Mar 21 – Sugar No.11

There was some light buying for this morning’s opening which nudged March’21 up to 14.77, though once concluded we edged back off to hold just beneath unchanged levels against very light volumes. Having recovered a touch from recent lows over the past couple of days there has been talk that the weakening USD and stronger macro could act as reason to push back above 15c however it has been some time now since we followed the macro and by early afternoon it was clear that this remains the case with nearby values starting to move back down to the 14.50 area. Volume picked up a little below this level with some consumer scales having been raised up since Wednesday but still we eroded through some of it to reach 14.40 before seeing a remarkable unexpected turnaround. Whether it be due to specs or otherwise the front month traded up by 25 points against volume of just 3,000 lots in quick time though if it was hoped the move would get the upward momentum back on track then the longs were to be disappointed as we soon began to edge lower once more. Over the course of a couple of hours we found ourself back within touching distance of the earlier lows, and with the March’21 spreads now also at session lows (March/May21 at 0.59, March/Jul’21 at 1.04, March/Oct’21 at 1.11) we headed into the close. Mixed activity during the final minutes left March21 settling at 14.44, towards the lower end of a weekly range spent entirely below 15c.

March 21 – Sugar No. 5

Early trading saw the March’21 contract make minor losses though in continuing low volumes there was little to get excited about. After a few hours of complete boredom the market began to edge its way downward on light selling though the lack of any significant buying in front of recent lows was also attributable and made it very easy to decline. The movement in the flat price led to some change in the white premium as March/March’21 worked between $77 and $79 while the March/May’21 spread saw an increase in yesterdays paltry volume as it narrowed back in to $4.30. The slide lower saw March’21 down to $396.00 by mid-afternoon before rallying sharply in response to gains from our No.11 counterpart though no substantial volume changed hands on the recovery. It turned out to be a very short-lived rally as prices returned to the familiar tedious chug lower and by the time we approached the close we were back withing close proximity of session lows. Some late short covering ensured that these were not breached, leaving March’21 to settle at $397.30 but still providing a negative slant to the weekly chart.

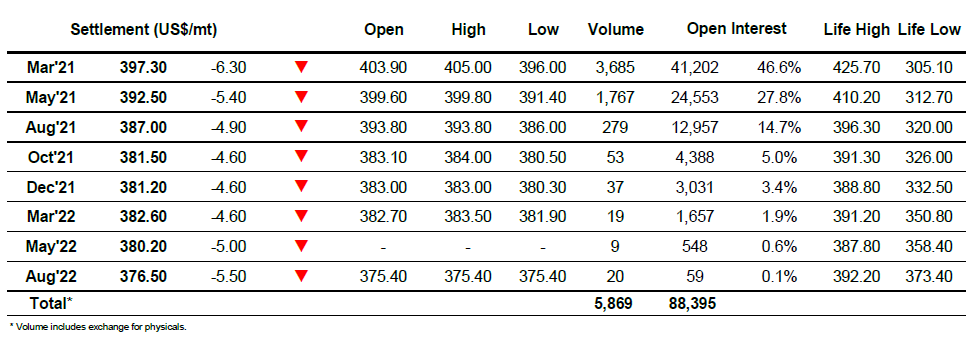

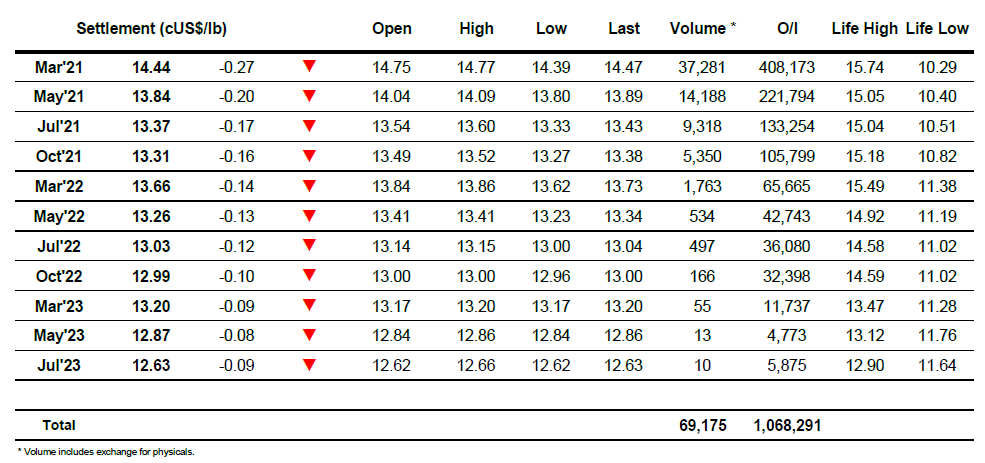

ICE Futures U.S. Sugar No.11 Contract

ICE Europe White Sugar Futures Contract