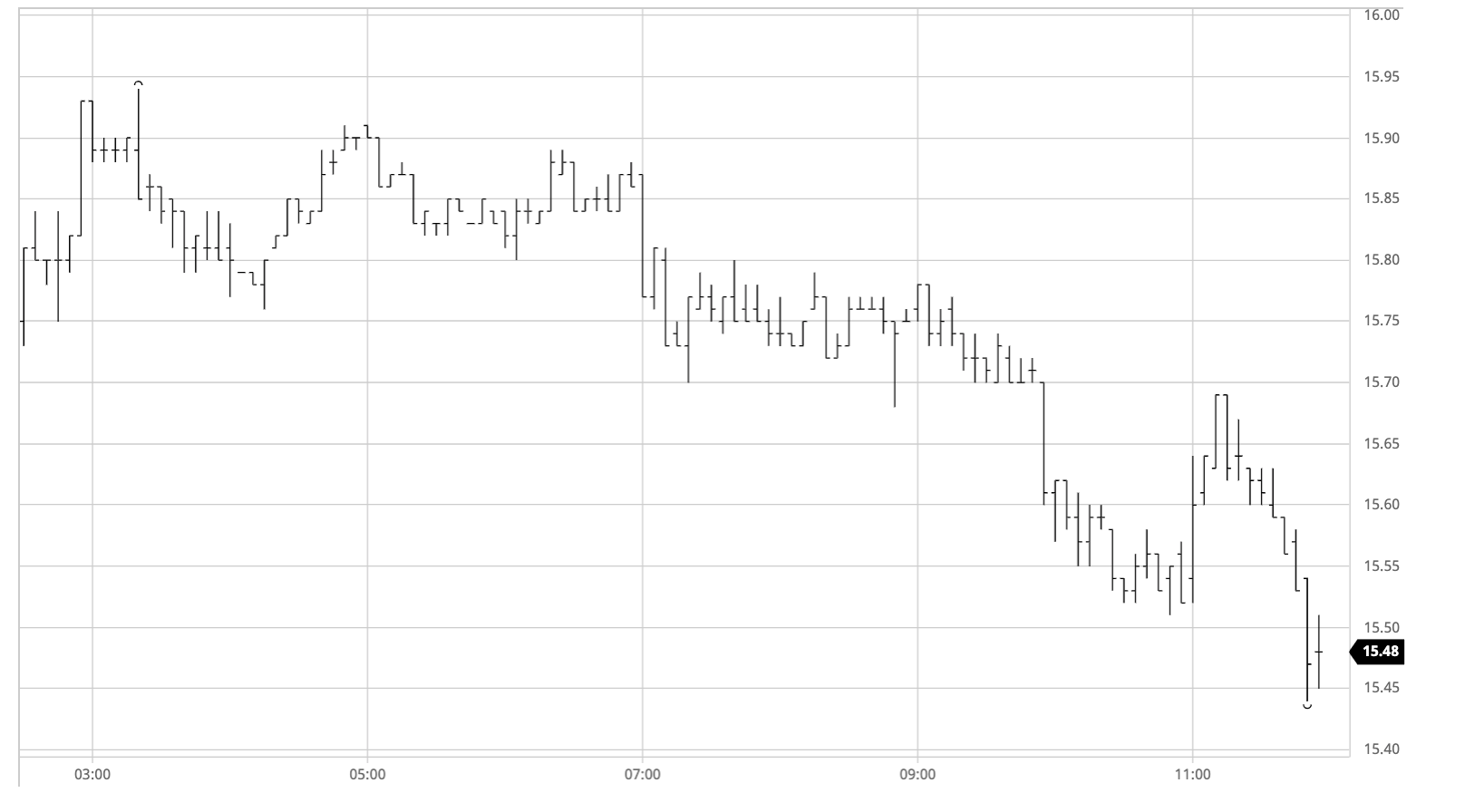

Sugar #11 Mar ’21

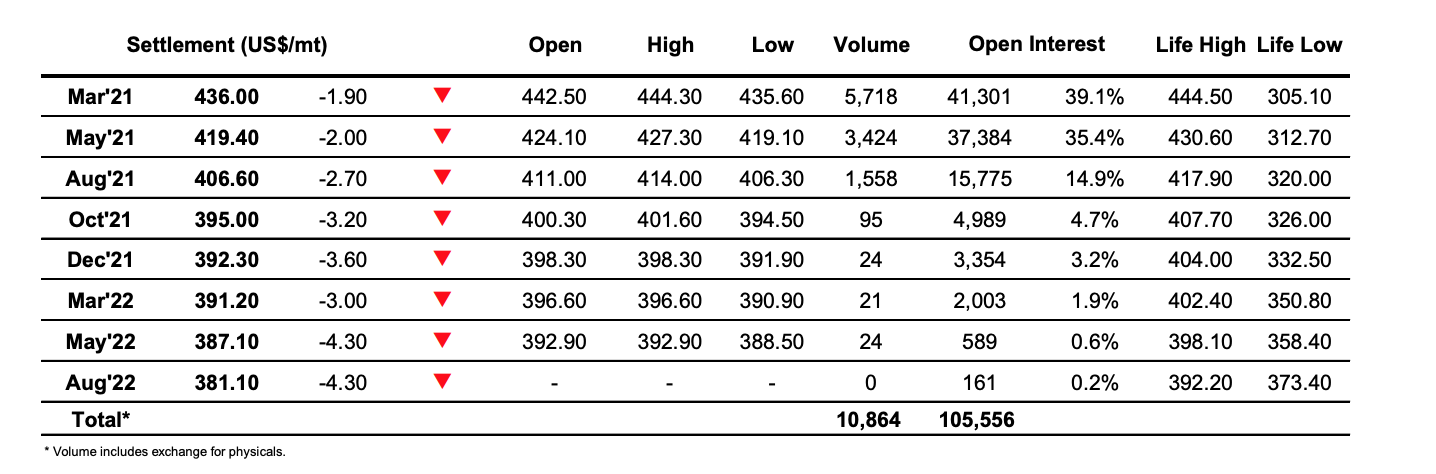

The market shot out of the traps this morning with some solid early buying sending March’21 up to 15.94 during the first hour in a sign that the reversal of recent days may be behind us. Values then retreated a little as buyers eased back however given the struggles of recent days it was impressive to see March’21 largely holding above 15.80 to try and bring the technical picture more positive once again. It was a bit of a surprise that the US morning failed to generate any fresh spec support and the afternoon saw the earlier optimism evaporate as nearby values retreated once more with March’21 recording a session low at 15.51 while nearby spreads also gave back their earlier gains with March/May’21 moving back in to 0.87 points. With the day’s action painting a negative picture we saw a defensive move as we entered the final hour with longs making an effort to pull nearby values back into positive ground however they had limited ammunition and when the buying eased so the cracks quickly started to appear once more and an equally quick decline followed. This shook any remaining confidence and led to to further selling as we moved into the close, sending March’21 down to 15.44 with the March/May’21 making a session low at 0.83 points. Settlement was only just above the lows at 15.46 and the negative sentiment of the close will likely see a test of the recent 15.40 low mark when we resume tomorrow.

