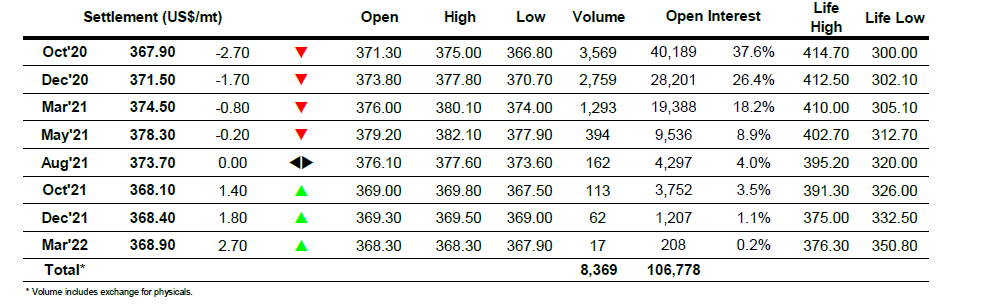

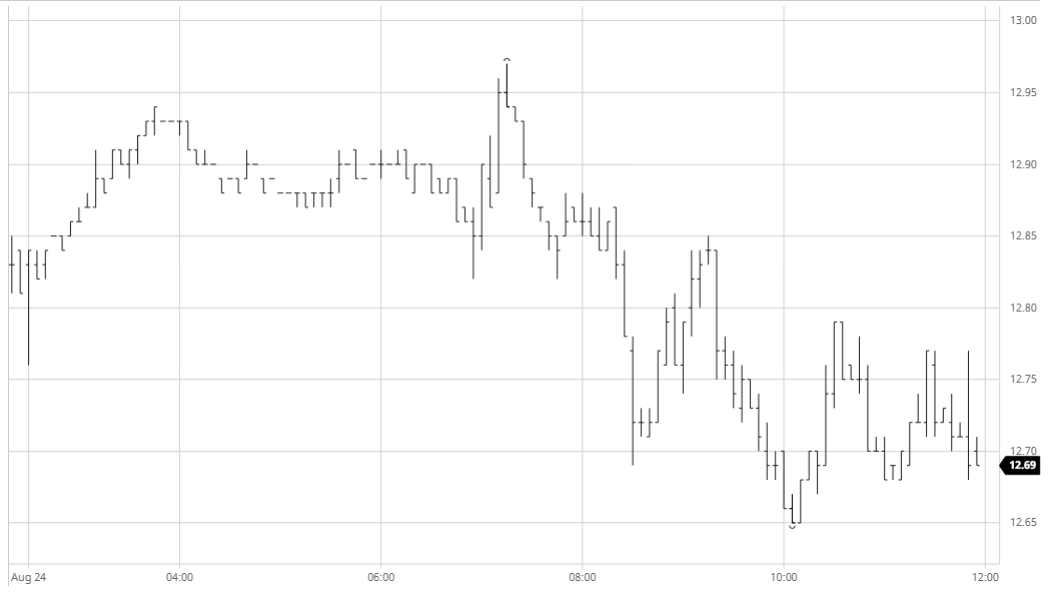

Having fallen back beneath 13c at the end of last week we commenced rather slowly with traders reluctant to push back upwards, playing out the first few hours either side of Fridays closing levels. Fridays COT number showing the funds net long having grown to 179,251 lots may also be leading to some reluctance from buyers as though history shows that they have the potential to double this figure we would likely need a far stronger fundamental picture for this to occur. At present the weakness in the BRL (though the USDBRL is currently trying to gain some stability around 5.60) is encouraging pricing down the board on rallies while the potential for Indian exports should prices rise further will also combine to potentially cap rallies. This did not prevent a brief spec led push to 12.97 soon after the arrival of US based traders however the move was short-lived and we soon began to decline once again, seeing some long liquidation when breaking beneath the morning lows. The remainder of the afternoon became a rather choppy affair but with the 13c momentum lost for the time being it was the lower end of the range which was encouraging the greater interest. Spread selling was also showing a marked increase with Oct/March moving to a 63 point discount, combining with the outright activity to leave Oct’20 closing at 12.71 to mark a third consecutive decline.

Oct – Sugar No.11

ICE Futures U.S. Sugar No.11 Contract

ICE Europe White Sugar Futures Contract