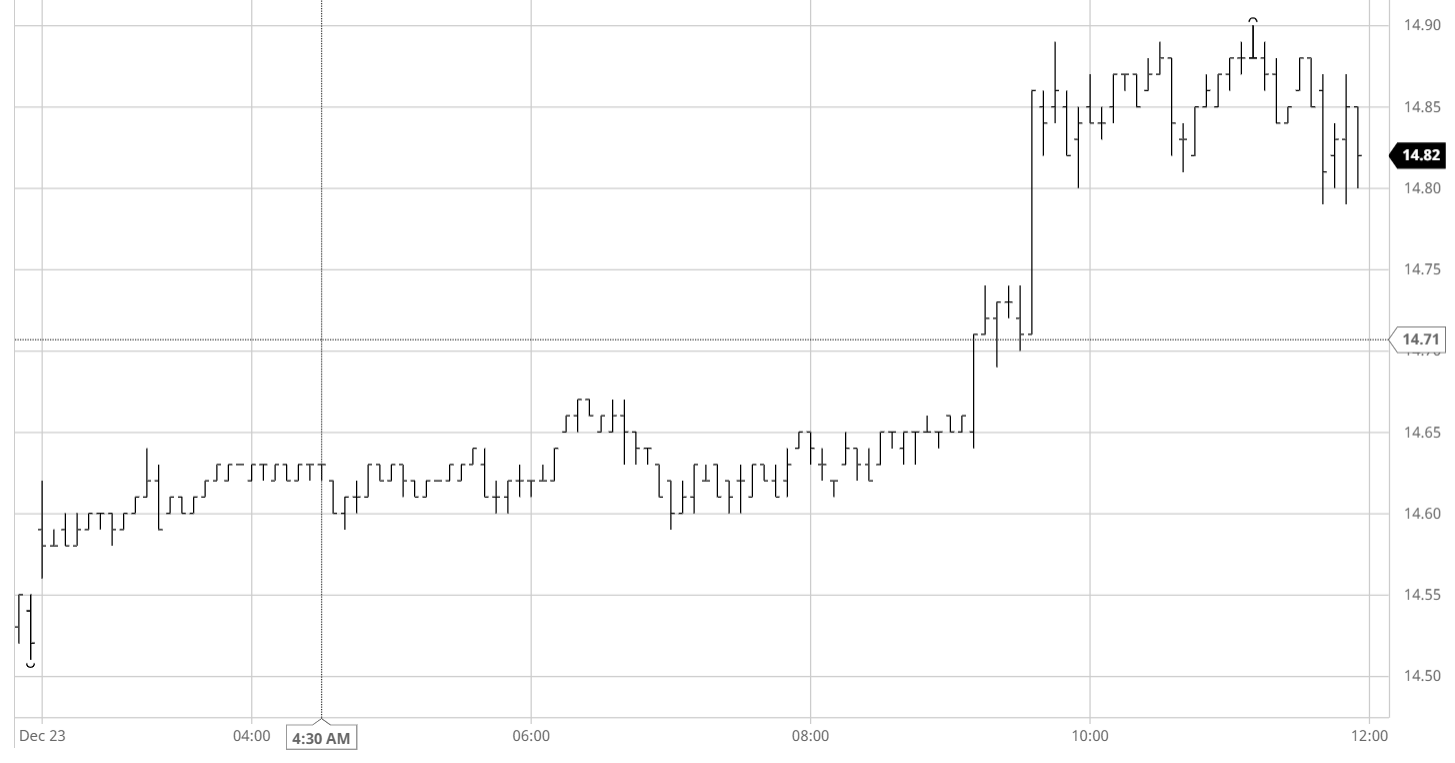

Sugar #11 Mar ’21

Early buying got the market off to a positive start and despite the general chatter being negative on recent macro weakness and expectations that continuing lockdown factors could impact consumption we remained quietly steady throughout the morning. The same pattern was maintained into the first part of the afternoon and it seemed as though we were set for another dull affair within a narrow range until some mid-afternoon buying led the March’21 contract into the lower 14.70’s, providing the platform for buy stops above 14.76 to be triggered and take us to 14.89 on some more substantial volume. Nearby spreads widened sharply on the move, reaching 0.78 for March/May’21, 1.13 for March/Jul’21 and 1.20 for