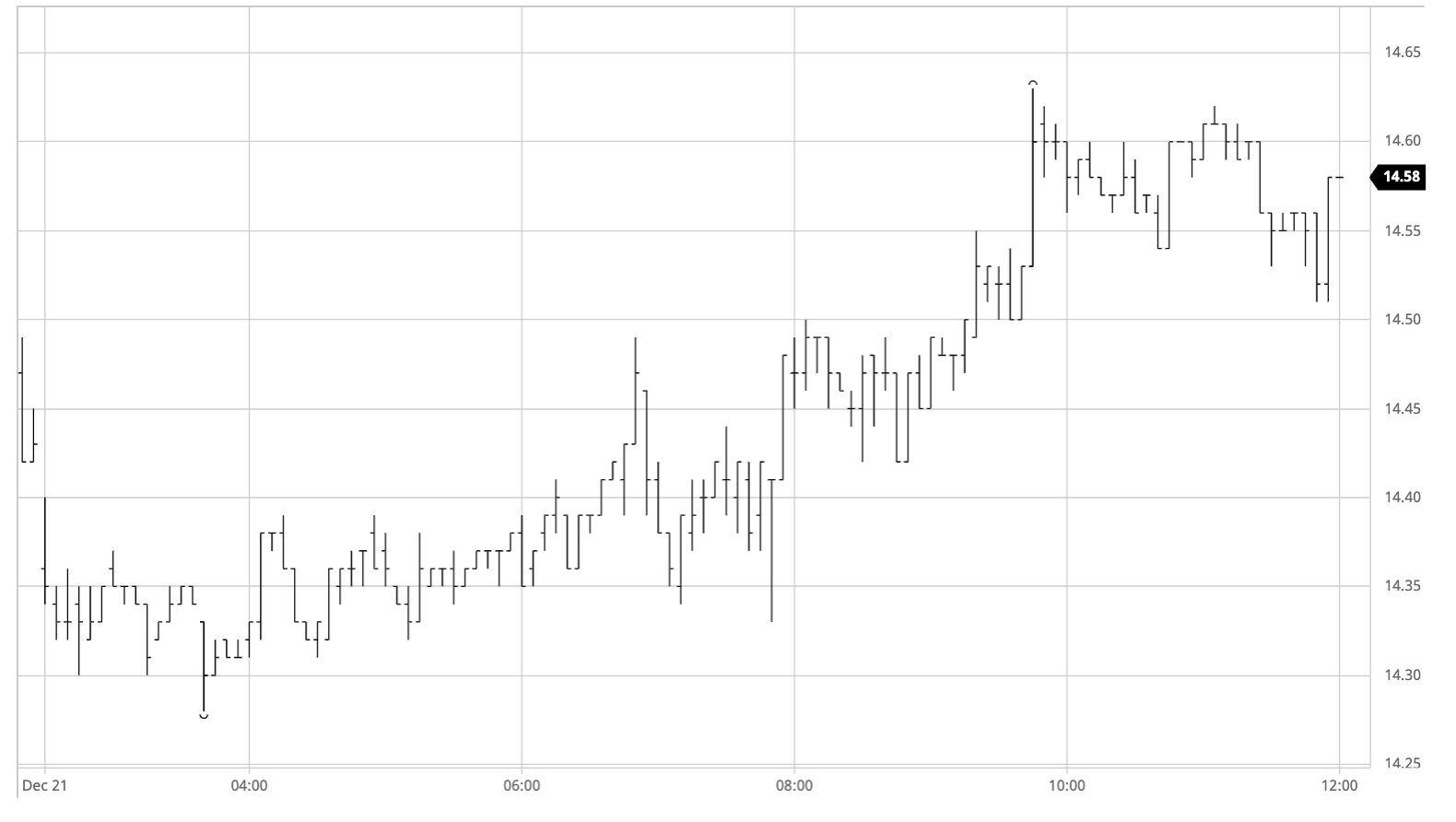

Sugar #11 Mar ’21

The week commenced with lower values to follow the path already being forged by both the wider commodity world and equities as renewed concerns over the impact of a more infectious strain of covid-19 weigh upon global markets. March’21 recorded an early low mark at 14.28 and we continued in deficit throughout the morning although never looked likely to work beneath this mark with the market appearing content to continue within the broad parameters of the recent range on thin volumes. In a featureless news environment, something which is likely to remain the case as we move through the Christmas and New Year holidays over the next couple of weeks, the market meandered along until finding some light support during the early afternoon which sent values back into positive ground. This maintained a fairly regular pattern of trading in a contrary nature to the wider macro, while the move also came in spite of a weaker BRL which was ranging between 5.20 and 5.13 against the USD with the dollar proving stronger across the board. The afternoon strength was maintained as specs and day traders continued to play the long side, and the outright strength transferred through to the March’21 spreads which were broadly trading around 6 points above Fridays closing values (March/May’21 0.65 points / March/Jul’21 0.95 points / March/Oct’21 0.99 points). The latter stages played out at the upper end of the day’s range though some late end of day position squaring meant that we settled a little shy of the highs

