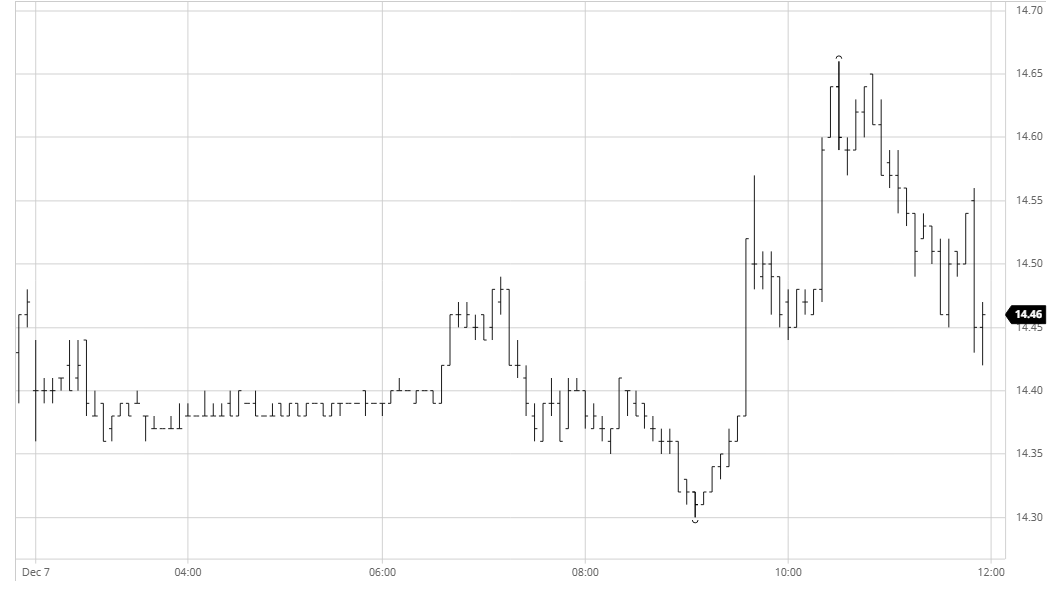

Mar 21 – Sugar No.11

The new week commenced with what could possibly be the most uneventful morning of the year. Early activity saw the market remain within a narrow 8 point range but this was then surpassed as March’21 then spent more than two hours stuck within a 3 point band between 14.38 and 14.40 as even day traders seem to have accepted the situation and switched off. With the macro leaning to the negative and the USD firmer there was an effort to try and nudge downwards during mid-afternoon which nudged March’21 just beneath last weeks lows to 14.30, however contrarian as ever this was soon followed by two separate waves of light buying which in the thin environment were sufficient to take us all the way back up to 14.66. Fridays COT report showed that the funds had reduced their long holding down to 220,174 lots as some of the higher priced long holders had liquidated, and the final couple of hours again proved that the market will require some positive news if some of these longs are to be encouraged back as we faded back down into the range once more. March’21 spreads saw more struggle as March/Jul’21 narrowed to 0.99 points and March/Oct’21 to 1.03 points, while despite some mixed activity ahead of the call the front month concluded the day just a single point higher at 14.45. While the lower values and firmer BRL mean that producers have no current interest in pricing it is difficult to see where any significant buying emerges from at this stage, potentially cheering consumers with each failed rally increasing the likelihood that we will edge further down through their scales towards 14c.

