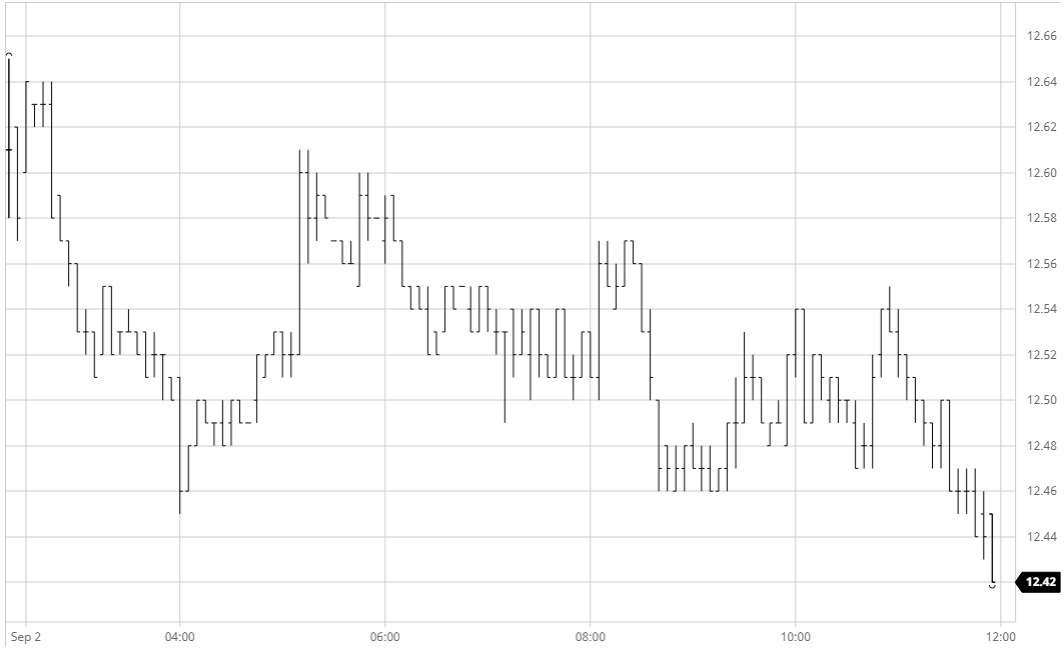

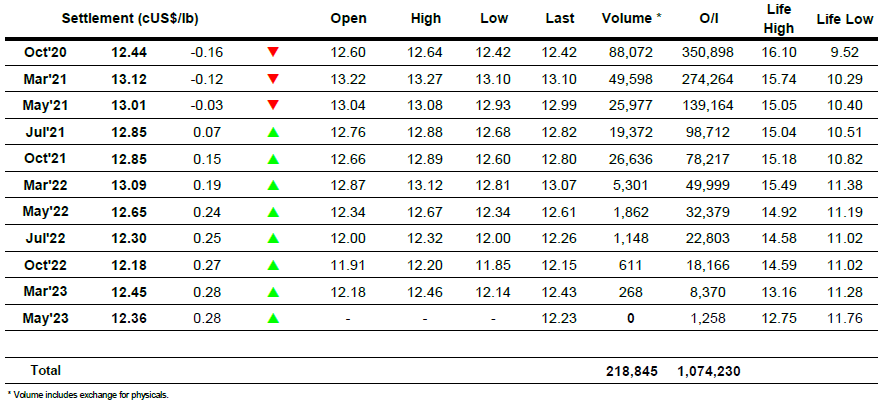

Yesterday’s struggles led to something of a hangover as initial light gains were quickly lost and the market resumed the downward path to explore underlying support basis last week’s 12.50 lows/August’s 12.39 low. Selling was appearing for October both outright and through the spreads leading the price down to 12.45, though the pressure was then relieved through some short covering that rather unexpectedly pulled values back towards overnight levels. This was merely a blip to the trend however and in rather mundane trading we saw nearby prices begin to edge downward once more. In stark contrast to this action the back half of the board was finding remarkably good support with all positions from Oct’21 forward showing double digit gains though this did nothing to reverse the struggles for the nearby prompts. More aggressive selling emerged for the nearby positions during the final hour to send Oct’20 to new session lows while the Oct/March’20 discount widened a little further to -0.69 points. A weak settlement was posted at 12.44 as a result of this move and we would expect to see further testing of the 12.41/12.39 support tomorrow.

Oct – Sugar No.11

ICE Futures U.S. Sugar No.11 Contract

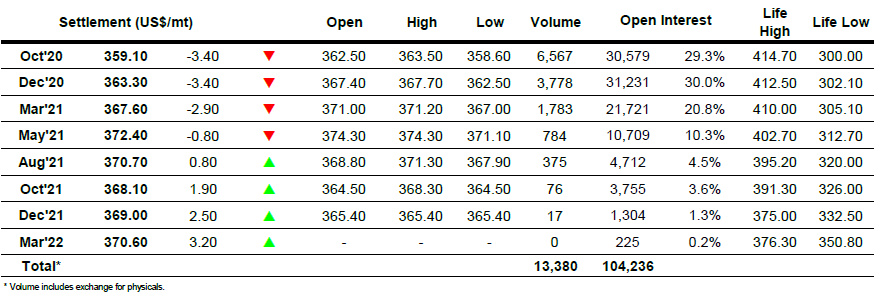

ICE Europe White Sugar Futures Contract