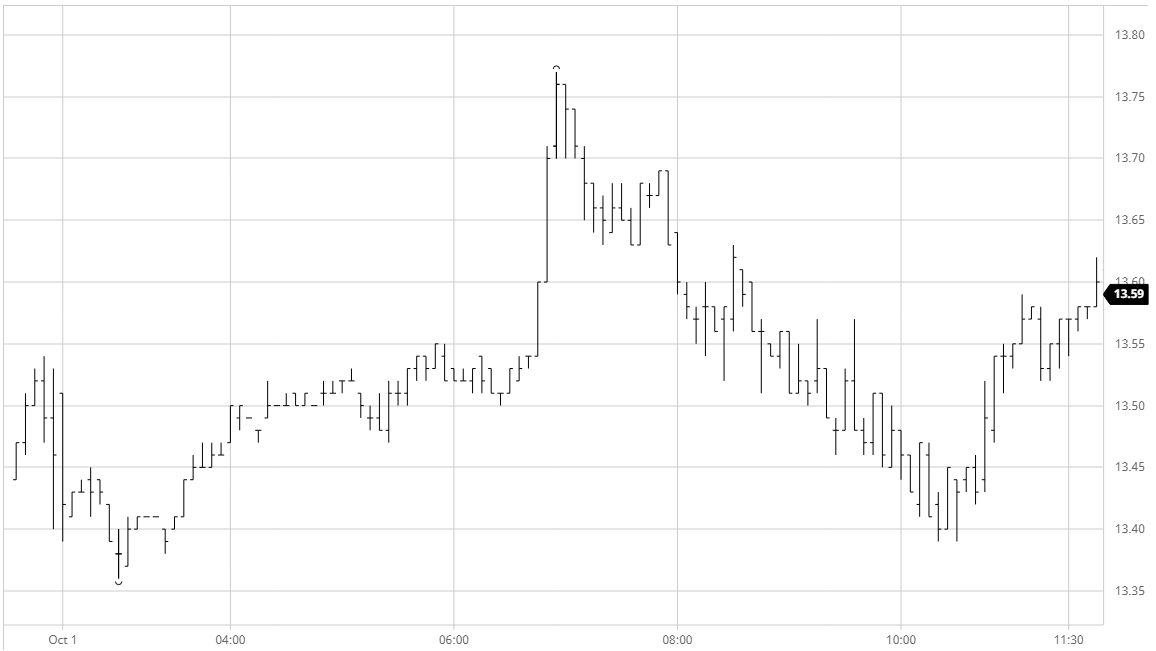

Mar 21 – Sugar No.11

• The market started the day slowly as traders interpreted the news of a huge 2.6m ton delivery and we spent the morning trading a little lower to unchanged, consolidating the recovery from Mondays decline. As is so often the case it was the arrival of US funds which enlivened proceedings as buoyed by the recent recovery they charged in with fresh buying to test the recent highs, breaking through 13.54 and 13.65 in quick time to challenge the August high mark of 13.77. In the event they matched the 13.77 level to form a double top on the charts, and despite best efforts to initially hold a short way below this mark a steady decline followed which took us back down to within touching distance of the morning lows. Specs were keen to avoid a repeat of Mondays failure and stepped in to defend the market from this point, pulling values back up to mid-range as we moved in to the final hour. There was a move to take March’21 back over 13.60 as we headed into the close although MOC selling sent us back into the 13.50’s though still ending showing modest net gains. Overall it was a mixed day and the spec longs will no doubt be keen to try and build once more tomorrow to prevent the 13.77 double top from casting a shadow and killing the latest momentum.

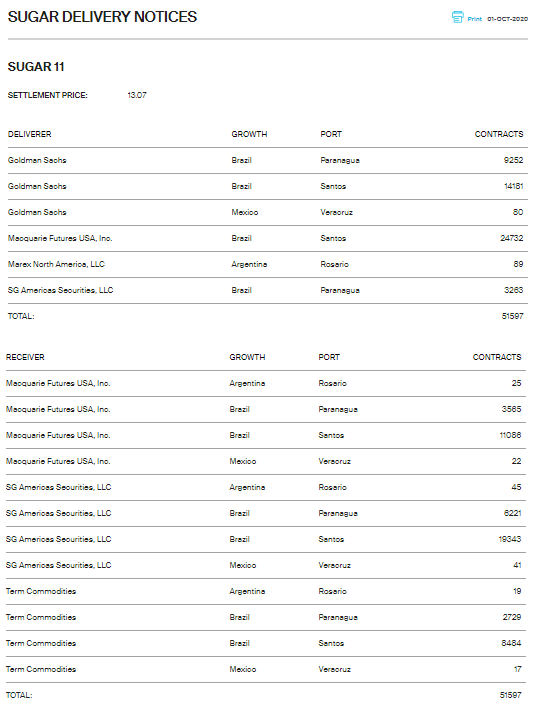

• The Oct’20 expiry has seen a record volume with 51,597 lots (2,621,256t) tendered. Delivering are Goldman (Raizen), Macquarie (Cofco), Marex (Enerfo) and SG (Glencore). Receivers are Macquarie (Alvean), SG (Wilmar) and Term (Dreyfus). Full details are show below.

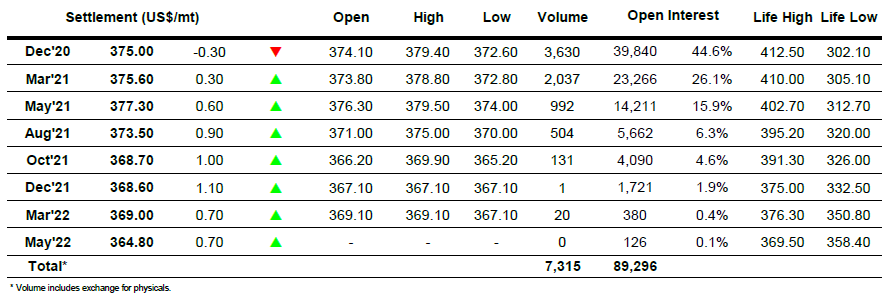

Dec 20 – White Sugar No 5

• The recent pattern of volatility continues although there was no immediate sign of significant movement this morning as we recouped initial losses to hold near to unchanged levels. It was only around mid-session that the situation ignited as we followed No.11 higher in quick fashion, moving up to 379.30 on only around 400 lots of volume, emphasising the thin nature of the whites market at present compared to our US counterpart. Recent action has told us that spec buying is key to the continuing strength and so it proved that as the buying eased so prices fell back to make new session lows later in the afternoon before encountering defensive buying from longs. Throughout this flat price action we saw spreads remain rather muted, Dec’20/Mar’21 trading either side of parity, while white premiums continued to zip about the recent range, March/March’21 between $76 and $79 albeit on very light volumes due to the lack of whites liquidity. A sharp burst of selling for the close sent prices back down, narrowing premiums as we ended comfortable within the range.

ICE Futures U.S. Sugar No.11 Contract

ICE Europe White Sugar Futures Contract