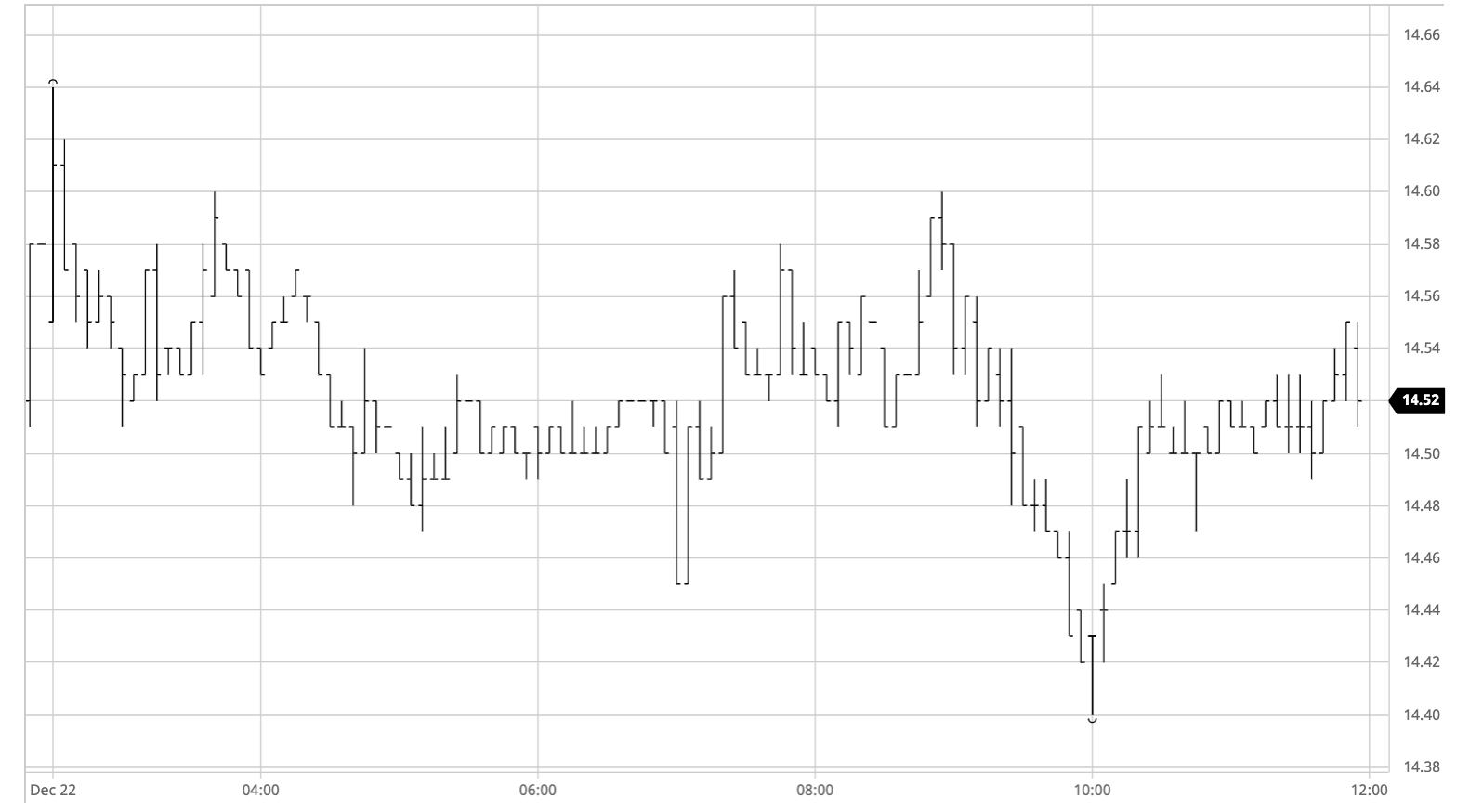

Sugar #11 Mar ’21

There was some light early buying which pushed March’21 up by a few points however it soon petered out leaving values to ease back and consolidate near to unchanged levels. In very low volumes we then saw very little movement until the early afternoon, and even when we did it simply served to widen out the daily range by a few points with virtually no spec or algo interest to enliven the dull environment. Rumours that Indonesian refiners have been granted their import licences for 2021 were completely ignored, and on the one occasion that the market showed any sign of building some momentum in trading down to 14.40 it was quickly nipped in the bud with prices returning to unchanged levels where they remained through until the close. The latter stages saw March’21 holding back in mid-range, while the rest of the board lagged a little behind due to spread strength, March/May’21 pushing to 0.70 points late on, before a quiet close saw the front month settle a single point higher at 14.54.

