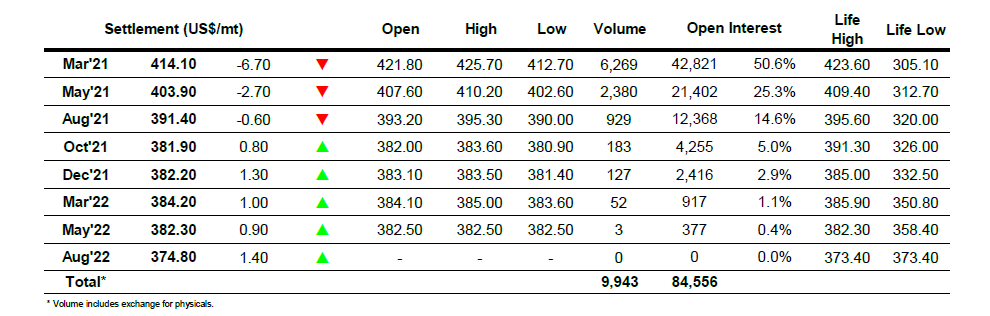

Mar 21 – Sugar No.11

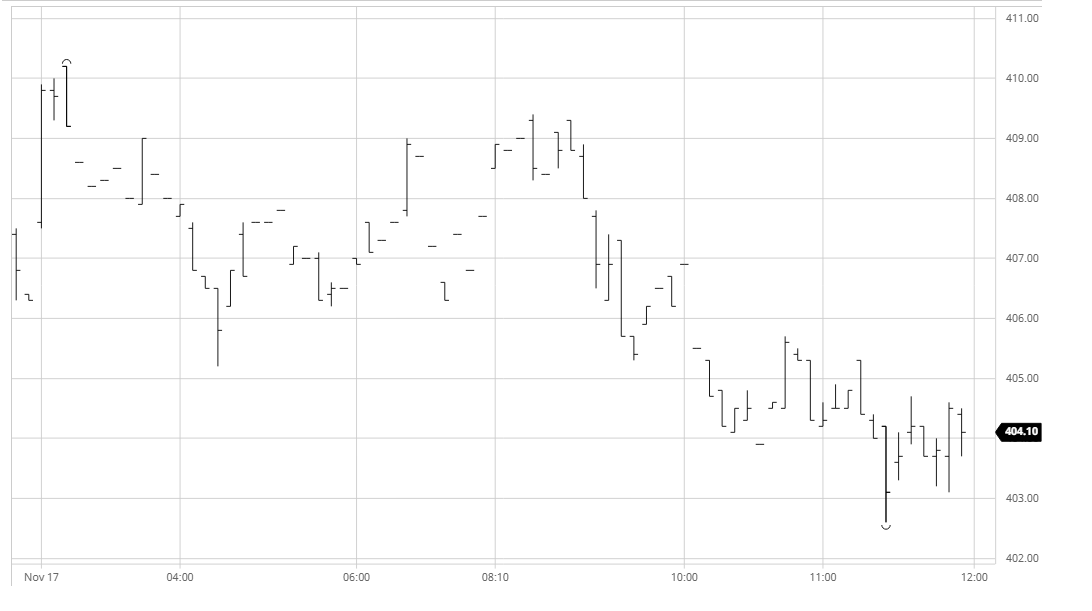

Early morning trading saw March’21 soon working back through 15.50 and triggering some light buy stops above yesterday’s 15.58 high mark to reach 15.66 before pausing and taking stock of the situation. The March’21 spreads were also continuing their resurgence during the early stages and while the flat price consolidated March/May’21 was nudging out around 1.10 points in a further show of the technical momentum and strength of the recent recovery. Despite a lack of fresh fundamental news some traders were making noises regarding Hurricane Iota and the concerns as to its impact upon the Central American belt, though with the market simply ranging sideways there appeared to be little of this worry reaching the market. The situation remained little changed into the afternoon with the exception of the March’21 spreads which had lost their earlier support and instead beginning to send negative signals as they slipped beneath last night’s closing values. The flat price followed this lead with a short but sharp dip mid-afternoon and though it never seemed likely that prices would collapse the second half of the afternoon day played itself out in lower territory. Moving through the final hour March/May’21 narrowed back to 0.91 points with the March’21 down to 15.22 as some light long liquidation took place however defensive buying returned for the call and settlement was established at 15.31 to conclude todays corrective action with the technical strength comfortably intact.

