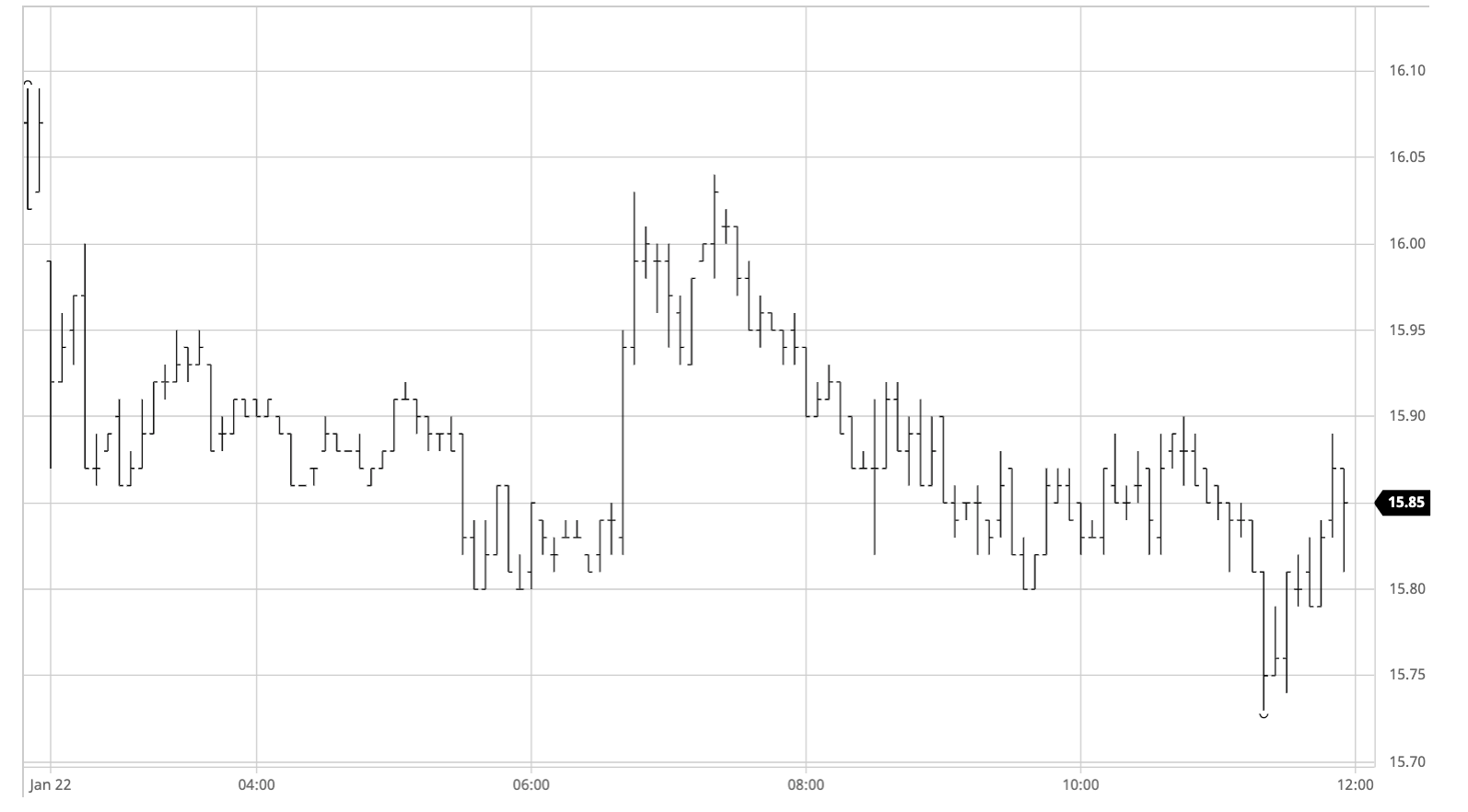

Sugar #11 Mar ’21

There was early selling on display for nearby positions with the spot March’21 contract immediately pushed beneath 16c and then sliding down to 15.86 before encountering support placed ahead of yesterday’s 15.81 low mark. The mixture of trade/consumer buying served to provide decent support to the market ahead of 15.80 throughout the morning and provided the platform for a sharp rally during the early afternoon that saw March’21 burst up from 15.82 to 16.03 on a low volume of just 1,900 lots. While we continued to flirt with the 16c area for a time afterwards the move failed to generate any additional spec support and gradually the price retreated lower once more, culminating in a fresh examination of the 15.80 area. Having seen nearby spread values giving back some ground yesterday today was proving to be rather more contrarian in nature with March/May’21 shrugging off some light early losses to be trading back up around 0.80 points this afternoon, while March/Jul’21 also firmed to a widest 1.30 points in spite of the struggling flat price. The final hour saw the 15.80 level crack to widen the range down to 15.73 though defensive buying returned and ensured settlement at 15.87 to conclude another day within the broad range.