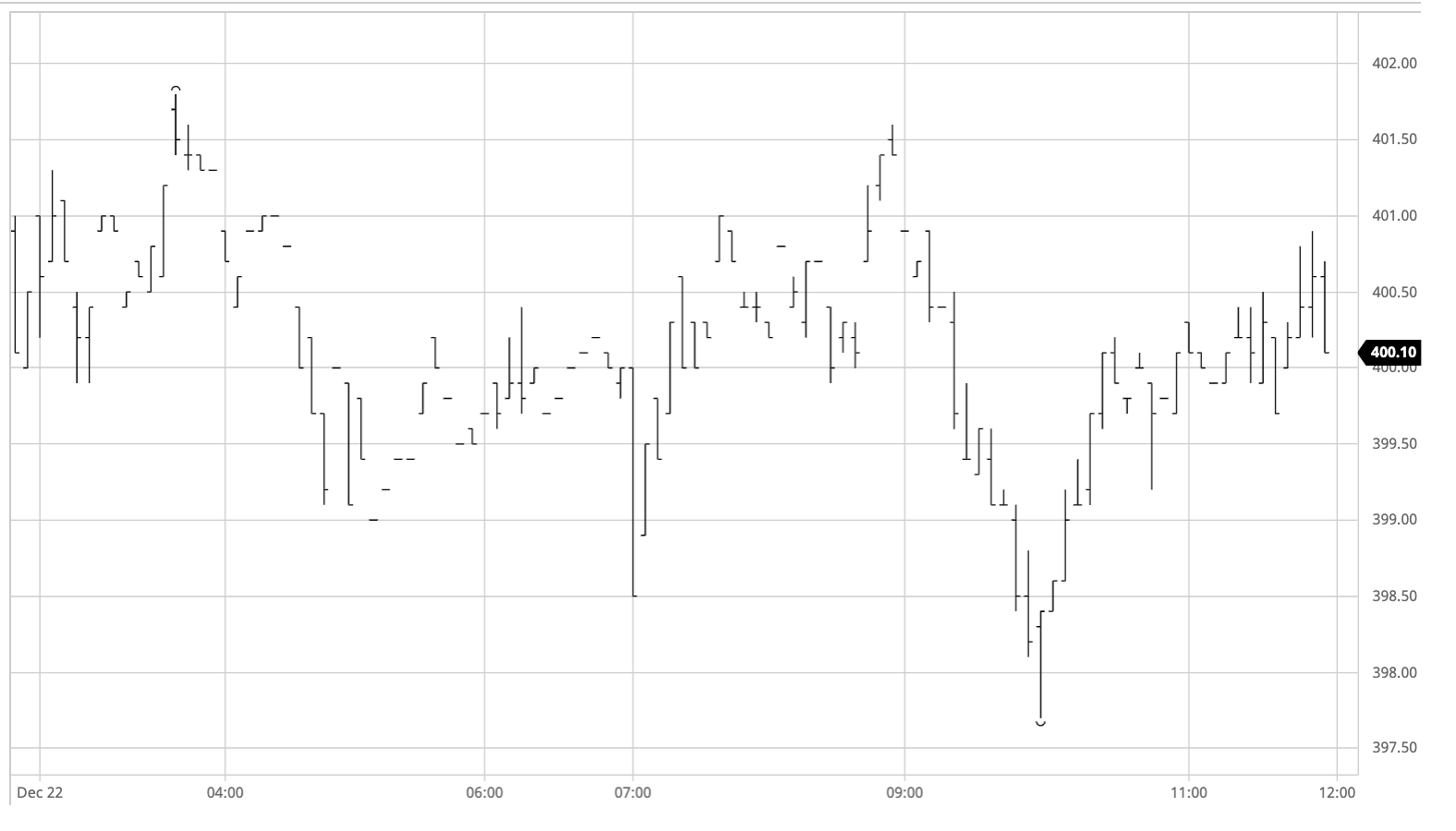

Sugar #5 Mar ’21

It was a very muted start to the day as it becomes increasingly clear that many participants are standing back from the market ahead of the Christmas holidays, making a previously thin environment appear almost illiquid at times. This can be seen through some of the gaps in the intra-day chart below, while even the moves were generally on light volumes with few resting orders within the confines of the recent range. Having traded lightly either side of unchanged during the morning the afternoon did bring a little more movement to widen the range, though all the activity was confined to the front of the board with just 8 lots traded forward of Aug’21 over the entire session. Nearby white premium values were a touch firmer with March/March’21 nudging towards $80.50 during the afternoon despite the March contract working down towards a session low of $397.70, while the greater movement came from the March/May’21 spread which pushed out to $8.30. The latter stages saw March’21 holding back in mid-range, with a very quiet close seeing March’21 settle just marginally changed at $400.60

