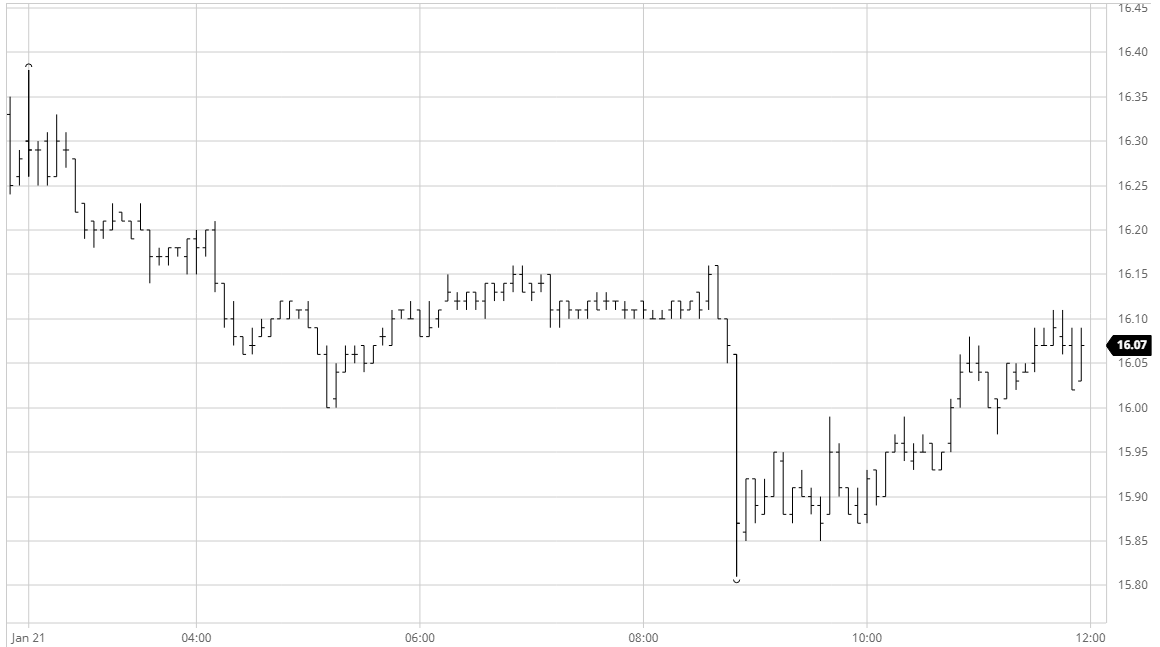

Sugar #11 Mar ’21

A higher opening was not sustained and once the initial buying was concluded we saw prices slip slowly downward to eventually consolidate the 16.10 area, placing us right around Tuesdays closing level and adding more confusion to the volatility seen yesterday. It seemed that we may be set for a quiet session until mid afternoon when a push beneath 16c triggered off a host of spec sell stops with March’21 crashing down to 15.81 before finding support from consumers and short covering which allowed it to hold just above in the 15.90 area. Given that the market has traded as low as 15.40 during the course of this month the dip will have been of little concern to the wider fund community however the bulls may be questioning the spread action with the move down seeing March/May’21 into 0.75 points and March/Jul’21 into 1.25 points, not a great signal for those that want the market to continue upwards. Indeed the spreads remained weak despite a defensive push which hauled March’21 back up to 16.10 later in the afternoon which left March’21 as the only double digit negative on the board while the middle months recovered back to unchanged levels. Some MOC selling emerged to leave March’21 closing at 16.05, concluding another session of some volatility with the expectation that we will see similar action continue within the very broad 15.40/16.75 recent range.

