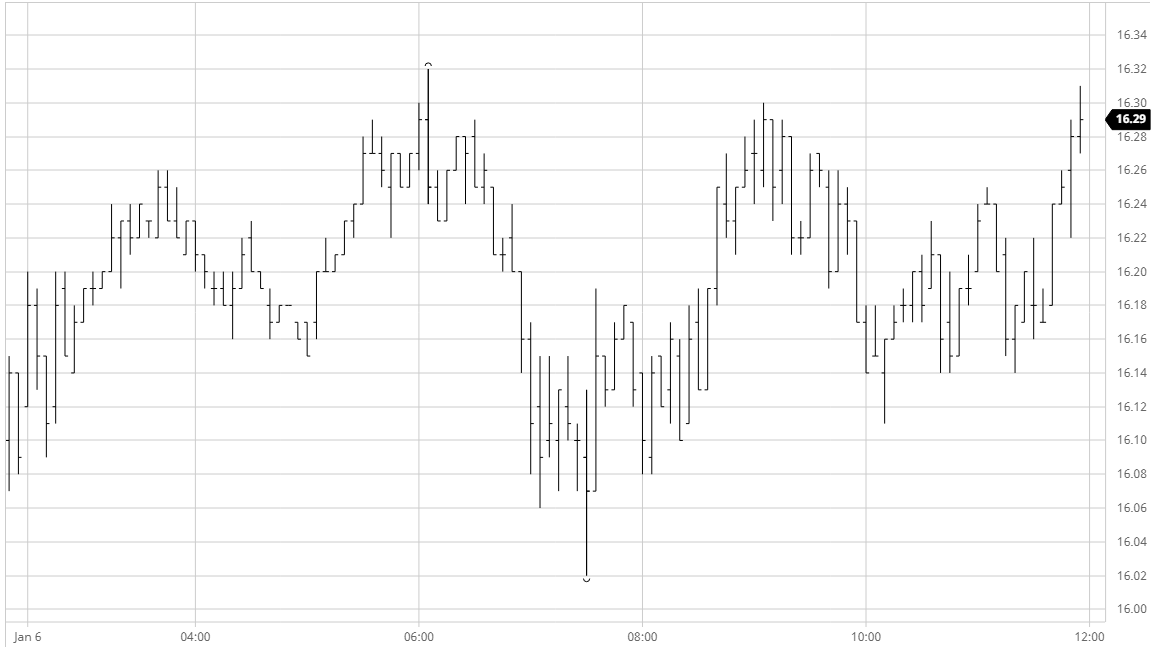

Sugar #11 Mar ’21

A mixed opening soon led to the market gaining fresh traction with some early buying taking March’21 up through 16.15 and into new ground once again. Some of the early interest appeared to be against physicals with the rally potentially having spooked a few people and though we then eased back a little the specs emerged by late morning to take us on upwards to 16.32. Once again the spec interest was focussed on the nearby prompts leading to another widening of spread values with March/May’21 punching out to 1.03 points, however the market was understandably lacking the spark to maintain the recent pace given the overbought short term indicators and so further rangebound activity followed. The refusal to fall back below 16c was a ringing endorsement for the fund longs as we continued largely sideways and with the USD remaining near its lows the macro strength will be giving great heart to the longs that we have the potential to move higher still when the time is right. The USDBRL above 5.30 once again meant that some continuing pricing was on show for the middle months, though in lesser quantities than seen earlier in the week, and as the afternoon progressed we became increasingly confined to the range. Macro values meanwhile remained strong on news that the democrats seem set to gain control of the US senate which will aid Bidens programme considerably, and supportive buying re-remerged late on to lead us back to the highs during the final minutes. Settlements were a little below final trades but at 14.25 March’21 still ensured a modest gain and maintained the strong technical momentum for another day.

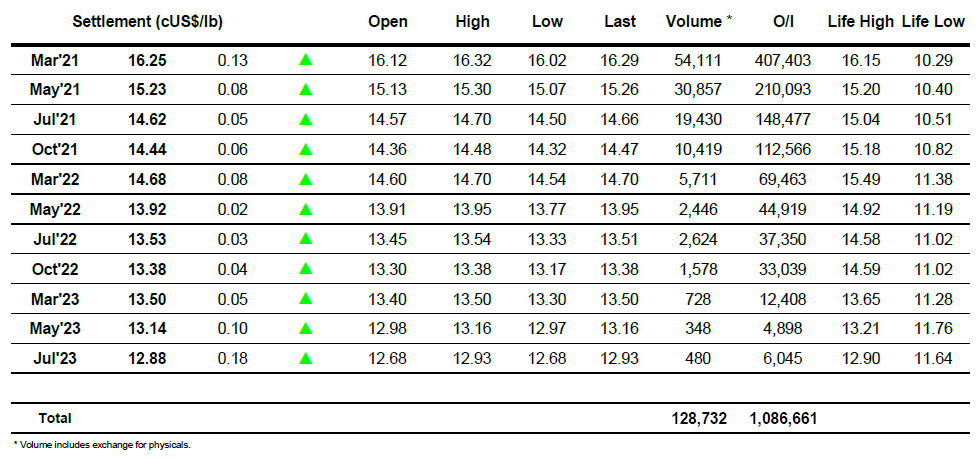

Sugar #5 Mar ’21

A mixed opening soon led to the market gaining fresh traction with some early buying taking March’21 up through 16.15 and into new ground once again. Some of the early interest appeared to be against physicals with the rally potentially having spooked a few people and though we then eased back a little the specs emerged by late morning to take us on upwards to 16.32. Once again the spec interest was focussed on the nearby prompts leading to another widening of spread values with March/May’21 punching out to 1.03 points, however the market was understandably lacking the spark to maintain the recent pace given the overbought short term indicators and so further rangebound activity followed. The refusal to fall back below 16c was a ringing endorsement for the fund longs as we continued largely sideways and with the USD remaining near its lows the macro strength will be giving great heart to the longs that we have the potential to move higher still when the time is right. The USDBRL above 5.30 once again meant that some continuing pricing was on show for the middle months, though in lesser quantities than seen earlier in the week, and as the afternoon progressed we became increasingly confined to the range. Macro values meanwhile remained strong on news that the democrats seem set to gain control of the US senate which will aid Bidens programme considerably, and supportive buying re-remerged late on to lead us back to the highs during the final minutes. Settlements were a little below final trades but at 14.25 March’21 still ensured a modest gain and maintained the strong technical momentum for another day.

ICE Futures U.S. Sugar No.11 Contract

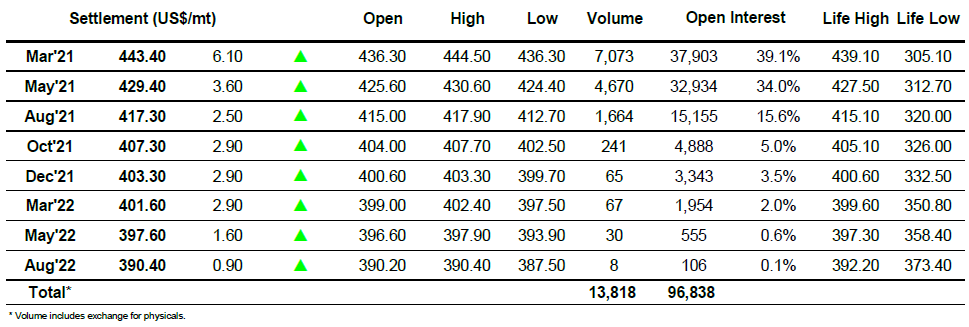

ICE Europe White Sugar Futures Contract