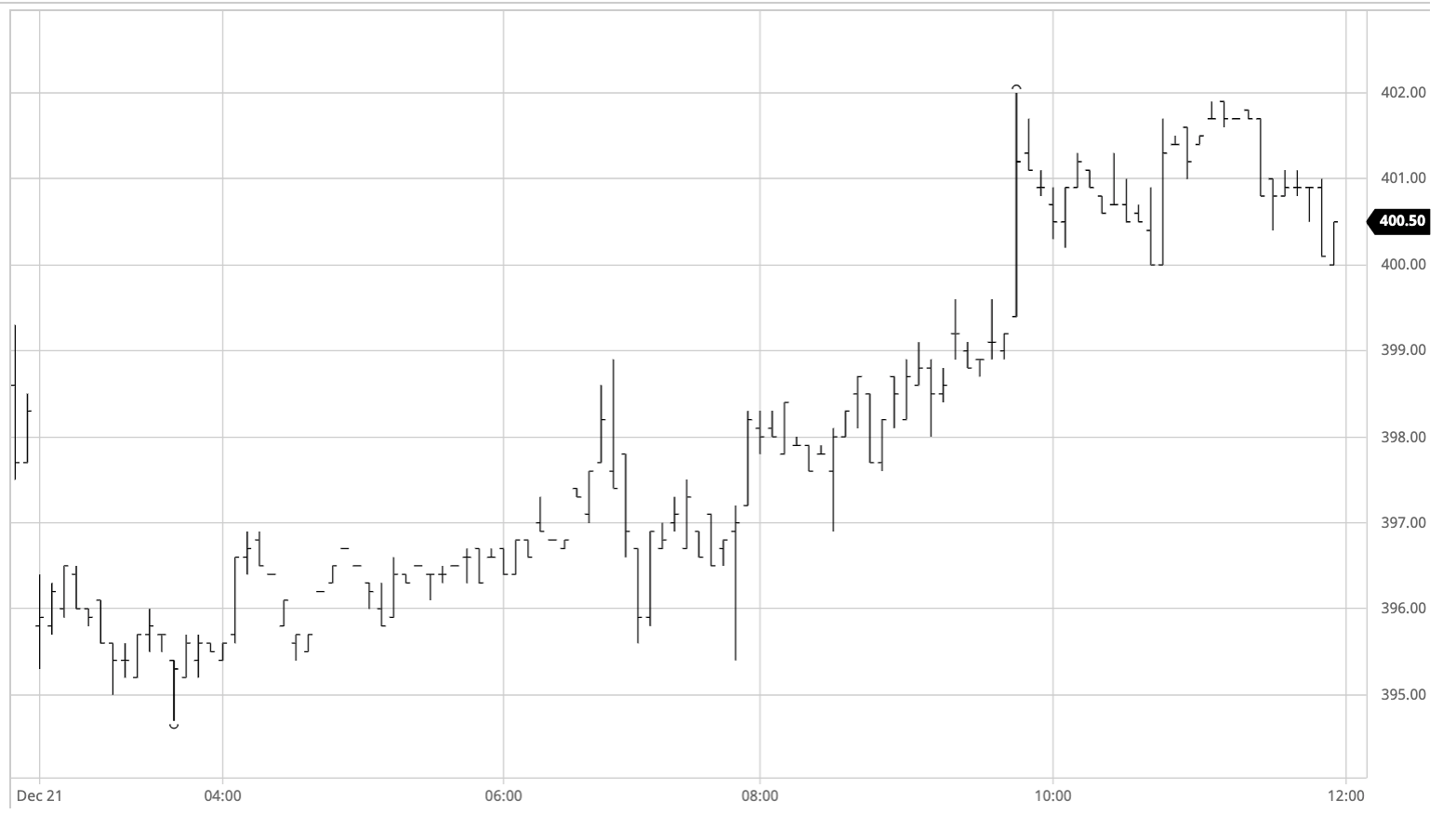

Sugar #5 Mar ’21

Negative sentiment following the negative conclusion on Friday combined with wider macro weakness on the back of a stronger USD to send values lower during the morning, falling by more than $3 for March’21 to record a low of $394.70. Volume remained in keeping with recent weeks with only small quantities changing hands on the decline, and while spreads were also a little lower with March/May’21 back to $6.00 there was little to get excited about here either. The early afternoon saw prices begin to climb away from session lows, and then on into positive ground, and though the buying was light it was sufficient to nudge the white premium values up a touch