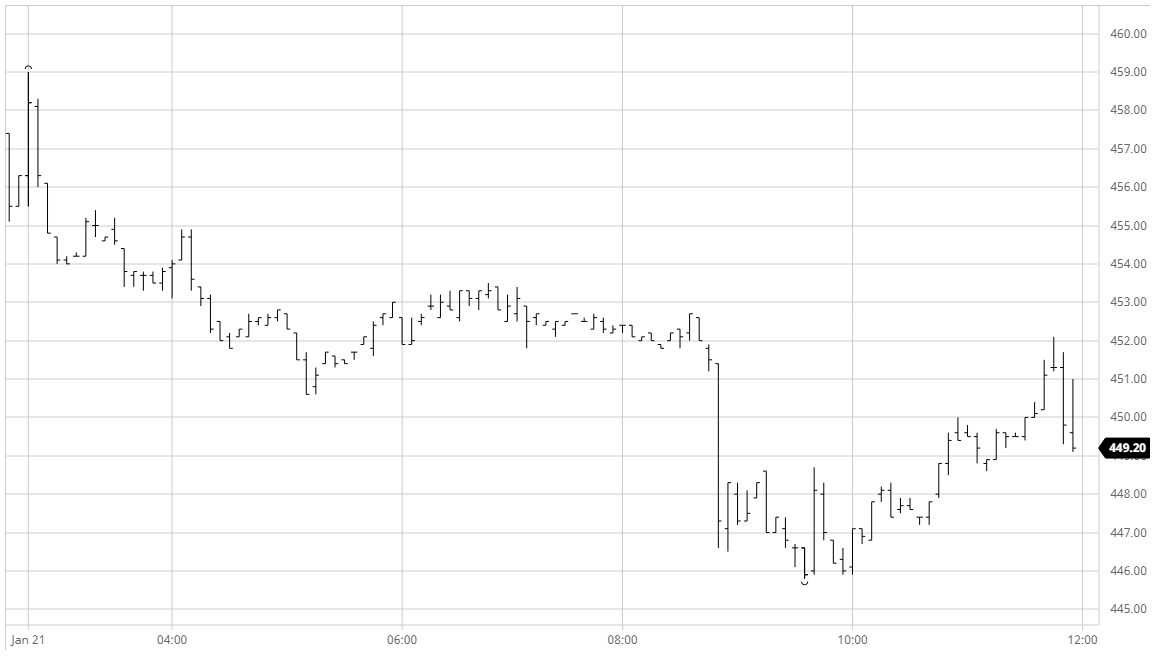

Sugar #5 Mar ’21

A higher opening was not sustained and once the initial buying was concluded we saw prices slip slowly downward to eventually consolidate the 16.10 area, placing us right around Tuesdays closing level and adding more confusion to the volatility seen yesterday. It seemed that we may be set for a quiet session until mid afternoon when a push beneath 16c triggered off a host of spec sell stops with March’21 crashing down to 15.81 before finding support from consumers and short covering which allowed it to hold just above in the 15.90 area. Given that the market has traded as low as 15.40 during the course of this month the dip will have been of little concern to the wider fund community however the bulls may be questioning the spread action with the move down seeing March/May’21 into 0.75 points and March/Jul’21 into 1.25 points, not a great signal for those that want the market to continue upwards. Indeed the spreads remained weak despite a defensive push which hauled March’21 back up to 16.10 later in the afternoon which left March’21 as the only double digit negative on the board while the middle months recovered back to unchanged levels. Some MOC selling emerged to leave March’21 closing at 16.05, concluding another session of some volatility with the expectation that we will see similar action continue within the very broad 15.40/16.75 recent range.

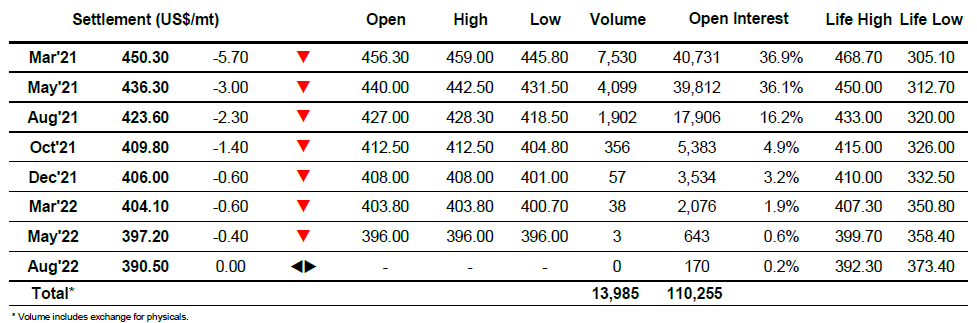

ICE Futures U.S. Sugar No.11 Contract

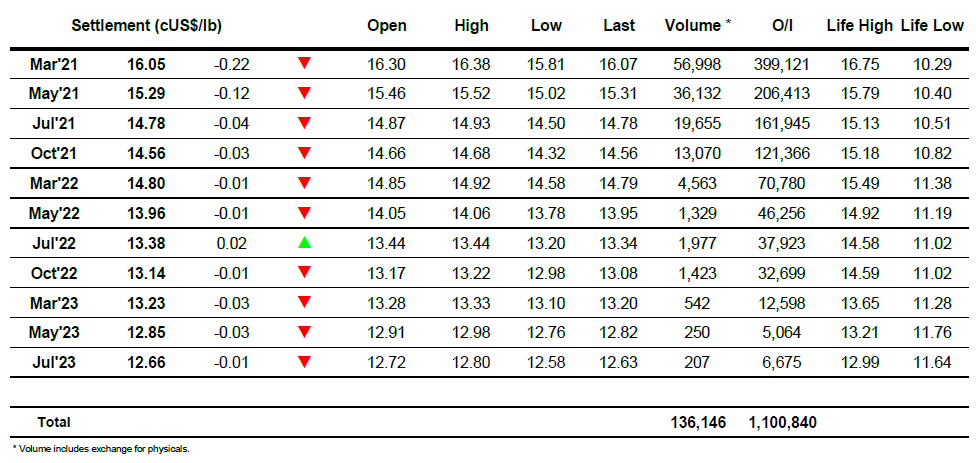

ICE Europe White Sugar Futures Contract