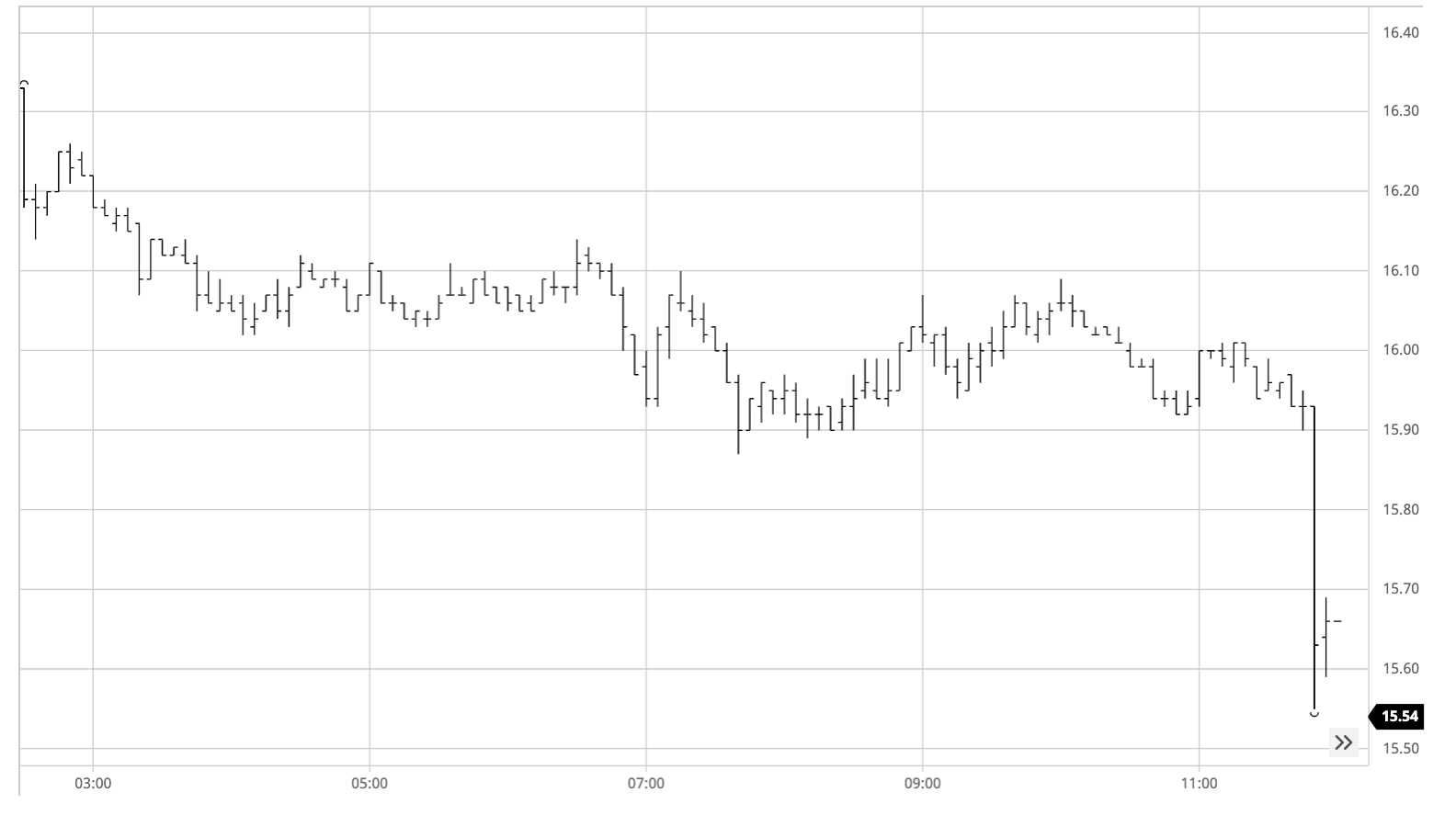

Sugar #11 Mar ’21

The surprise collapse late yesterday led to early buying as some opportunistic hedge lifting took place, pulling values up to 15 points above settlement levels during the opening minutes. Activity then calmed a little however with selling rather limited at these lower levels the nearby prompts were able to creep a little higher, reaching 15.87 for the March’21 contract which was aided by some spread buying that took March/May’21 up by 8 points to 0.90. With spec buying not returning in any significant way and today marking the start of the index fund rebalancing window which is expected to see them sell up to 20,000 lots over the next five sessions we began to slip back down into the range to spend a period consolidating the 15.70 area on low volumes. Mid-afternoon then saw a push lower for the front month to test yesterday’s 15.55 low mark, and the are was attracting some good trade/consumer support with scale buying from 15.60 on downward limiting the initial move to 15.56 before some defensive buying pulled values back upward. The run higher encountered some light selling as March’21 reached the 15.80 area and with nearby spread values struggling to make the kind of gains achieved on the morning rally the momentum was again lost and we slipped back down during the final couple of hours. For the second successive day there was some closing selling on show which pushed the front month back to settle an unchanged 15.60, before post close activity made a new low for the move at 15.54 and sent us into the weekend on a negative note

Sugar #5 Mar ’21

There was some early buying around with the lower levels seen last night having encouraged out some consumer interest and in low volume conditions we saw the market edge higher during the morning to reach $438.10 basis the March’21 contract. The early afternoon then saw some selling emerged to push us back down into the range, something that was aided by an easing in the quantities of buying, however there remained little appetite to move the market aggressively and so we simply entered a rather dull sideways pattern. A flurry of selling midway through the afternoon sent the price down to $433.30 however with the nearby spreads holding relatively constant and longs keen to defend their recent purchases a recovery followed soon afterwards that took March’21 to a fresh session high of $439.10 over the course of an hour or so. It said much about the lack of direction today that we again fell back into the range, and we appeared set to end quietly until some MOC selling emerged to send prices back to session lows as we headed out, leading us into the weekend negatively with the sweeping gains from the first half of the week a memory for now.

White premiums remained firm, holding the recent gains for March/March’21 at around $91. May/May’21 continued just above $95 while Aug/Jul’21 was trading around $94 heading into the close.