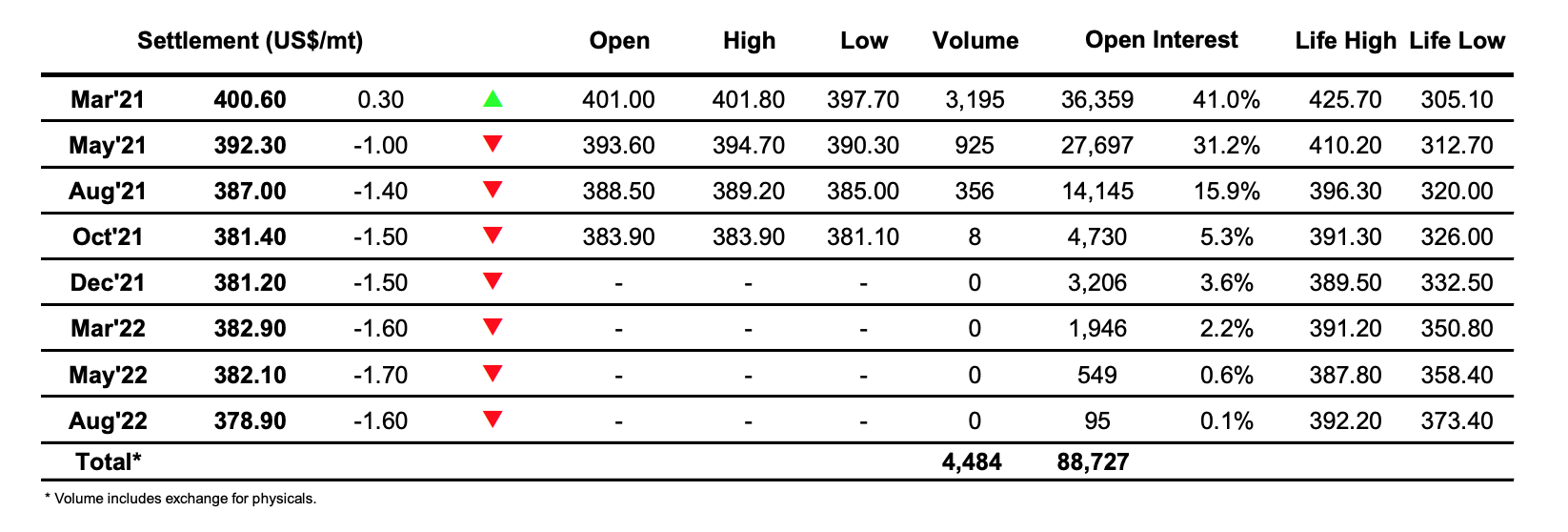

Futures U.S. Sugar No.11 Contract

