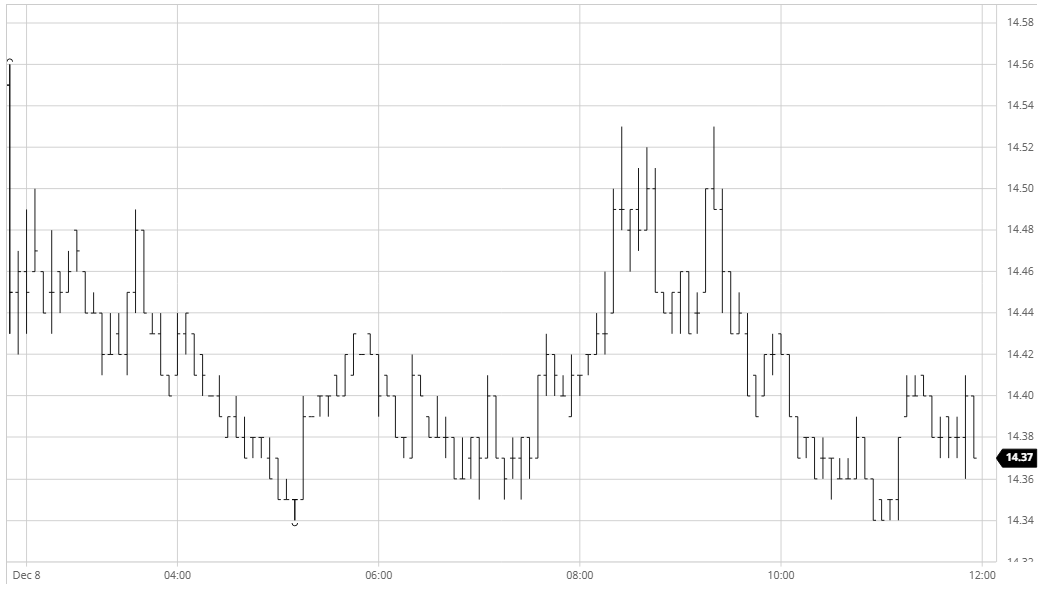

Mar 21 – Sugar No.11

The latest in a growing series of uninspiring performances saw March’20 edging quietly down towards recent lows during the morning though failing to test yesterday’s 14.30 low in reaching a daily bottom of 14.34. Spreads were as quiet as the outright prompts with March/May’21 narrowing by a couple of points to 0.57 but with very little volume changing hands. The situation remained the same as we moved through into the afternoon and even when we maintained the recent trend of an afternoon upside push the move lacked the limited legs of recent efforts with March’21 only reaching 14.53 before slipping back down to stagnate within the range. Volume was even lower than some of the paltry recent efforts and with just two hours remain had failed to pass the 30,000 lot mark, counterproductive action which has even limited the level of algo activity with the thin environment providing no opportunity to trade against. Having fallen back the final couple of hours played out within an 8 point band at the lower end of the range, closing a few points lower at 14.39 to conclude an inside day with the outlook unchanged.

