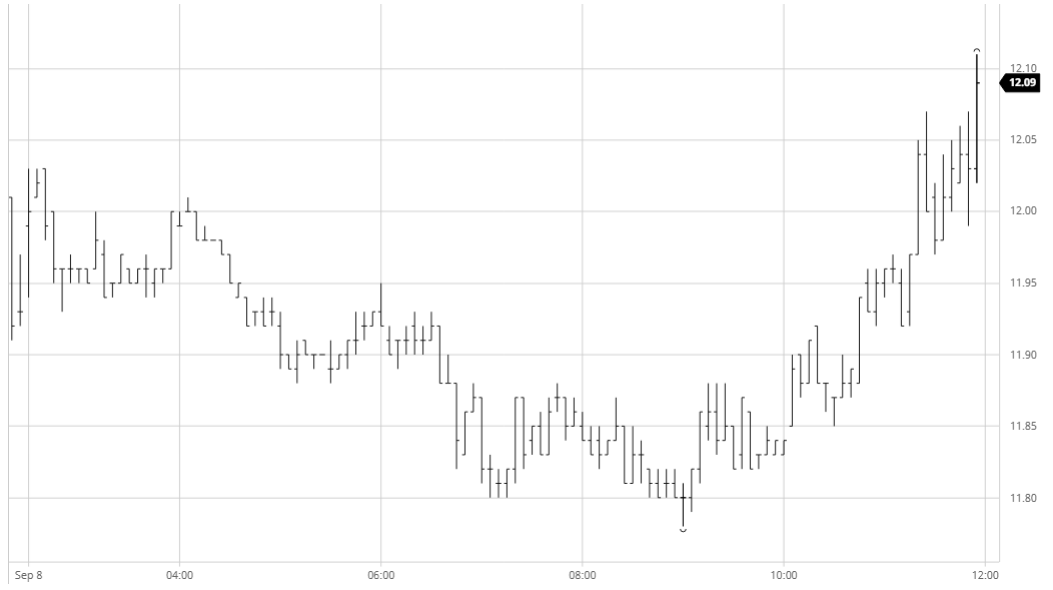

Returning from the long weekend the market was arguably due to begin around 20 points higher on the basis of the firmer London whites yesterday, though in reality following a weak technical close on Friday this never seemed likely. In the event we saw initial gains of up to 10 points though they were remarkably short-lived with prices soon retreating back towards unchanged levels where they remained for a while as hedge lifting of fresh sales took place. Gradually we then slipped into negative ground though the decline was relatively orderly despite weaker macro factors, in particular crude which was taking a hammering. Moving to new recent lows and breaking the first nominal support at 11.84 failed to garner any increased momentum with a prolonged period at the bottom of the range seeing Oct’20 only extend to 11.78 with only small quantities of spec involvement. The larger volumes were being seen for the Oct’20/March’21 spread with today marking the first day of the main index roll, though here too there was limited lower impact with the differential only moving to -0.69 before strengthening to -0.65 as the day progressed, suggesting some strong trade interest to offset the spec selling. With the spreads now firmer the later afternoon saw outrights also recover and somewhat unexpectedly we were back into positive ground as we entered the final hour. The closing stages saw values remain firm with late buying ensuring that Oct’20 settled back above 12c to post its first positive session for a week and negate some of the recent weak technicals.

Oct – Sugar No.11

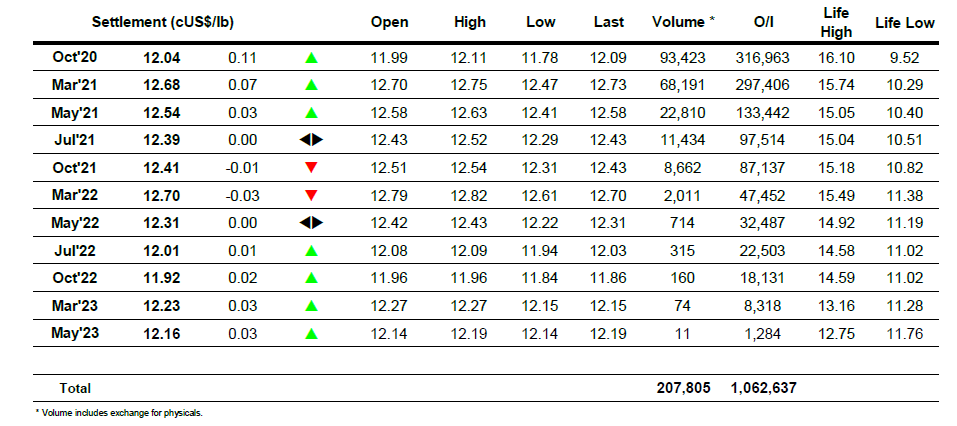

ICE Futures U.S. Sugar No.11 Contract

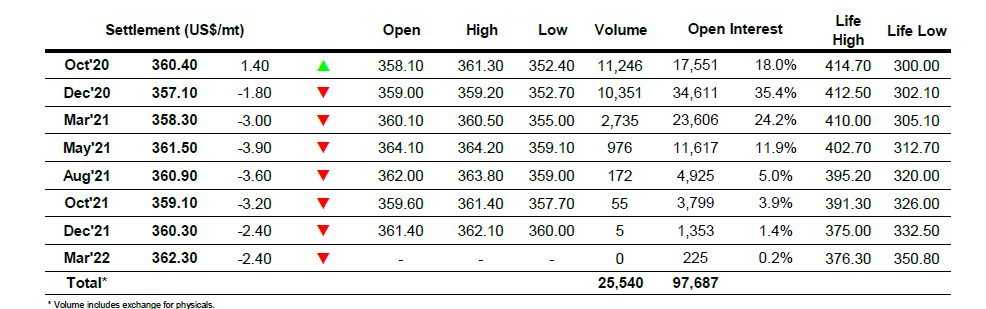

ICE Europe White Sugar Futures Contract