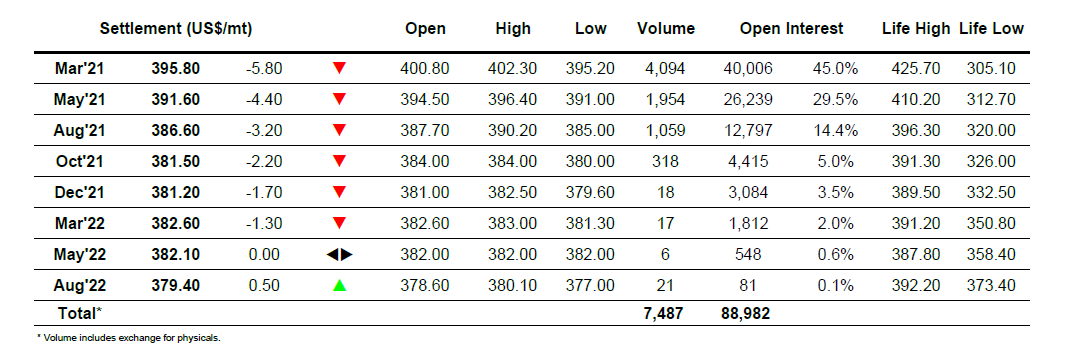

Mar 21 – Sugar No.11

Despite the fact that yesterday’s fall only brought us back into the recent range it was sufficient to attract some initial buying interest which enabled values to remain positive through the early part of the day. Little changed and we enjoyed some quiet consolidation for a period though never looked like attracting the buying necessary to push back towards 15c despite the macro experiencing another broadly positive session. The consolidation came to an abrupt halt just after noon as some selling sent March’21 down through the morning lows and bringing in some spec selling to aid the momentum and send the price down to 14.38. Better support was found in this area, a mere 8 points ahead of the recent lows and the market duly stabilised a little, but though there was an effort from longs to pull prices back up midway through the afternoon it proved short-lived and the sentiment remained broadly negative. This sentiment was being aided by talk amongst brokers that an Indian subsidy has been agreed which is certainly reason enough to not want to buy, although no details were forthcoming either through the rumour mill and certainly not in the form of any formal announcement. The latter part of the day played out in the 14.40’s, and with no late buying emerging we remained here to post a weak technical conclusion.

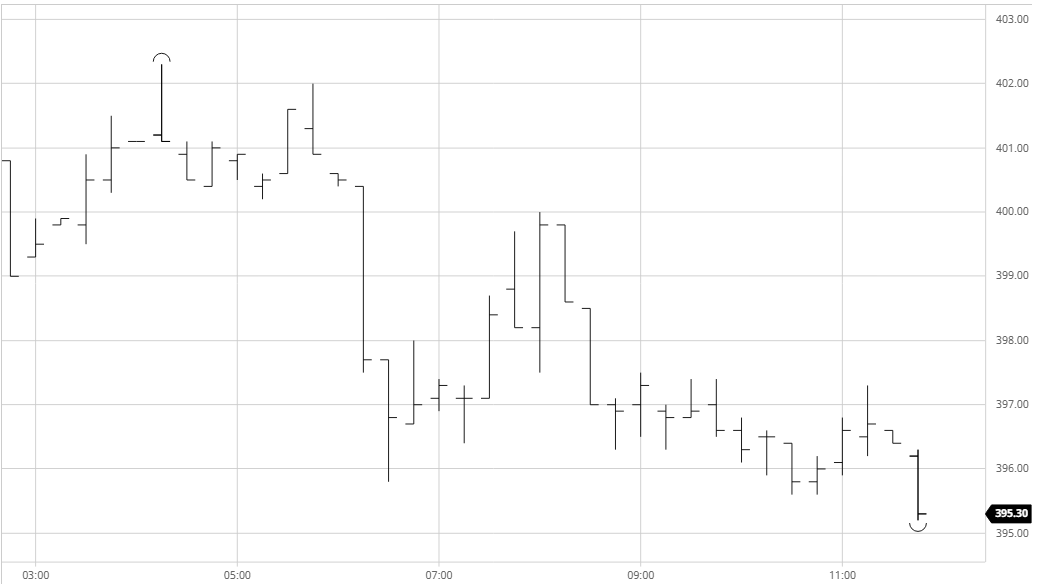

March 21 – Sugar No. 5

There was some morning buying for the whites which enabled prices to hold in positive territory, though as can be seen from the sporadic nature of the prints on the 5 minute chart below volume was as thin as ever throughout this period. It was not until just after noon that we actually saw any meaningful activity, and when it arrived the move was lower with a resumption of the broader recent trend as sellers pushed March’21 down toward $396.00. This move lower caused the March’21 spreads to unwind more of Wednesdays gains with the March/May’21 back to $4.50 while May/Aug’21 as the only other spread seeing any noteworthy volume headed back towards $5.00. White premiums meanwhile were a little narrower as the whites struggled a little more than the No.11, sending March/March’21 back to the $87 area and May/May’21 to $87. An attempt at pushing back upward during the early afternoon stalled at exactly $400.00 basis March’21 and the rest of the afternoon saw a quiet resumption of the toil, playing the lower end of the range and making marginal daily new lows as we moved towards the final hour. Further lows were recorded during the final stages as we ended a largely quiet but sometimes eventful week negatively.

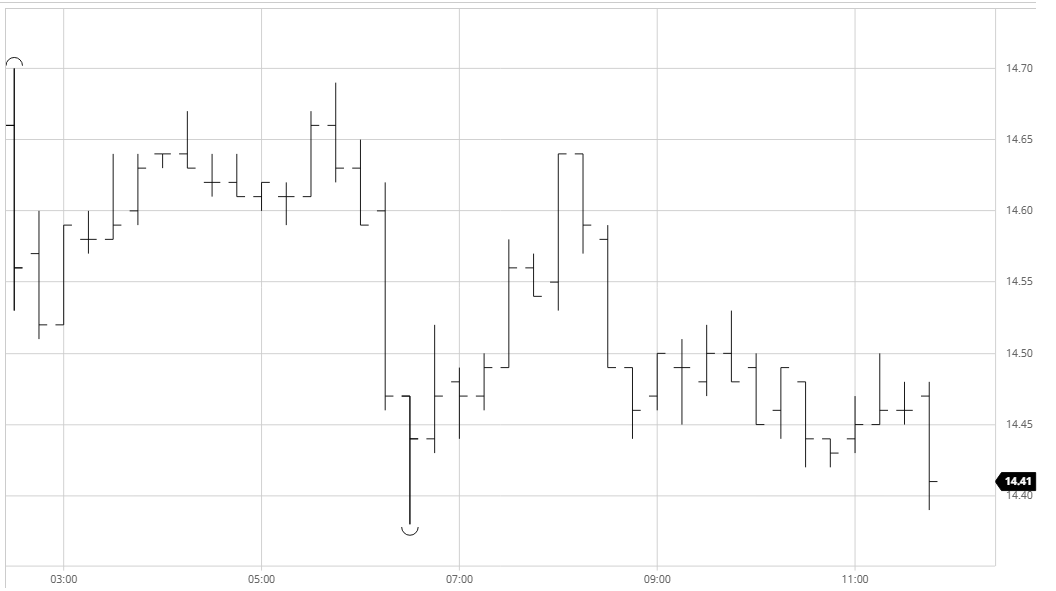

ICE Futures U.S. Sugar No.11 Contract

ICE Europe White Sugar Futures Contract