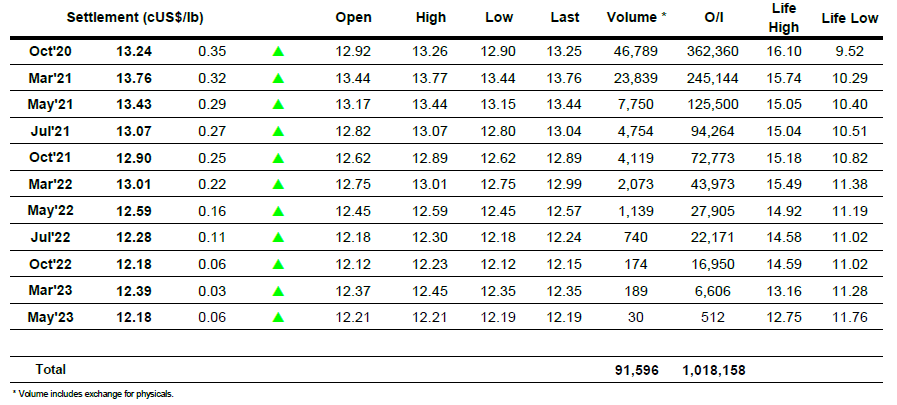

Slim buying in the morning led the market once again to the 12.90 levels, with very little volume. An early decline in crude oil prices, which undercut ethanol prices and may encourage Brazil’s sugar mills to direct more cane crushing toward sugar production rather than ethanol production. The market thereafter was swinging around 12.95 until 8:30. a.m., when the funds resumed their buying on the wake of continuous strong Chinese demand and concerns that drought conditions will reduce Thailand’s sugar crop despite some recent rain, reached level of 13.16. However, oil prices recovered leading the market into the 13.23s since then swinging back to the 13.21s and up again to settle at 13.24.