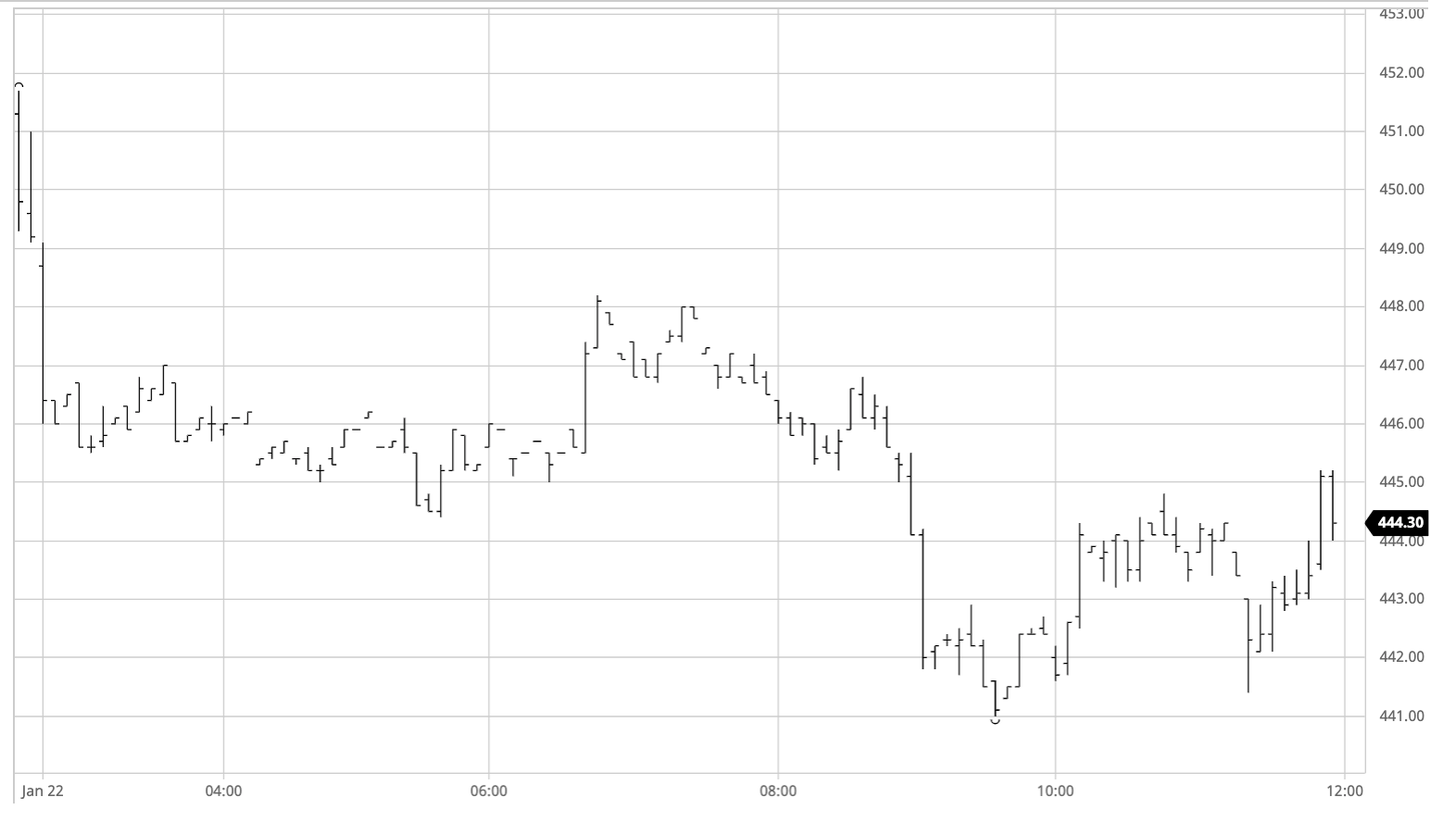

Sugar #5 Mar ’21

Confidence was undermined by yesterday’s decline and we started today on the backfoot with selling from the get go sending March’21 downward to $446 before finding some support against consumer pricing which enabled values to move into more of a consolidation pattern over the course of the morning. The desire from longs to defend their holding remains unquestionable and the early afternoon saw a defensive push away from the lows however with limited buying quantity and no desire from the consumers to follow suit the move could not be sustained and gradually we retreated back to the earlier lows. Breaking below $444.50 then led to a move in the opposite direction with some sell stops triggered on route to a session low mark of $441, and with no apparent appetite to push back upward we settled down at the lower end of the range. Volume was strong on the day, particularly for the March/May’21 spread which was sold down to $12.20 on the decline, possibly against spec rolling with only 3 weeks now remaining until the March’21 expiration. Despite the flat price remaining weak there was a recovery for the spread later in the afternoon when the selling pressure eased, and as we entered the final hour we were trading at a daily high of $15.50. The flat price saw late volatility between $441 and $445 with settlement made in the centre of the day’s range at $444.80 to send us quietly into the weekend

