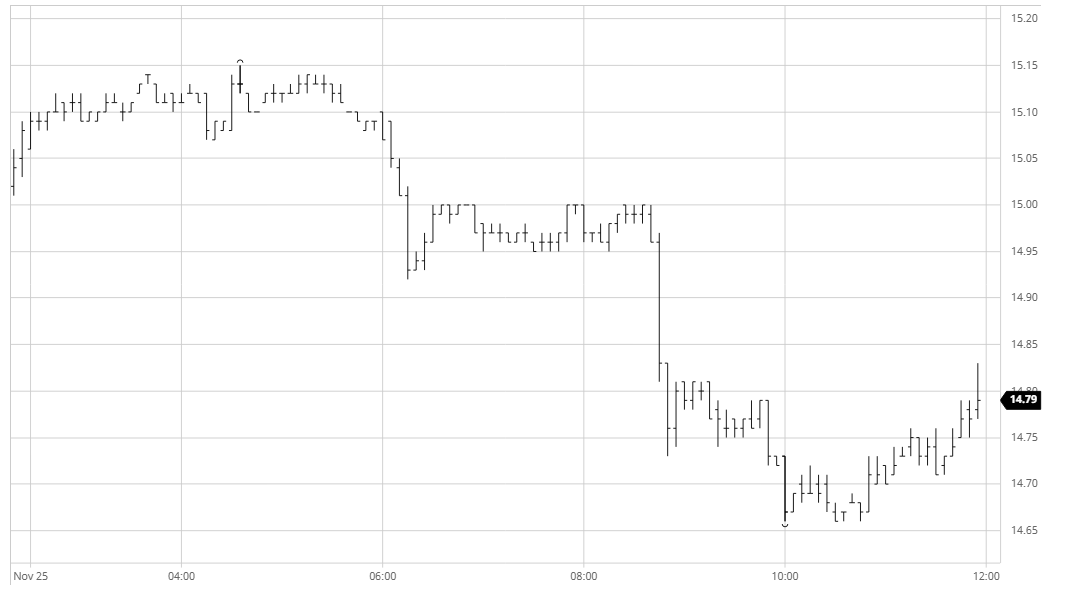

Mar 21 – Sugar No.11

Early activity saw some light buying to pull values up by a few points however the muted rally was disappointing in the context of the wider macro which was once more seeing strength across the energy sector while equities continue their own recovery on the continuing wave of Covid vaccine positivity. Struggling to make further gains and holding a narrow range throughout the morning the market slipped back a little around noon to leave March’21 below 15c and it seemed that this dip caused some selling to be lowered with the 15c mark then providing a ceiling which could not be broken in a further extended period of sideway trading. The Unica announcement showing 20.34m tons cane / 1.24m tons sugar / 41.7% mix / 153.56 ATR was above estimates though being we are into the tail of the crop had no obvious impact, however within an hour something did give with some more sizable spec selling observed as we broke through 14.90, moving quickly into the low 14.70’s on around 8,000 lots of March’21 volume. Some were suggesting that this dip was based on rumours that an Indian announcement on subsidy is moving closer and though there was nothing to back this up if it does turn out to have some truth then there may well be further losses to come. There was no sign of any significant recovery during the final couple of hours as we continued at the lower end while spreads showed weakness with March/May’21 back to 0.81 points while March’21/March’22 came all the way back to 1.05 points. We head into tomorrow’s Thanksgiving holiday showing some vulnerability but as ever all eyes will remain on India to determine whether this represents a mere blip or a wider turnaround.