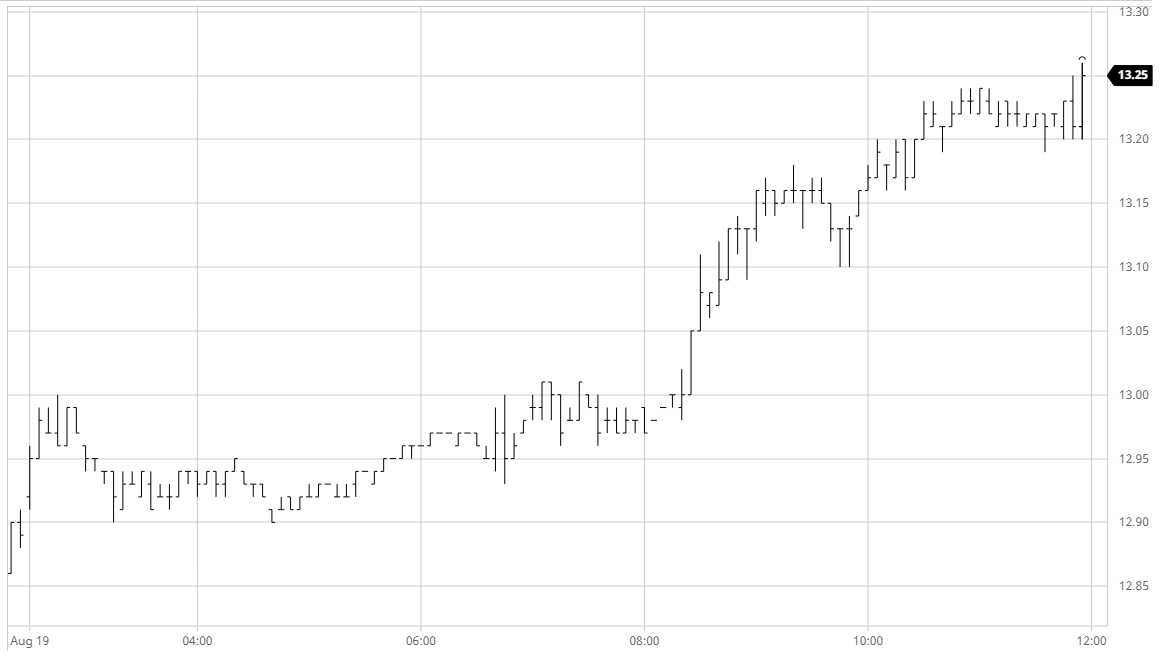

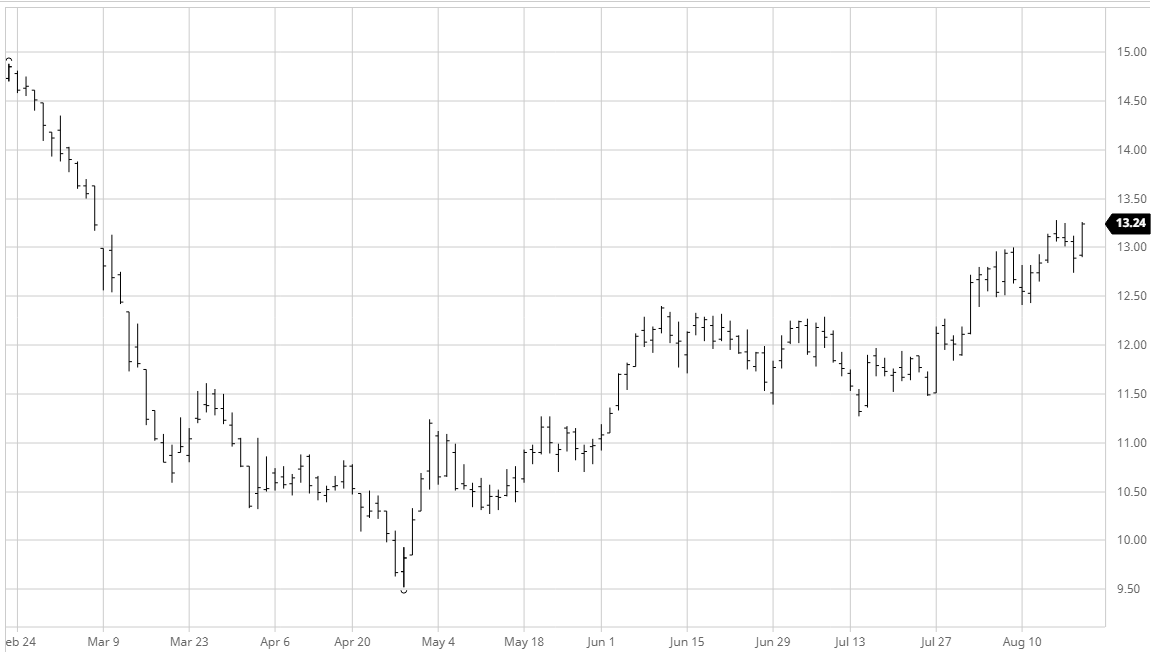

Oct – Sugar No.11

ICE Futures U.S. Sugar No.11 Contract

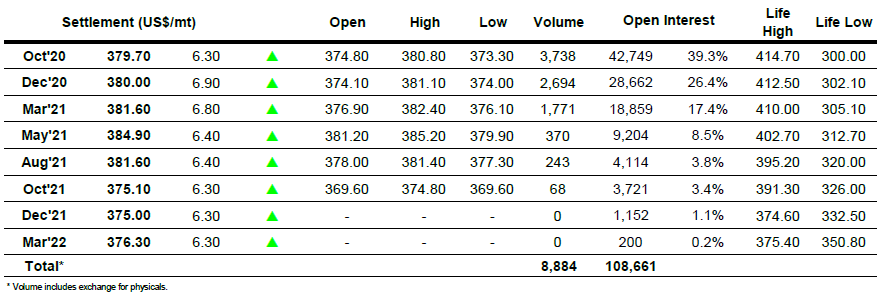

ICE Europe White Sugar Futures Contract