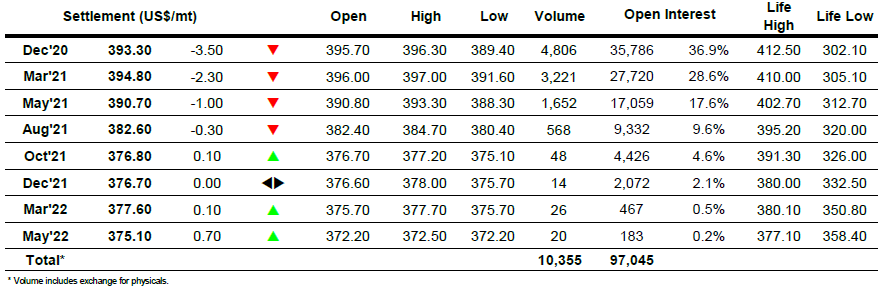

Mar 21 – Sugar No.11

Having rallied to another new set of recent highs yesterday we commenced near to unchanged levels though struggled to progress by very far with some strong selling sitting in place ahead of 14.75 as producers looked to take advantage. This led to something of a stalemate for a while but gradually the lack of progress impacted upon the day traders with prices sliding back by a small distance as some long liquidation took place. Moving into the afternoon we continued at the lower end of the day’s trading range finding moderate support in front of 14.50 to keep the pullback in check, while nearby spreads also levelled out having lost ground on the slide narrowing to 0.64 points for March/May’21 and 1.14 points for March/Jul’21. In quiet conditions the afternoon saw prices yo-yo within the range but falling short of the morning highs until the final stages when a few thousand lots of selling (long liquidation) sent March’21 back to trade a marginal new session low 14.51, settling just above this level at 14.54. While this was a weaker close it only represented an inside day on the charts and goes a small way to unwinding overbought indicators, though it will be a test of the specs desire and capacity to see how they react as without any real consumer activity the onus remains upon them to maintain the move higher.

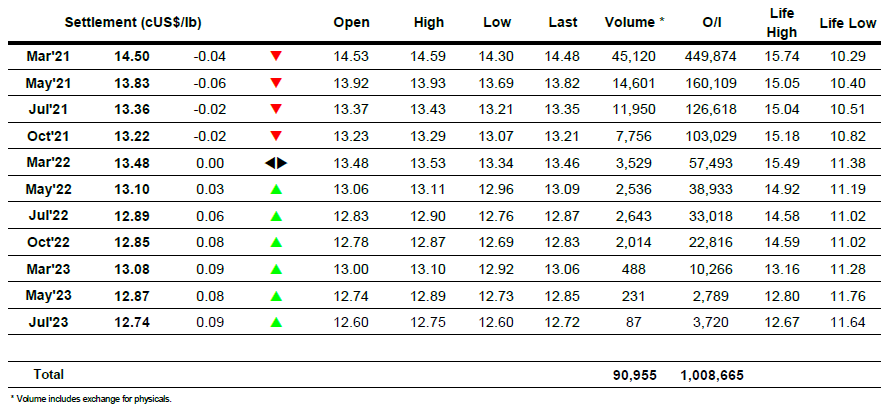

Dec 20 – White Sugar No 5

There was something of a hangover following the wobble on last nights close as we commenced a little lower with Dec’20 slipping towards $393.00 in a thin environment before attempting to stabilise. With buyers few and far between this pause in the decline did not last for too long and the downward trend resumed during the last morning to send the front month down to a low of $389.40 while the Dec’20/Mar’21 spread also suffered and pushed back to -$2.30 discount having been trading at $2 premium just a couple of sessions ago. The fall again impacted upon white premium values which fell beneath yesterday’s lows with for March/March’21 at $75.50, May/May’21 below $85 and Aug/Jul’21 around $87, providing worrying signs for the longs. A No.11 led recovery pulled flat price values back upward during the final couple of hours however the move merely pulled prices back nearer unchanged values before faltering during the later stages. A mixed closing period saw Dec’20 veer between $394.80 and $392.30, settling between the two at $393.30 to conclude a fairly meaningless day.

ICE Futures U.S. Sugar No.11 Contract

ICE Europe White Sugar Futures Contract