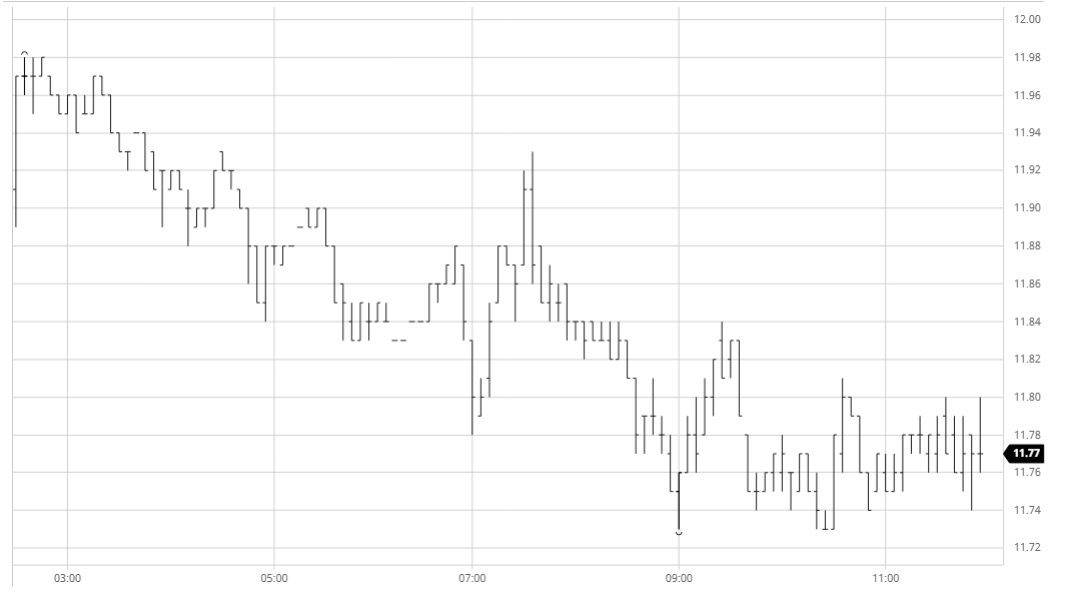

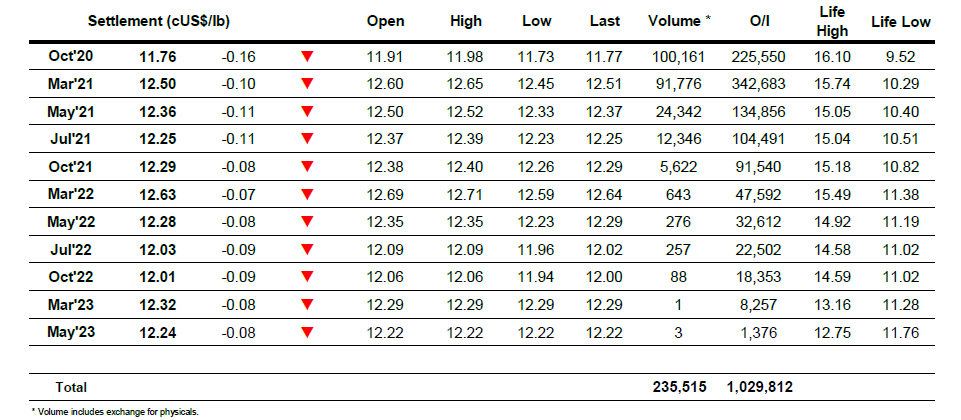

The market struggled to break free of the recent range once again today, slowly grinding lower against relatively limited outright volumes with many traders showing apathy and standing aside. As always there was some initial support against physical offtake but once that had been concluded so the trend lower was established with the last of the index roll providing the lead. Oct/March had been holding up relatively well and maintained a tight range last week, but today there was less support from the long side and this led the differential to weaken to -0.74 points by late afternoon, maintaining pressure on the nearbys. Specs were not particularly visible however the expectation would be that there may have been some more light liquidation to continue the recent trend, last week’s COT showing a fall of 32,000 lots for the net long to 158,516 lots with my expectation that a further 25,000 lots more may have been liquidated since. The move to a new recent low of 11.73 failed to garner much momentum however unlike recent days the market remained towards the lower end of the range going out which may unsettle the longs a little moving forward.

Oct – Sugar No.11

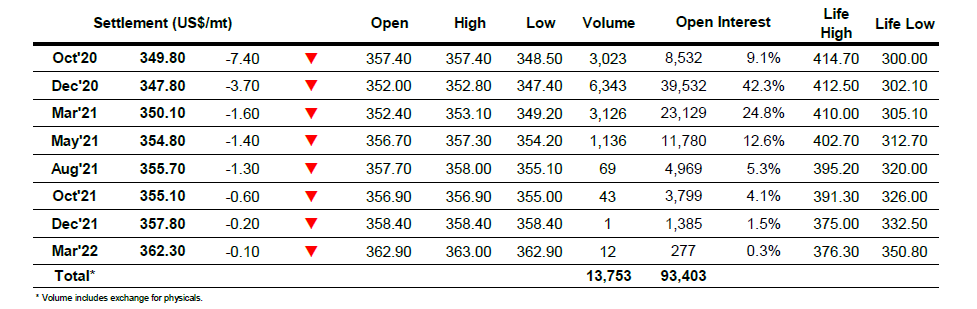

Early support soon faded with the market coming under pressure by mid-morning, led by the last of the rolling ahead of tomorrow’s Oct’20 expiry. The Oct/Dec’20 spread has performed well recently despite funds rolling their longs into it however having recorded a new recent high of $6.50 during the morning the presence of selling sent the differential all the way back to flat before stabilising a little during the later afternoon. This vulnerability pulled Dec’20 down to a new recent low at 347.80 and with last week’s COT report showing the fund long remaining high at 27,988 lots there may be some who are questioning whether they can continue to hold their longs should we break down further. Open interest has fallen a little to 8,532 lots and we seem to have established the core position for expiry with 350-400,000 lots anticipated to be tendered, subject to tomorrows spread moves. Closing values were technically weak, settling just 0.40c above the lows at 347.80.

Dec – White Sugar

ICE Futures U.S. Sugar No.11 Contract

ICE Europe White Sugar Futures Contract