had been down at $95 earlier in the session, and though both were at the higher end of their ranges late on the market volatility saw them off of the highs. The call was quieter than recent days and saw March’21 post a loss with settlement at $441.60.

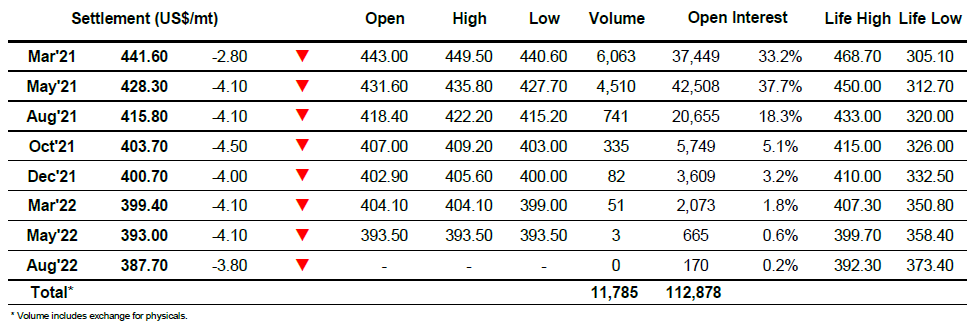

ICE Futures U.S. Sugar No.11 Contract

ICE Europe White Sugar Futures Contract