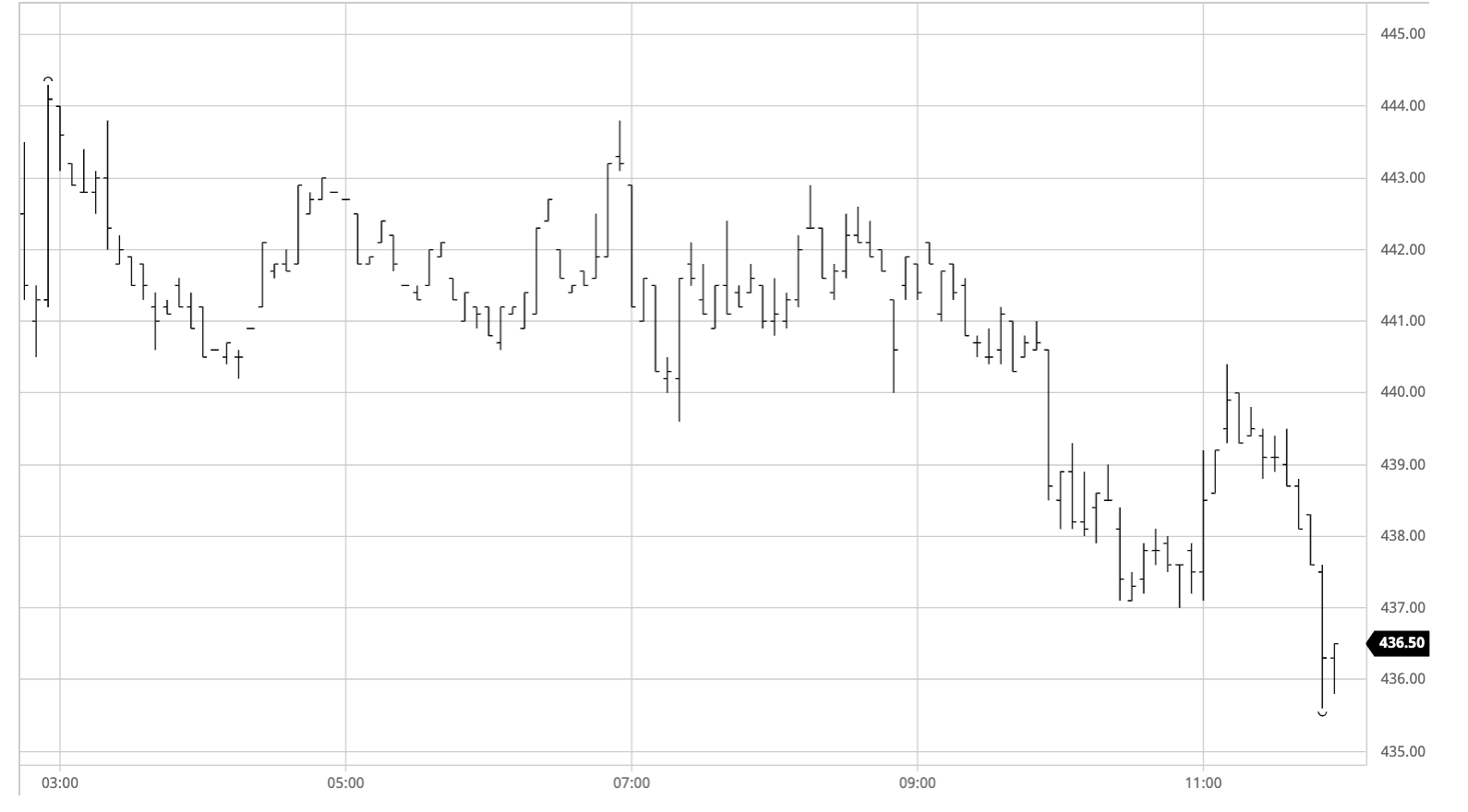

Sugar #5 Mar ’21

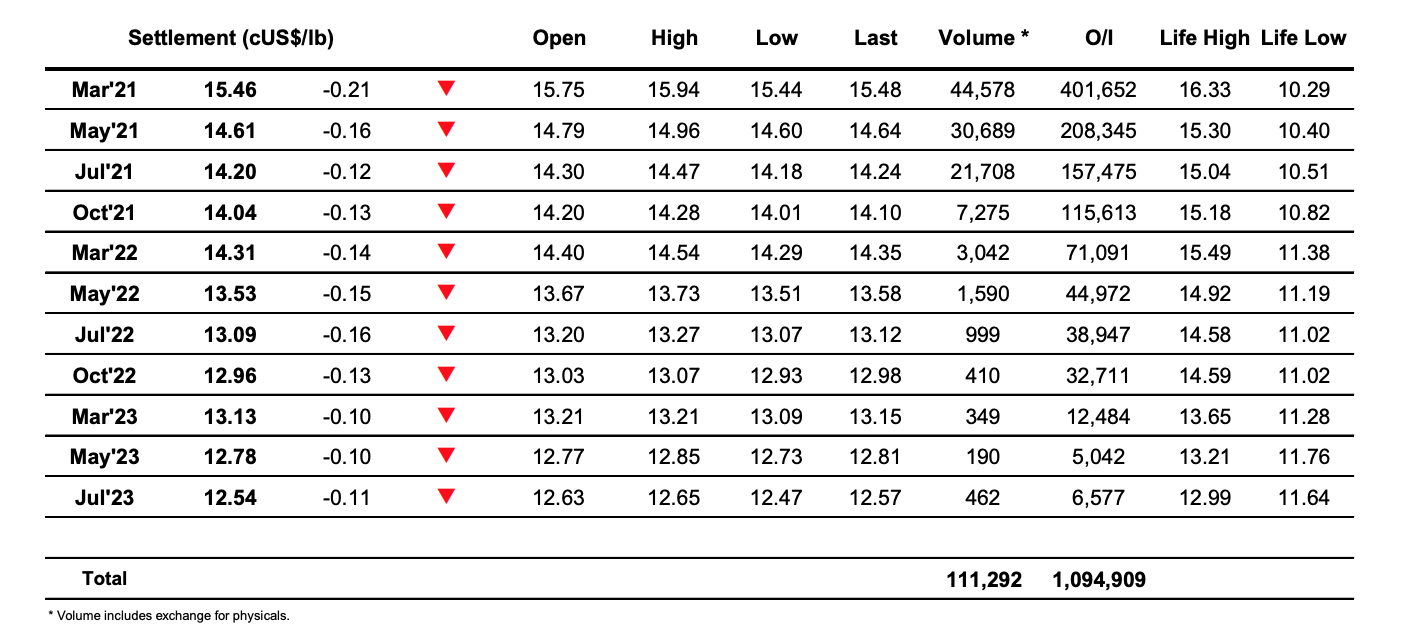

The strong conclusion to the market yesterday set in motion some continued momentum that saw the March’21 gap higher on this mornings opening to reach $444.30 during the first 15 minutes of trading. This early rally also encouraged some fresh buying of the March’21 spreads that pushed March/May’21 back up towards $18, however once the initial flurry of activity had been concluded we retreated back into the range and consolidated the low $440’s. In what was a rather disappointingly quiet session we struggled to find any real direction for several hours and it was not until the later afternoon that we broke from the range when some light selling emerged to break beneath the morning lows and send prices back into marginal net deficit for the day. Initially this encouraged some defensive buying to emerge and we saw values pulled back up briefly however the damage had been done and with the technical picture made negative with the emergence of a double top on the daily chart selling into the close had March’21 settling negatively at $436.00 to raise fresh questions over the near term upside potential.

ICE Futures U.S. Sugar No.11 Contract

ICE Europe White Sugar Futures Contract