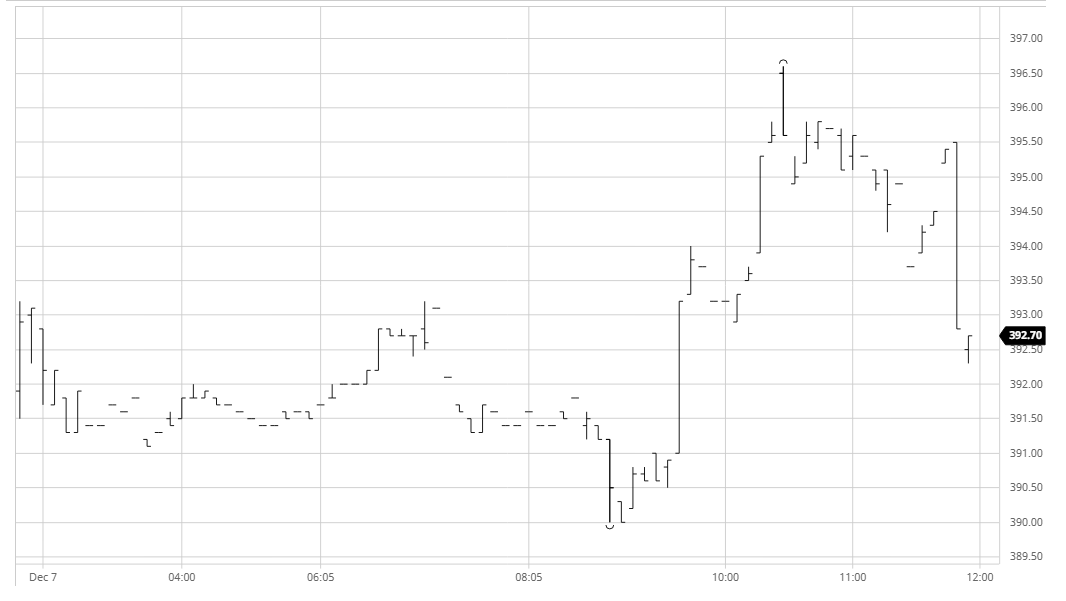

March 21 – Sugar No. 5

An unbelievably slow start to the week even when measured against recent standards saw March’21 edging sideways near to $396.00 on very low interest. It was early afternoon before a small wave of buying broke the monotony and with this proving to have had a limited effect some selling emerged to send nearby values lower to a new recent low mark of $394.00. The recent market fatigue has come despite the funds still holding a considerable 29,000 lot long position and though there has been some light liquidation we are seeing most of the longs stand firm. With this in mind it should not be surprising that we saw some light buying send prices up through the overhead vacuum to briefly trade $401, however each move upward lacks momentum recently and as we moved into the final hour we had returned to the centre of the range. Nearby spreads were struggling as March/May’21 traded back to $4.00 while white premium activity was virtually non-existent with values showing little change. Buying emerged for the close to ensure marginal net gains though it does little to change the outlook which remains sideways to slightly negative.

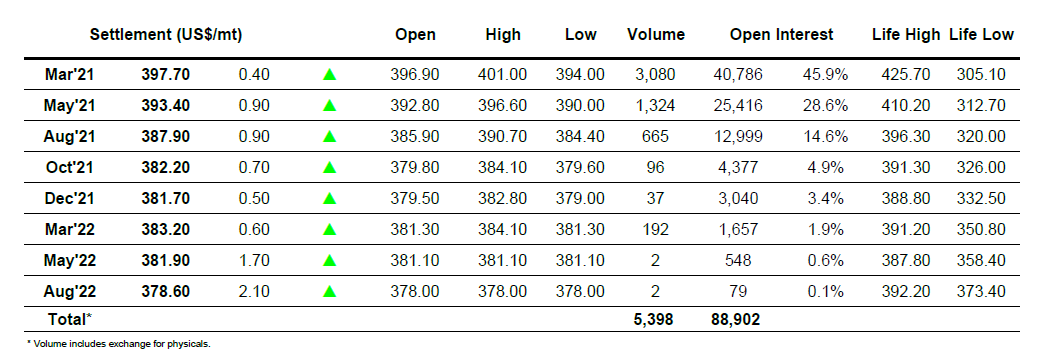

ICE Futures U.S. Sugar No.11 Contract

ICE Europe White Sugar Futures Contract