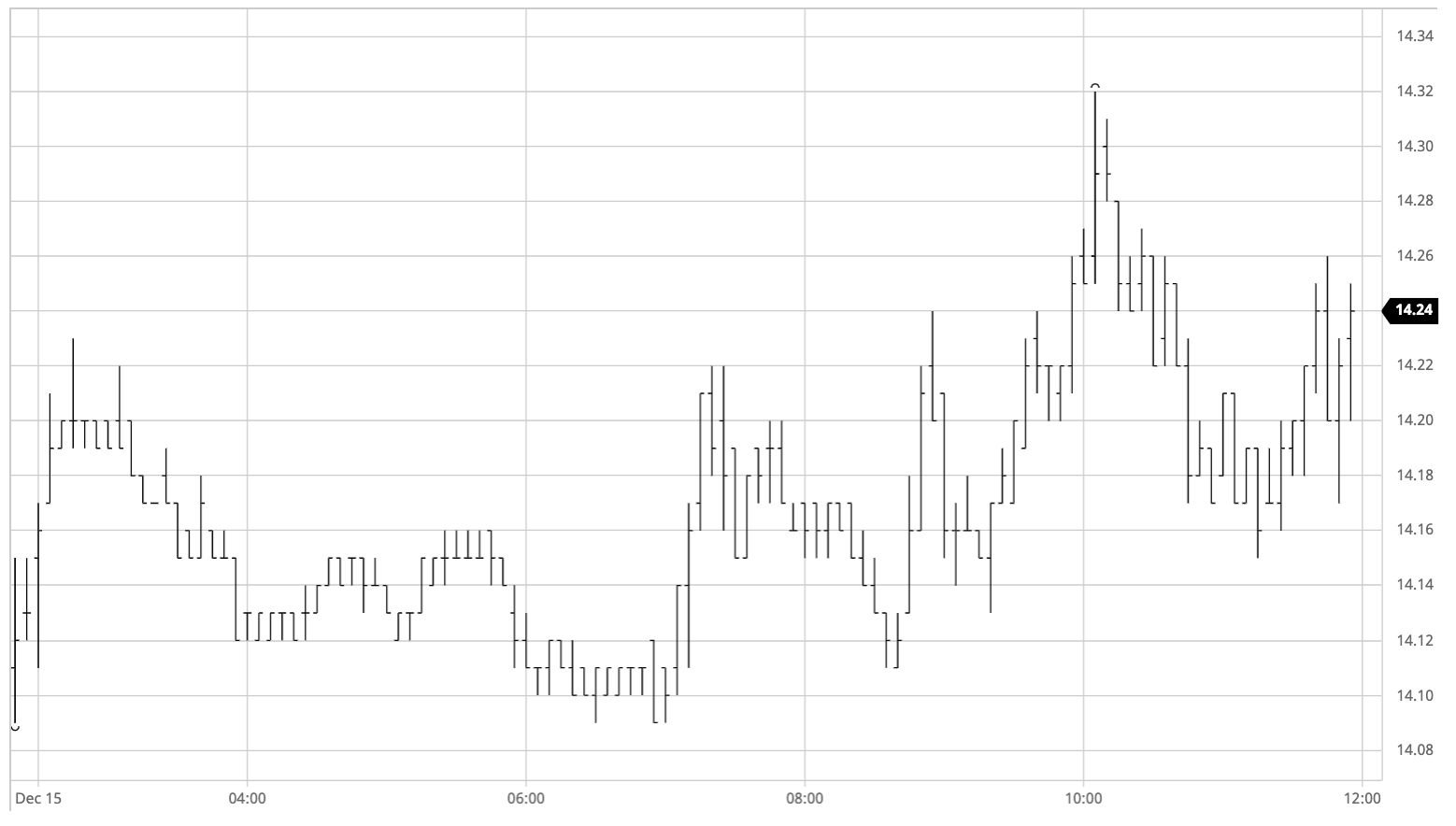

Sugar #11 Mar ’21

December has been so far a month of too few signals and too much noise, and today was no different.In a rather illiquid phase, the market traded a volume of 37k lots on the first prompt which makes price movements much more sensitive to smaller aggressions. Market traded within a 10pt range for most of the morning, with very slim volume. After 10 a.m. BRT activity picked up, with market reaching 14.22 by 10:25 am and receding shortly after. By 11:40 a.m. buying action renewed, and the high of the day (14.32) was reached at 13:06 p.m. Trading eased until the closing call where, probably due to the January options expiry was by far the most liquid hour of the day, buyers and sellers on a tug of war that saw H21 settling at 14.21, 9 pts above last settlement.

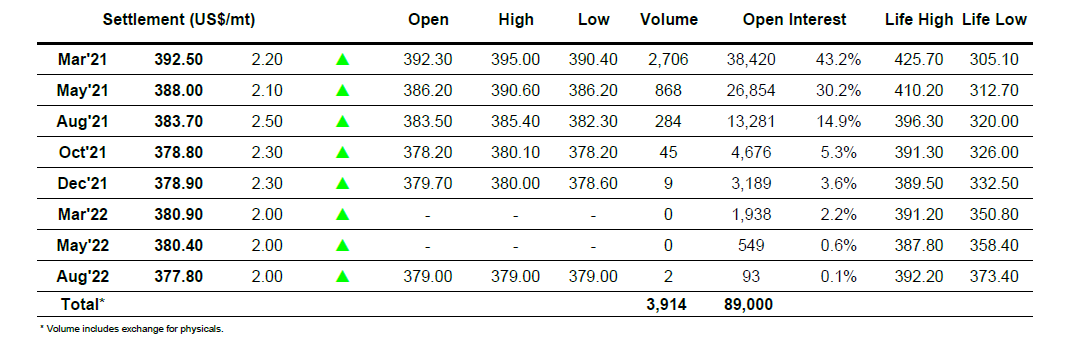

Futures U.S. Sugar No.11 Contract

ICE Europe White Sugar Futures Contract