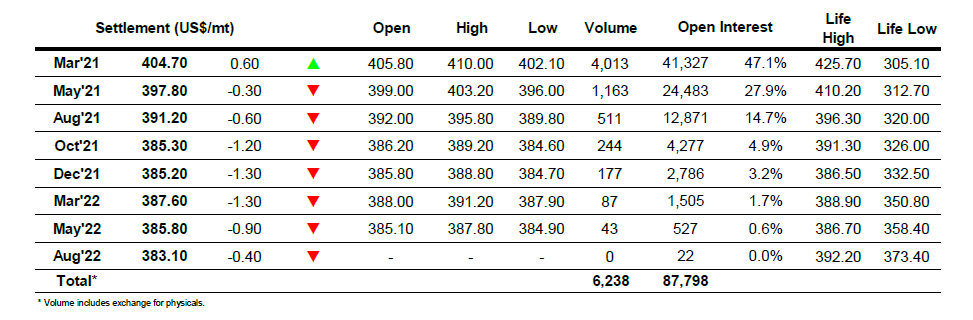

Mar 21 – Sugar No.11

The Thanksgiving holiday seemed to have breathed some enthusiasm back in to the market with a firmer opening followed by a push back up towards 15c. As ever the psychology of the round number drew in some selling and things quietened down for the rest of the morning as we held the mid 14.90’s, still lacking the impetus to rally significantly despite another steady showing from the macro. The stalemate was broken ahead of the US morning with a push through 15c and on to 15.18 but disappointingly the move seemed to be driven by smaller specs and day traders only and once the price had topped out at 15.18 we soon lost momentum and slipped back down into the range. This failure prompted long liquidation that took us briefly down to 14.76 before returning to the range once more with the specs now standing aside and licking their wounds. Spread volume was lighter than usual throughout the day as March/May’21 printed either side of 0.82 points and it was clear that many traders were taking the opportunity to turn the Thanksgiving holiday into a four day weekend. The final couple of hours simply saw values drift along at the lower end of the day’s range to send us into the weekend on a weak note.