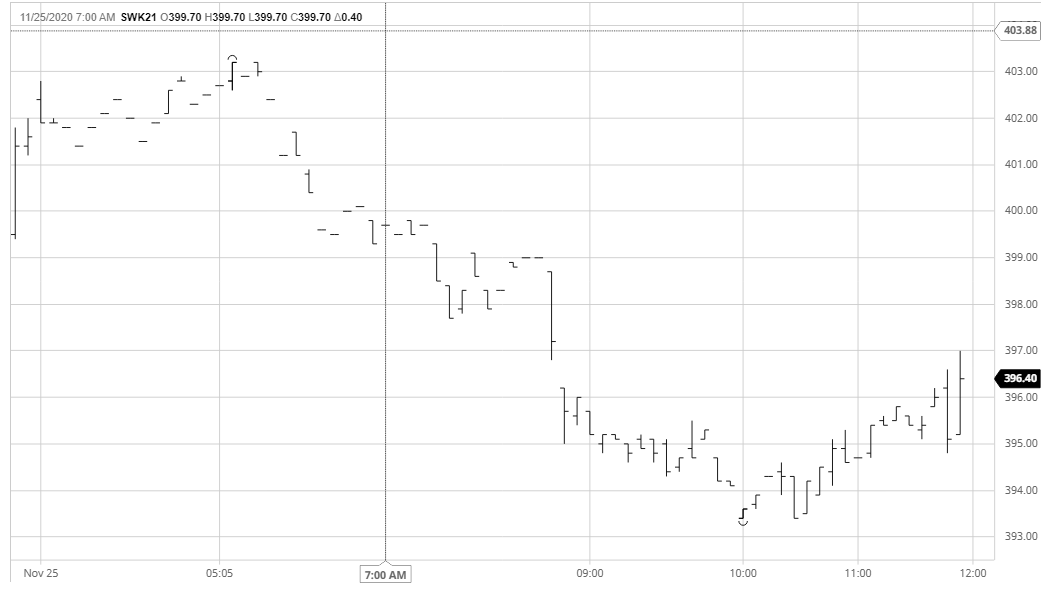

March 21 – Sugar No. 5

There were early losses for the market and a morning of toil endured, broken only by a brief early spike up to $411.40 for March’21 against a sharp burst of buying before returning to the $407/$408 area as soon as it had concluded. This served to temporarily inflate the March’21 white premium value up to the $79 area however with prices skimming along at the lower levels it spent much of the day valued nearer to $76 but with very little actually being traded against it. With the macro continuing to be ignored and India still showing no sign of making an announcement as to any subsidy the session became a complete non-event as set the range within the first couple of hours leaving many to simply stand aside and ignore the market entirely. Most of the residual; activity was seen at the lower end of the range with some consumer interest being observed and we continued here until the closing stages when some very light buying emerged to push up into the vacuum above and restrict the days losses with some MOC buying. March’21 settled away from the lows at $408.60 as a result but with the US fast approaching the Thanksgiving weekend quiet conditions seem set to continue.

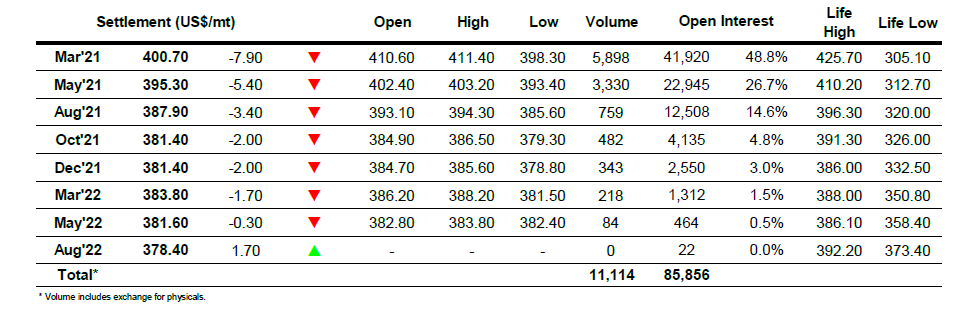

ICE Futures U.S. Sugar No.11 Contract

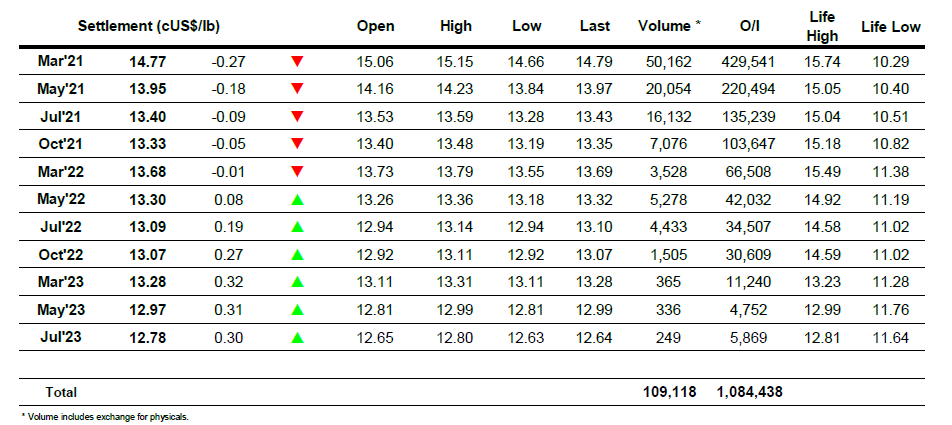

ICE Europe White Sugar Futures Contract