with the March/March’21 trading around $80 before slipping back by a dollar as the rate on increase in the No.11 took over. Still that did not detract too much from the gains that we were seeing as March’21 spiked up to $402, and though volume remained low (particularly outside of the front month) there was sufficient March’21 support to hold the value above $400 as we moved towards the end of the day. Some late position squaring sent process back from the highs, and though we remained in positive ground going out we seem set to continue broadly sideways

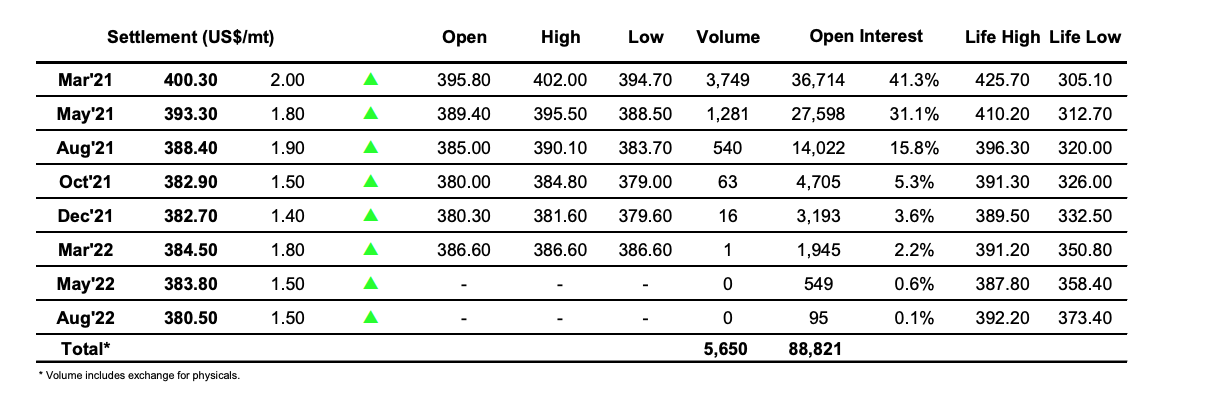

Futures U.S. Sugar No.11 Contract

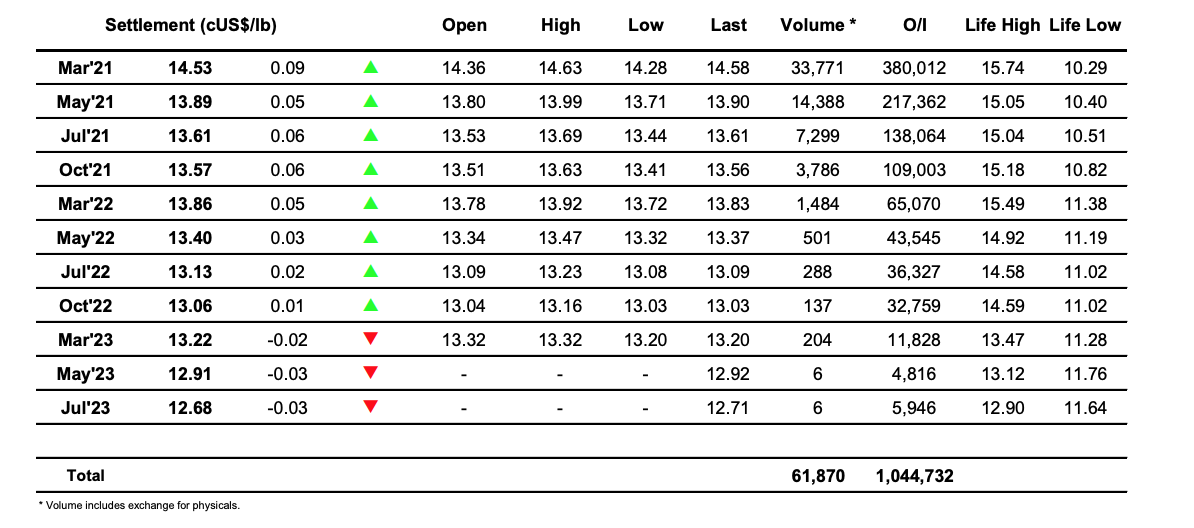

ICE Europe White Sugar Futures Contract