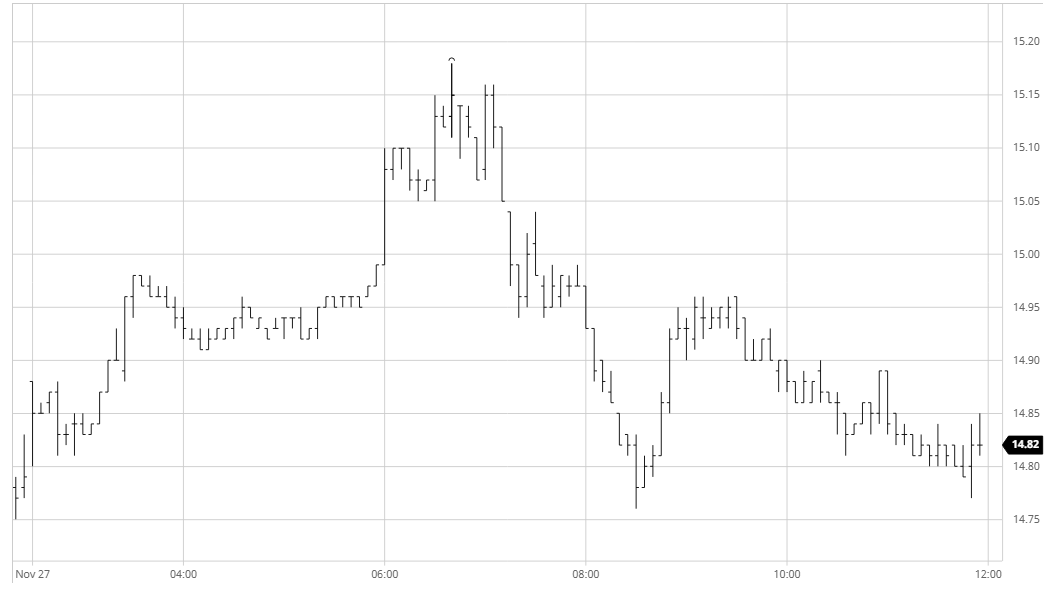

March 21 – Sugar No. 5

Yesterday represented the first positive close for the whites in more than a week and it seemed to be having a positive impact this morning as March’21 pushed up above $407 following a mixed opening. Volume soon dropped back to very low levels as values consolidated the range with spreads and arbs barely registering any activity at all. A burst of spec buying for No.11 around noon pulled nearby values higher as the white premium tracked the move but here again there was very little activity with a mere 170 lots traded as March’21 spiked by $3 to 409.50. We continued to track the US spec activity with a sharp decline back to $402.10 but this too was on minimal volume with market illiquidity leading to something of a vacuum, while the subsequent consolidation near to unhanged levels had many switching off for the weekend. March/May’21 did firm by around $1 on the light buying that it attracted while the March’21 white premium was quoted around $77.50 late afternoon having been printing in the vicinity of $75 during the mid-session volatility. Closing activity saw some light buying ensure a marginally firmer conclusion to a disappointing week.

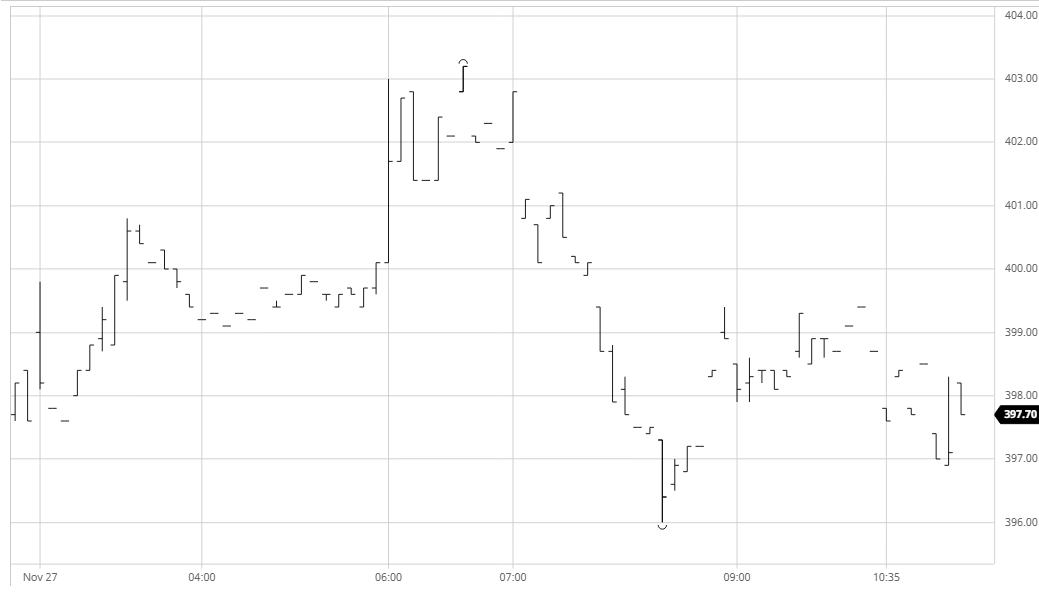

ICE Futures U.S. Sugar No.11 Contract

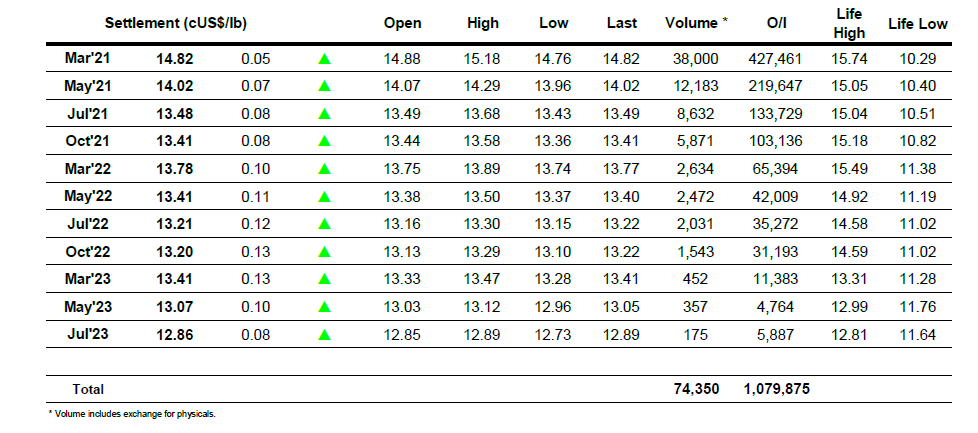

ICE Europe White Sugar Futures Contract