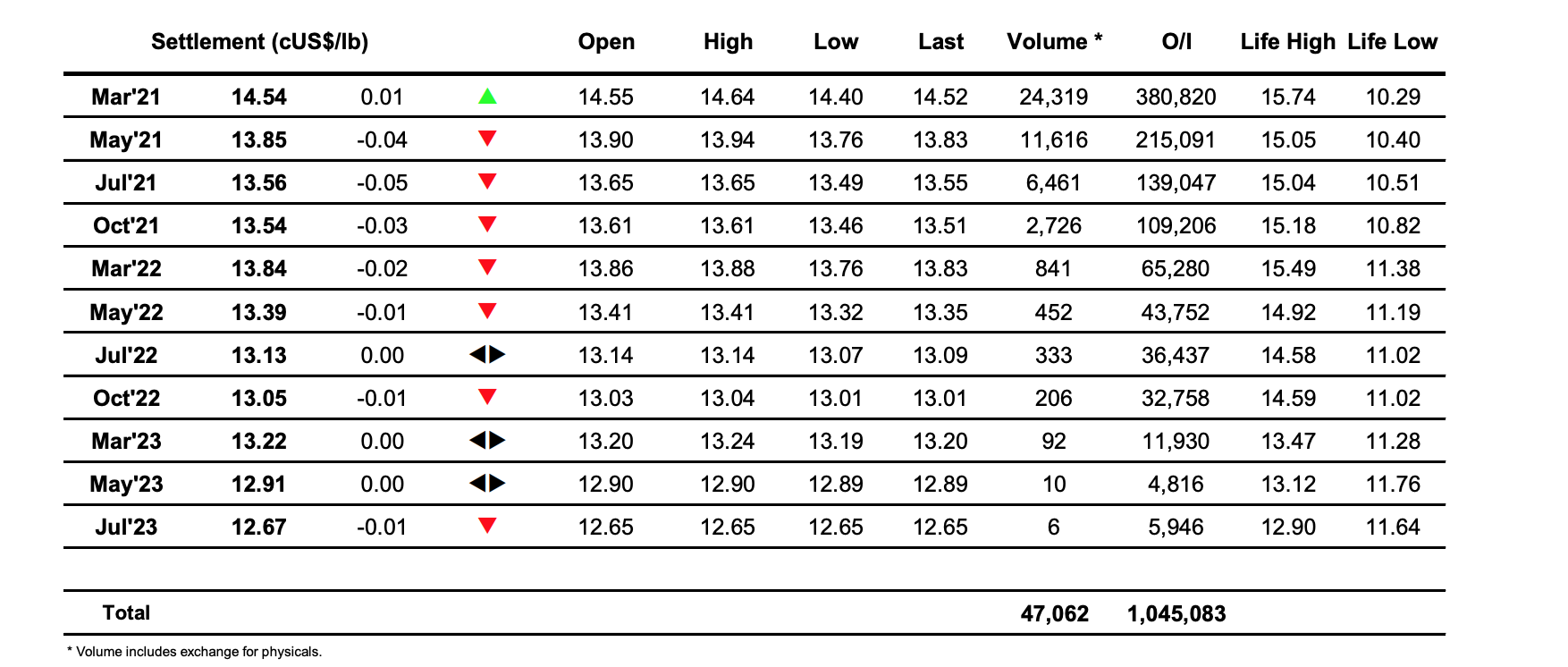

ICE Europe White Sugar Futures Contract