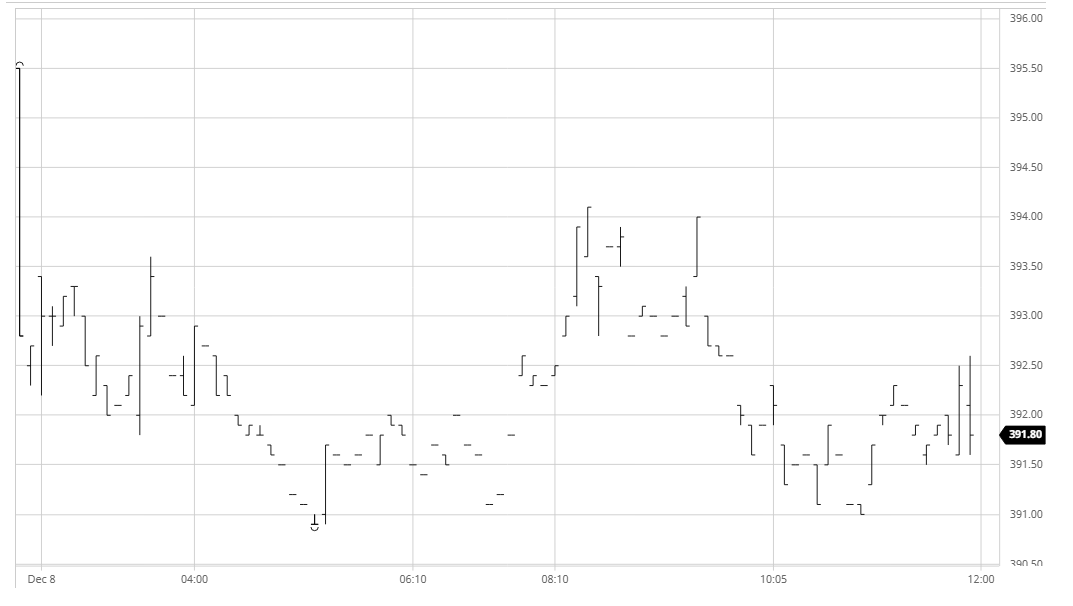

March 21 – Sugar No. 5

The lack of any fresh news in the market of late combined with a slightly more bearish sentiment due to Brazilian rains and reducing Chinese demand are leaving nearby values to toil below $400. Today saw another very slow session within similar trading parameters with the market mostly holding within a band no more than $2.70 beneath last nights $397.70 closing value. Volume remained incredibly light and even the spreads failed to provide any interest as March/May’21 held a very narrow band down to $4.00 but with only limited quantities changing hands while the longer dated spreads were barely traded. The market enjoyed a short mid-afternoon rally which took values back into credit for while however the buying was limited and as it withdrew so we slipped back down towards the morning lows. White premiums continue to hold quietly with March/March’21 near to $79 and May/May’21 around $88, though no discernible activity was seen for either. The latter part of the day was played out at the lower end of the day’s range though some MOC buying did emerge to enliven the final minutes, pulling the March/March’21 back up towards $80 as we concluded a technical inside day.

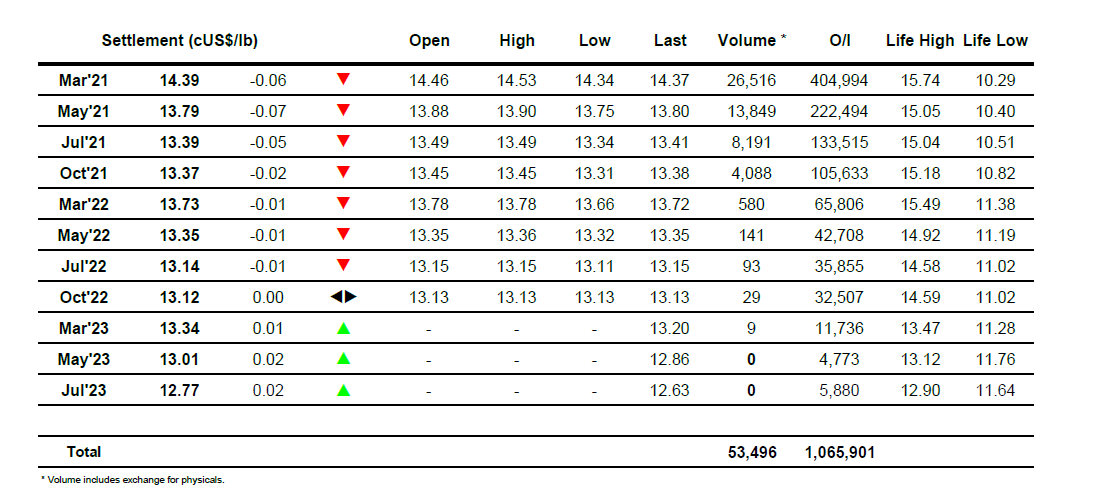

ICE Futures U.S. Sugar No.11 Contract

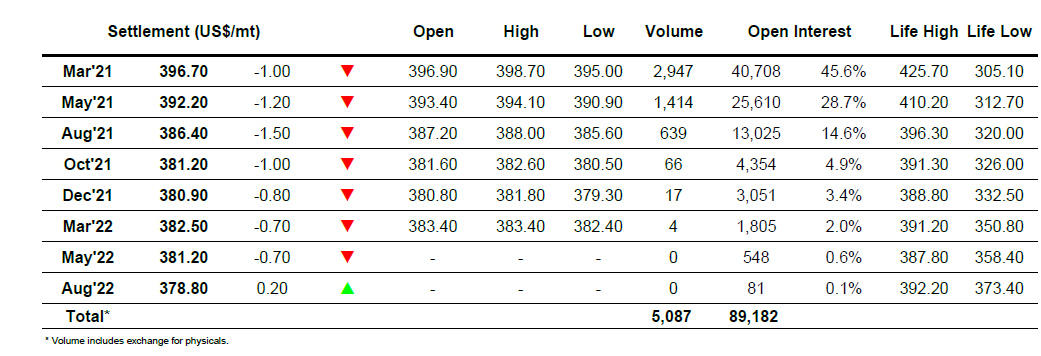

ICE Europe White Sugar Futures Contract