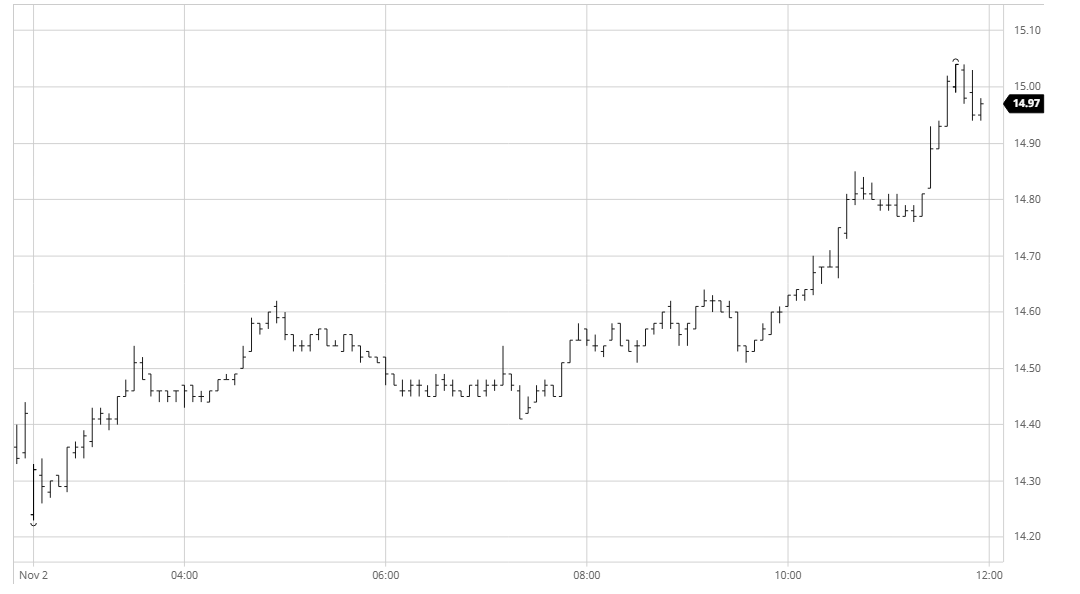

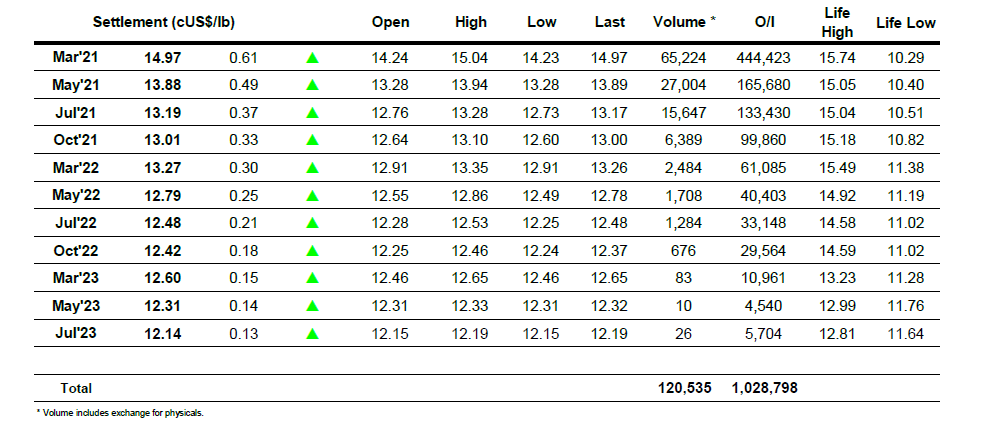

Mar 21 – Sugar No.11

Morning trading saw the market edge a little higher on quiet volume, continuing Friday afternoon’s recovery on the back of a similarly moderately firmer macro picture. Volume was thin outside of the front month and some nearby spread activity and for several hours the market proved to be rather mundane as we eased along either side of 14.50 in a featureless environment. Activity only began to pick up during the final couple of hours, and when it did it came from the specs who maybe taking advantage of the Brazilian holiday and more limited selling decided to once more push back to recent highs and reinstate the positive technical picture. The aggressive nature of the March’21 buying took the front month to 15.04 which matched the recent high from last week, while increased buying for the March/May’21 spread saw the differential widening out as far as 1.11 points premium as concerns over the availability of Q1 sugars continue. The final stages saw some profit taking from days traders combine with a little producer pricing to send March’21 back below 15c though we remained firm with settlement at 14.97. This left sugar a long way clear at the top of the CRB showing that despite using the macro as a guide we are some way detached presently, and with tomorrows US election liable to add to market volatility for the coming days we may see continuing macro shenanigans for the near term.