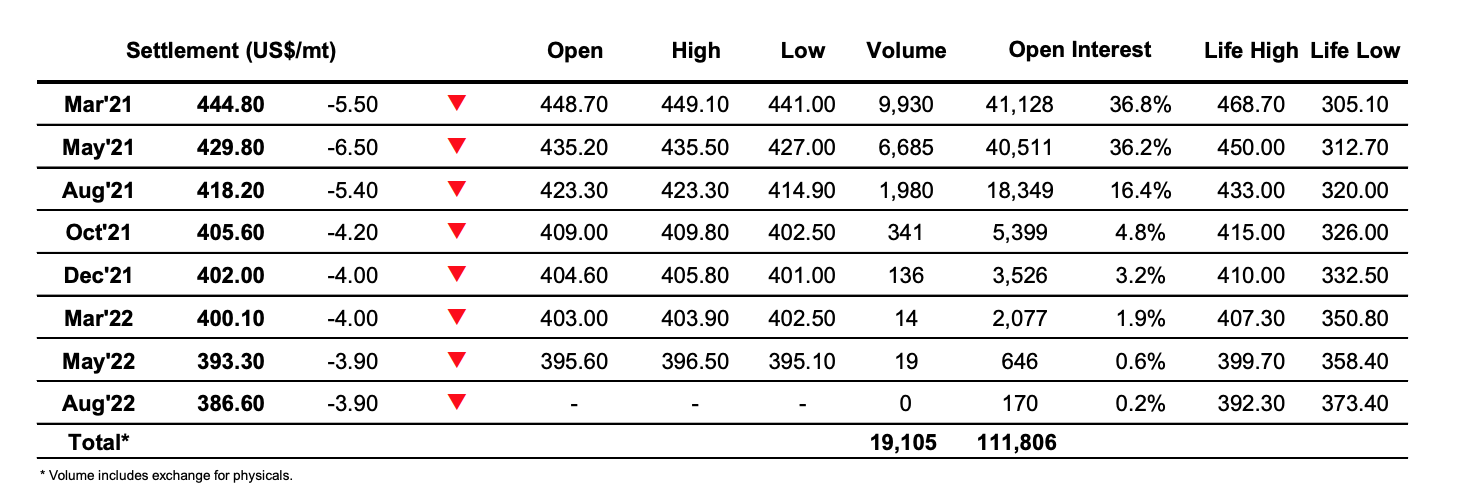

ICE Futures U.S. Sugar No.11 Contract

