Mar 21 – Sugar No.11

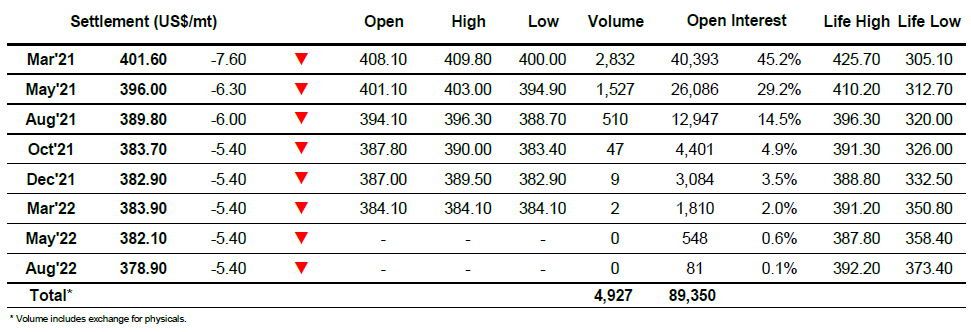

Yesterday marked a sharp turnaround in market direction with a significant afternoon rally which in the absence of any fresh news can only be put down to spec driven technical buying, bringing some of the faster moving specs back in on the long side. This momentum did not immediately carry over into this morning however with an initial dip to 14.87 for March’21 against some opportunistic selling, though once that had been concluded the market re-gathered itself to move into positive ground and consolidate the 15c area. Hopes that this would provide a basis to continue higher proved to be just that as we slipped to make new lows during the early afternoon and with buyers now rather thin on the ground an afternoon of lethargic toil followed spending long periods in the 14.70’s. Spreads were inevitable guided by the flat price, unwinding a chink of yesterdays gains with March/May’21 back to 0.66 points and March/Jul’21 to 1.10 points though as with the outright positions volume remained on the low side. As the Brazil crop moves nearer its end the announcement of the latest UNICA numbers (8.74m tons cane / 0.427m tons sugar / 35.55% mix) had zero impact upon prices and we continued resolutely within the range. The final hour saw a further slip to new session lows, leaving March’21 to end the day at 14.66 and so undoing the brief interlude of positivity.

March 21 – Sugar No. 5

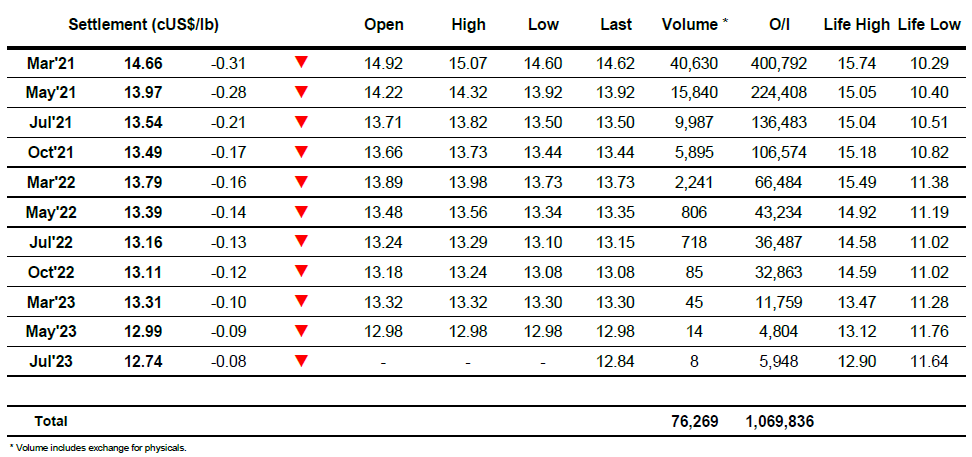

Following on from the sharp rise in prices yesterday afternoon the market initially consolidated the gains, holding near to $409 over the first couple of hours as longs looked to create a platform from which to push again. Selling began to emerged by later morning however and despite the near term technical merits of yesterdays performance it soon became apparent that there is insufficient appetite from the specs to continue pushing at the current time. Instead what started as a pullback became a slide which did not abate until $400 where some psychological support provided a floor which prevented us from sliding closer to recent lows. Volume was again thin throughout the day with fewer than 5,000 lots traded on the day despite a near $10 range, while in the thin conditions we saw nearby spreads give back a good percentage of yesterdays gains as March/May’21 retreated to $5.00. Closing activity played out near to session lows and while March’21 remained above $400 the sentiment at the end of the session was on the negative side once more.

ICE Futures U.S. Sugar No.11 Contract

ICE Europe White Sugar Futures Contract