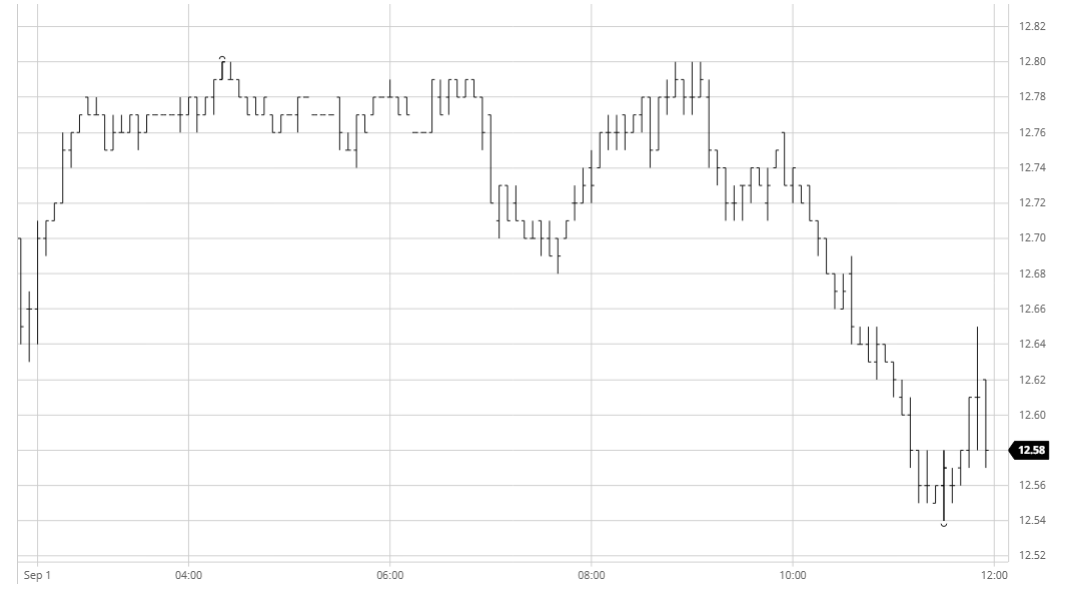

The market initially looked to push upwards as we followed on from the flat performance during yesterdays shortened session. This initial move successfully took Oct’20 to the 12.80 area however from here progress became much toucher and despite a positive macro environment we stalled and instead entered a sideways pattern which held for several hours. The pattern was only broken when selling around the US opening sent Oct’20 back beneath 12.70 however with the macro remaining positive and the USDBRL having opened firmer at around 5.38 there remained encouragement for the smaller specs who pushed back upward to match the morning highs. A second decline proved to be more significant than the first as prices fell back below unchanged and continued lower to move back within a few points of last week’s lows. Support emerged in front of 12.50 to stem the decline and limit the session low to 12.54 however the lack of impetus earlier in the day despite external encouragement may yet be a sign that the recent exhaustion may lead us a little lower in the near term.

Oct – Sugar No.11

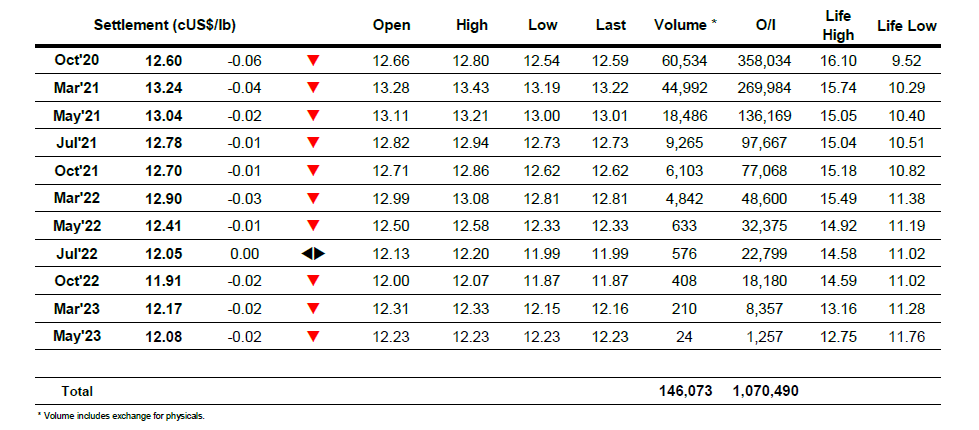

ICE Futures U.S. Sugar No.11 Contract

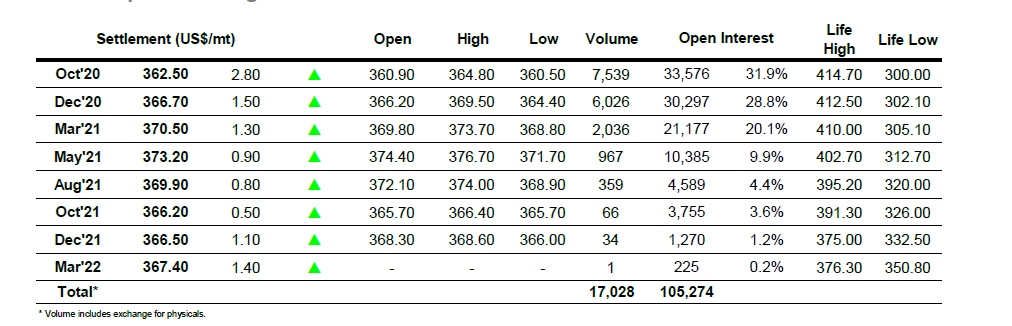

ICE Europe White Sugar Futures Contract