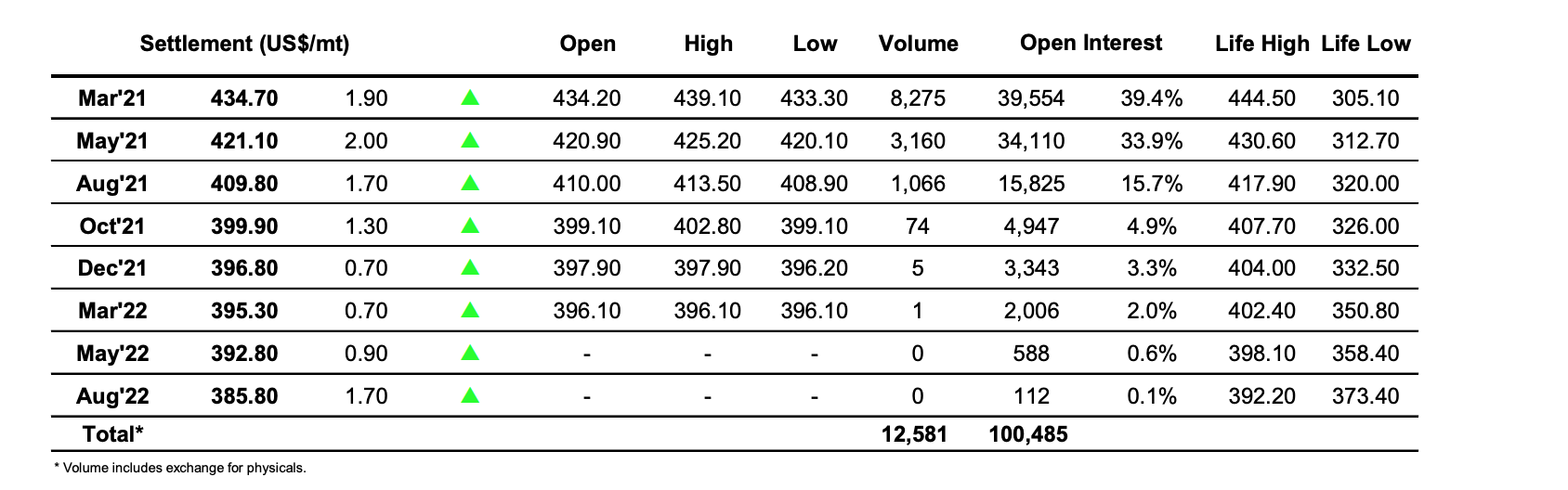

ICE Futures U.S. Sugar No.11 Contract

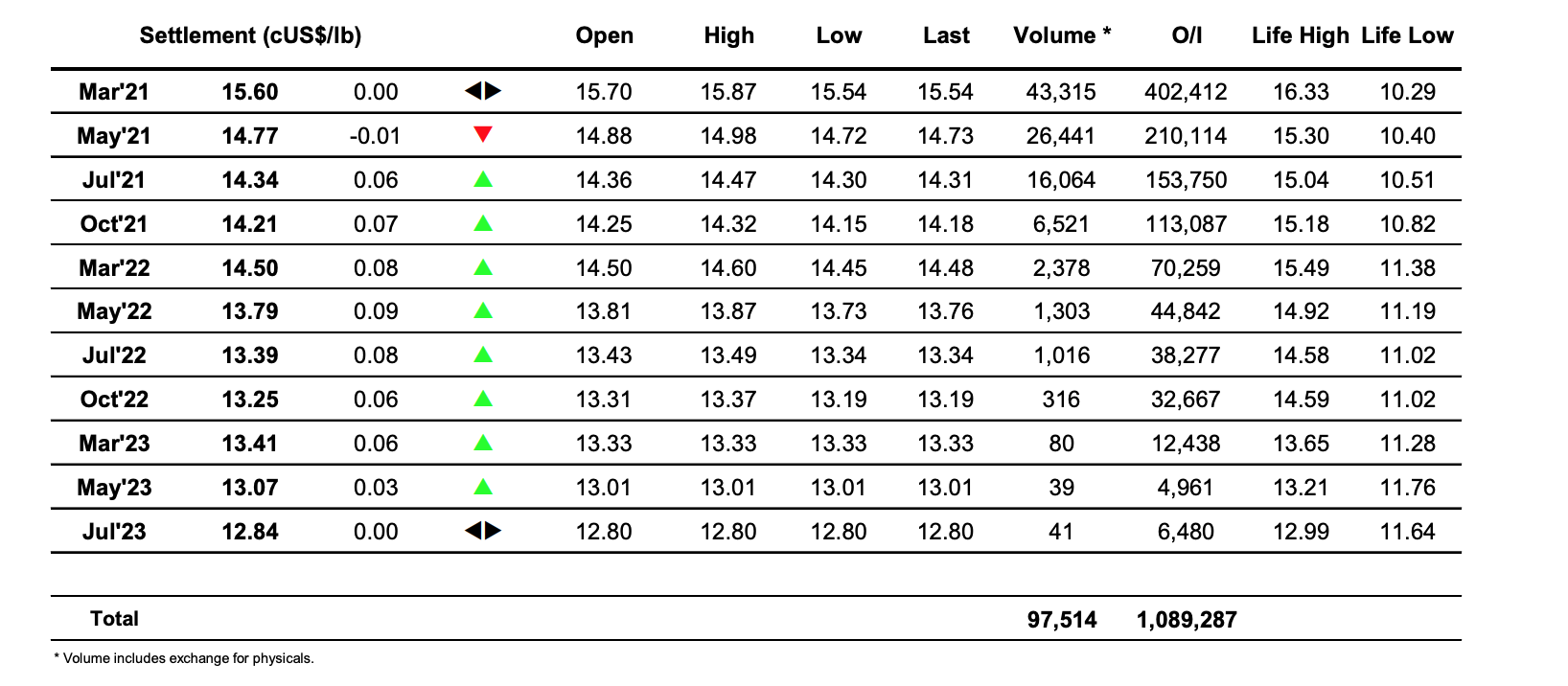

ICE Europe White Sugar Futures Contract