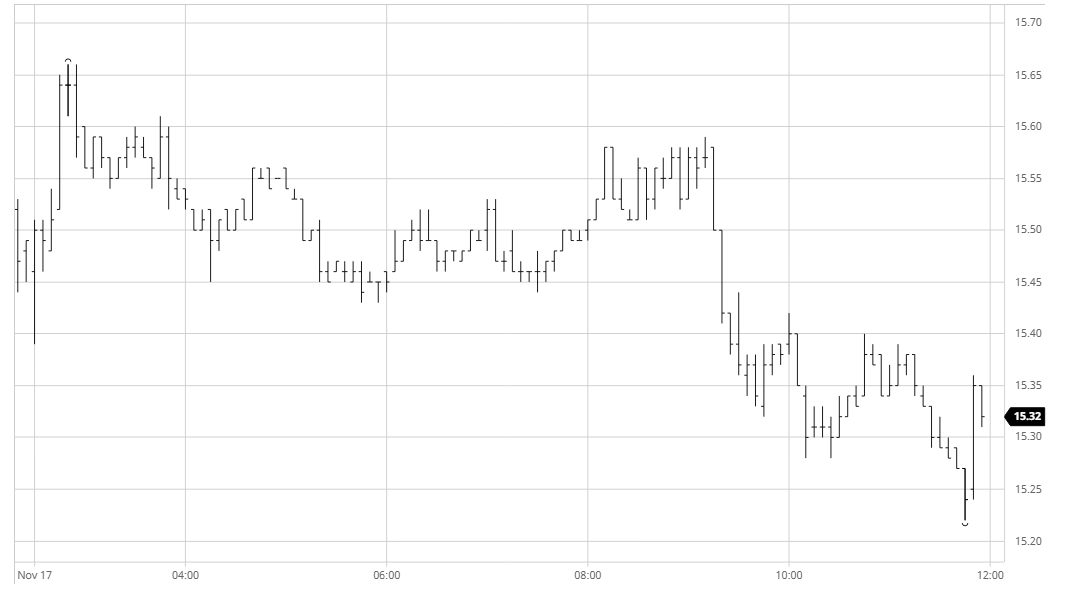

March 21 – Sugar No. 5

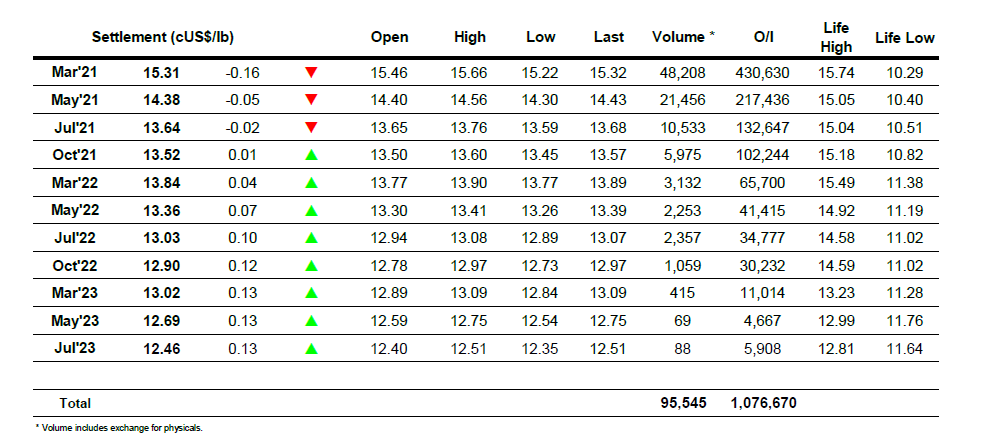

A strong start to the day saw March’21 push up to another new life of contract high at $425.70 against the initial burst of buying before pulling back by a couple of dollars once it had been concluded. The new highs bring a good deal of technical strength to the market but with the specs now likely above 30,000 lots long once recent additions are taken into account we are seeing their capacity reduced with moves becoming more targeted to best opportunity. As such it was not too surprising to see a period of prolonged consolidation with the market maintaining the strong recent performance by holding above $420.00 on moderate volume. This situation continued through to mid-afternoon when spec selling in the No.11 brought a reaction from the whites, following lower on very light volumes with the lack of buying at these levels clear to see. This caused some volatility for nearby premium values as they initially widened against the weak No.11 pushing March/March’21 above $80 but subsequently narrowing towards $76 against stronger whites selling towards the end of the session. The daily lows were recorded just prior to the closing call with March’21 settlement a little above at $414.10, still well above the previous $410 resistance area and maintaining the wider technical strength.

ICE Futures U.S. Sugar No.11 Contract

ICE Europe White Sugar Futures Contract