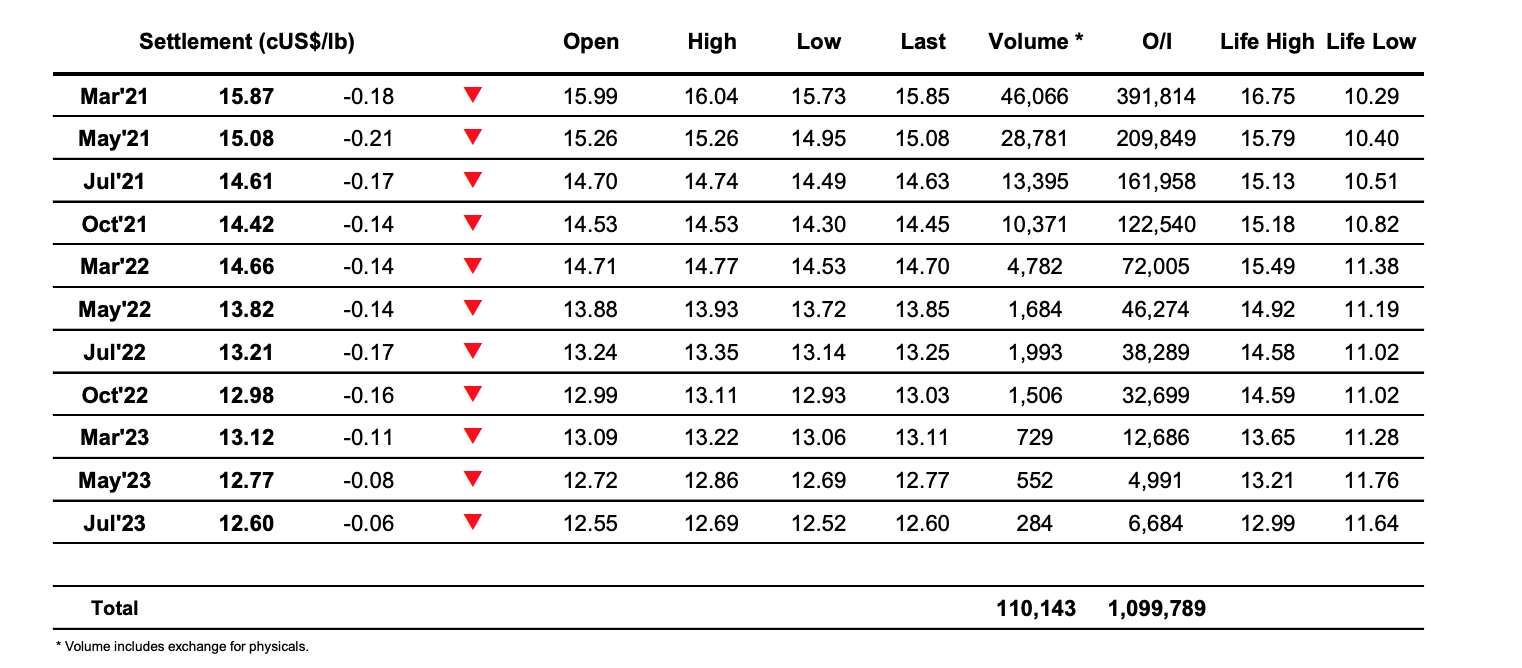

ICE Europe White Sugar Futures Contract