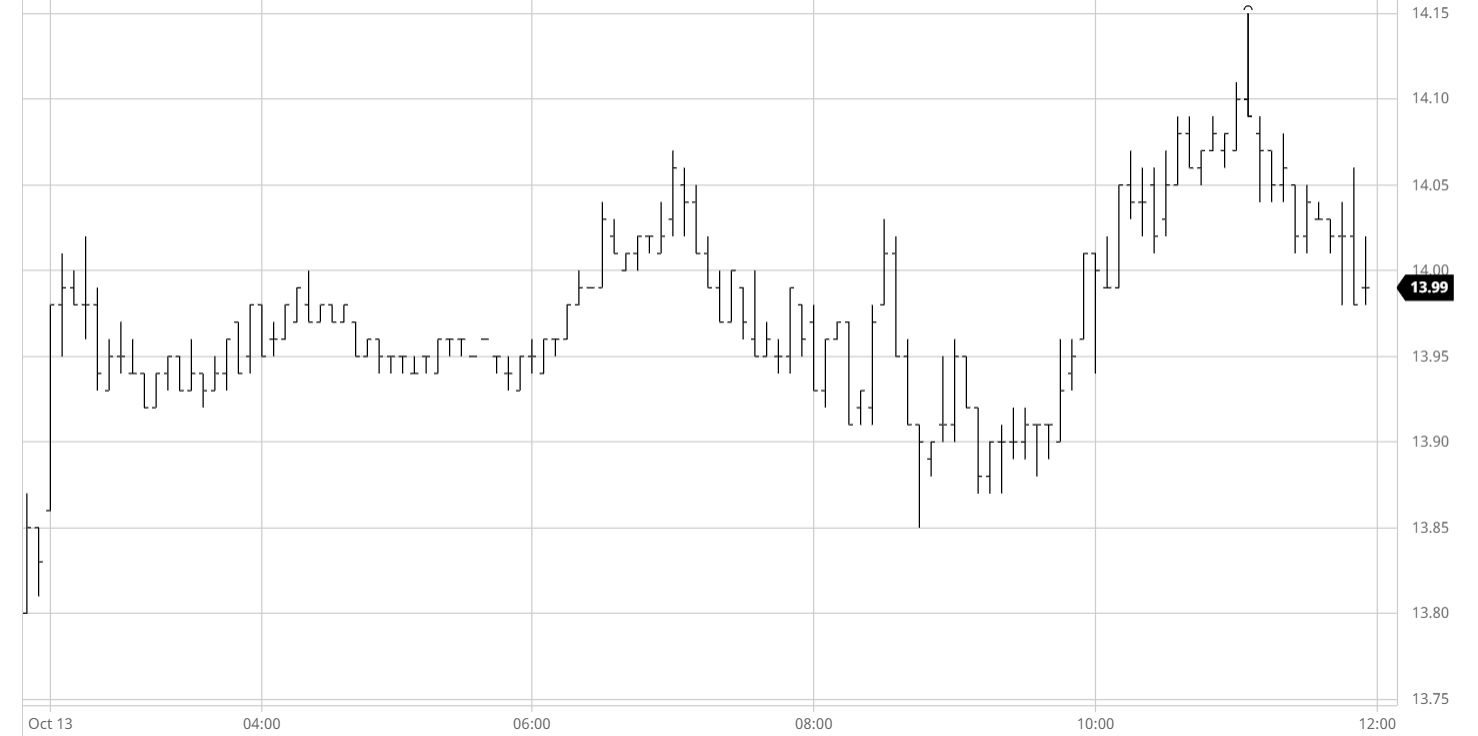

Mar 21 – Sugar No.11

The sharp decline seen yesterday afternoon did at least halt right in front of the former 13.77 double top, and this provides some technical merit to classify the move as a correction rather than a failure at this stage. Initially we saw some trade and consumer buying as hedges were lifted against overnight physical business, and with selling limited at these lower levels this activity was sufficient to enable March’21 to work back towards 14c. A push from specs as NY based traders arrived sent March’21 up to briefly reach 14.07 however in quiet conditions we then returned to the range before retesting the opening lows. These were gathered up quite quickly and with other participants largely absent the smaller specs and algo’s made a fresh push upward through 14c to achieve new highs, keen to reverse yesterday’s action and maintain some broad stability. A spike to 14.15 was short-lived and the final hour saw values gravitate back to mid-range, ending near to 14c to conclude an inside day in a cautiously positive way.

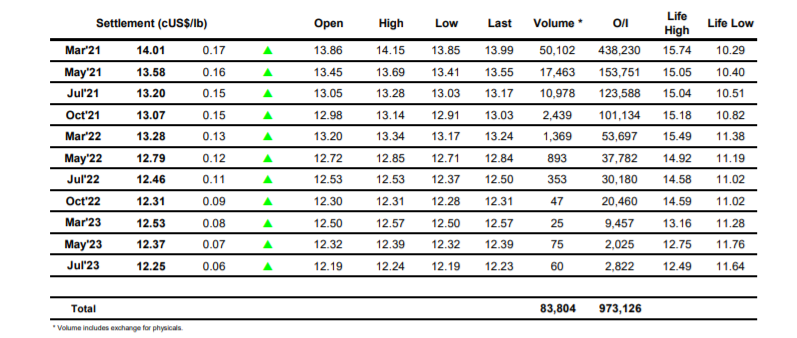

Dec 20 – White Sugar No 5

Yesterday’s decline encouraged some fresh physical sales overnight and hedge lifting from the trade lent support to the market during the morning which lifted values by a few dollars in an otherwise thin trading environment. The rally lent further support to white premium values and as some early afternoon spec buying took values to new session highs so we saw the same with March/March’21 trading to $78, May/May’21 to $86 and Aug/Jul’21 to $88. It was not too surprising to find that the buying was rather limited following the scale of yesterday’s pullback and as the spec buying eased back so we settled into the range, though still finding sufficient support to maintain a portion of the daily gains. Further bursts of buying during the afternoon sent Dec’20 to an eventual session high of 390.20 however we were unable to maintain these levels and ultimately fell back to conclude a largely quiet inside day in the middle of the range at 387.10.

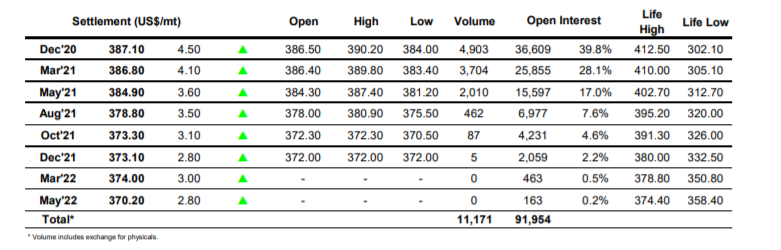

ICE Futures U.S. Sugar No.11 Contract

ICE Europe White Sugar Futures Contract