March/Oct’21. Activity calmed once more at the higher levels with producer activity still very limited despite BRL weakness which saw the USDBRL easing back towards 5.20, though any dips were swiftly gathered up ensuring the we matched the macro for a change and remained steady as we moved towards the close. Support remained through the closing stages and despite some MOC position squaring which pushed March’21 back to 14.79 (and in so doing sent some back months into marginal deficit due to the wider spread values) a positive settlement value of 14.83 means we head into Christmas Eve on a positive note.

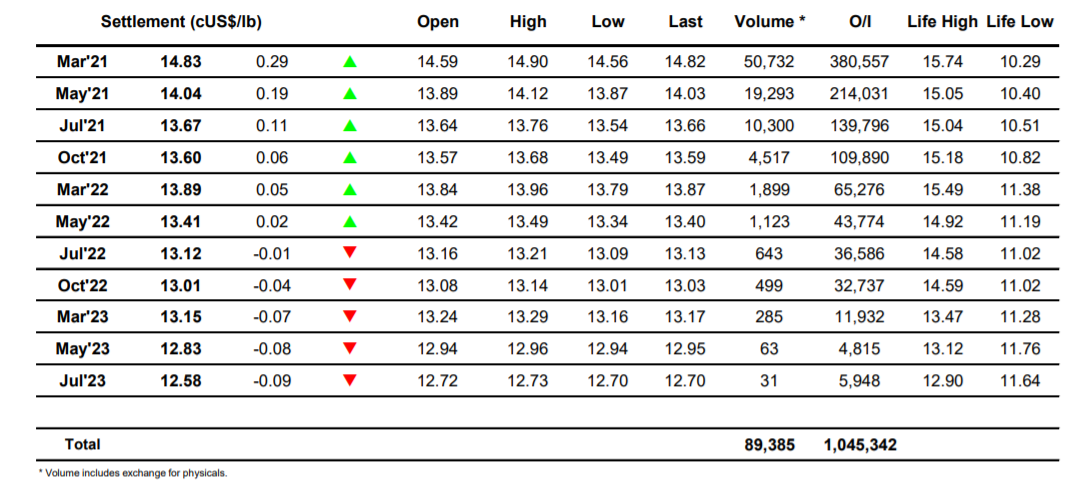

Futures U.S. Sugar No.11 Contract

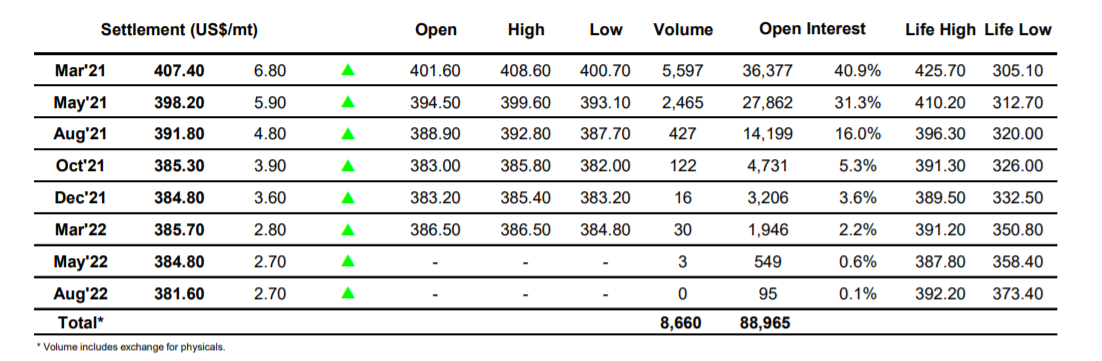

ICE Europe White Sugar Futures Contract