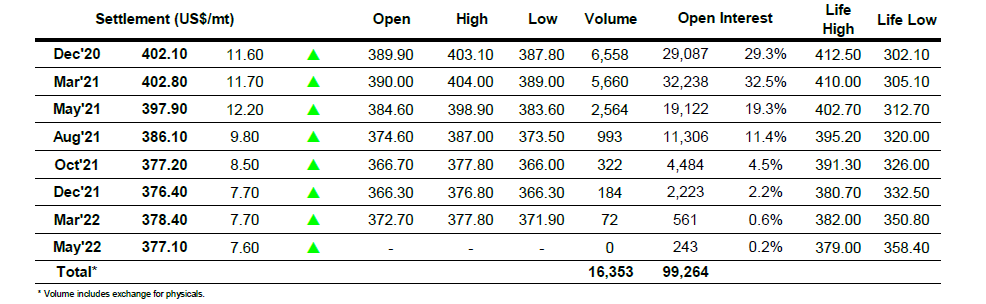

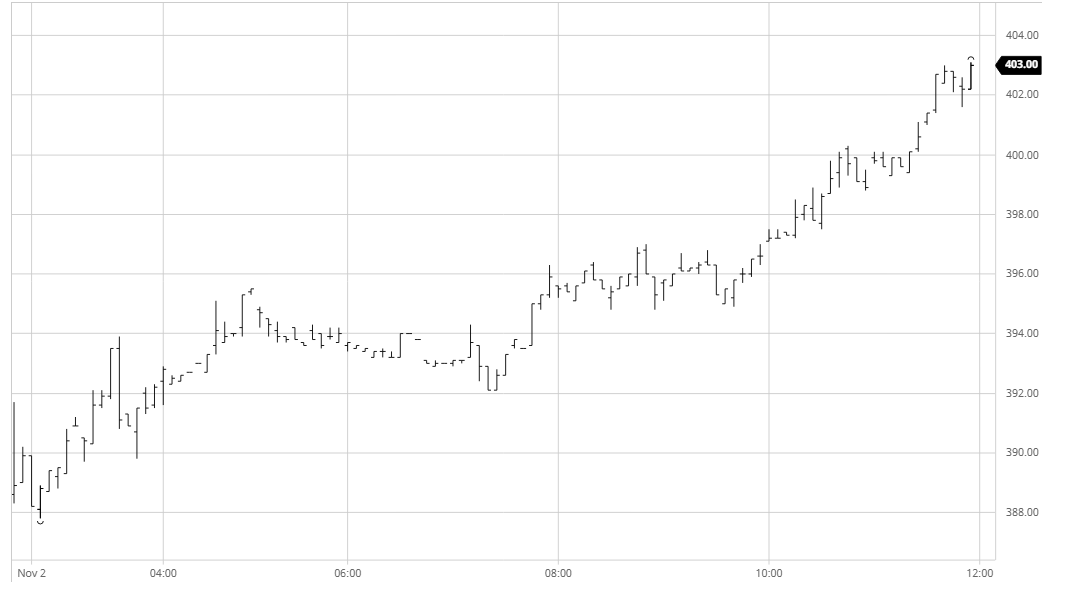

Dec 20 – Sugar No. 5

The market quickly reversed an early dip to make steady gains which were comfortably consolidated over the course of the morning in quiet conditions. There was little change as we moved into the afternoon until gradually some fresh buying began to filter through, edging Dec’20 back upwards towards $400 once again to reverse the losses seen during the second half of last week and in so doing pulling the 2021 positions up to widen white premium values. March/March’21 moved to $76, May/May’21 to $93 and Aug/Jul’21 beyond $95 before we found producer pricing orders which limited the white premium gains however values remained buoyant and it did little to impact the wider market rally with prices continuing upwards as we moved towards the close. Dec’20 recorded a session high of $403.10 which remained a touch shy of the levels reached last week however with a strong settlement value at $402.10 the move provides a solid platform to try and build the broader technical move and push upwards once again.

ICE Futures U.S. Sugar No.11 Contract

ICE Europe White Sugar Futures Contract