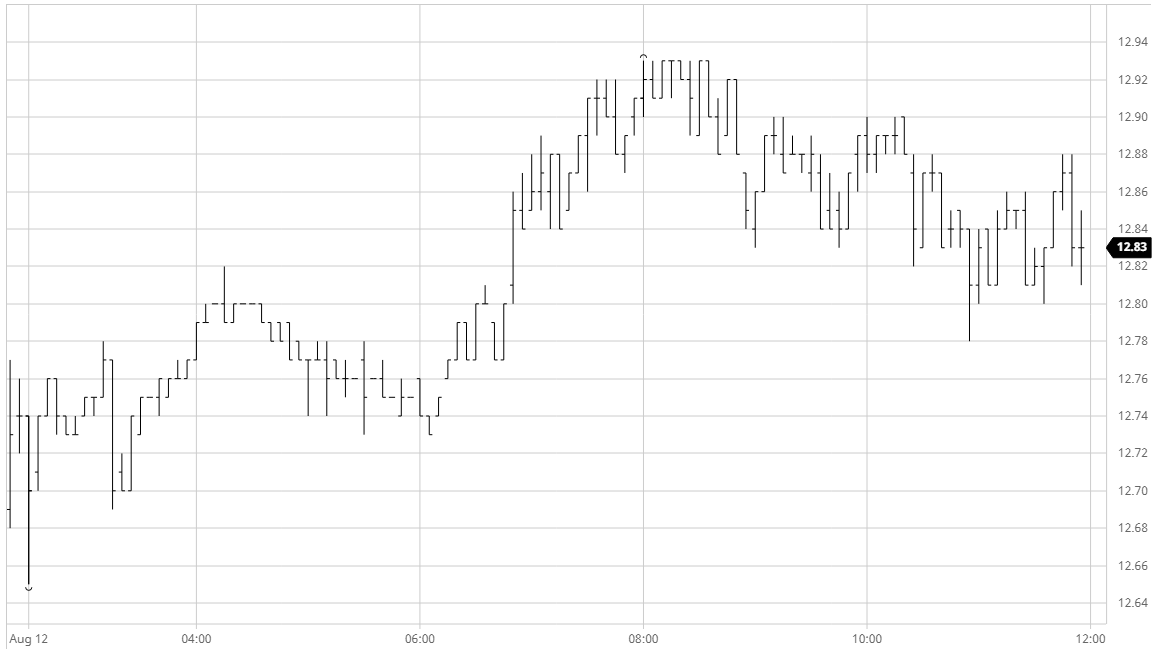

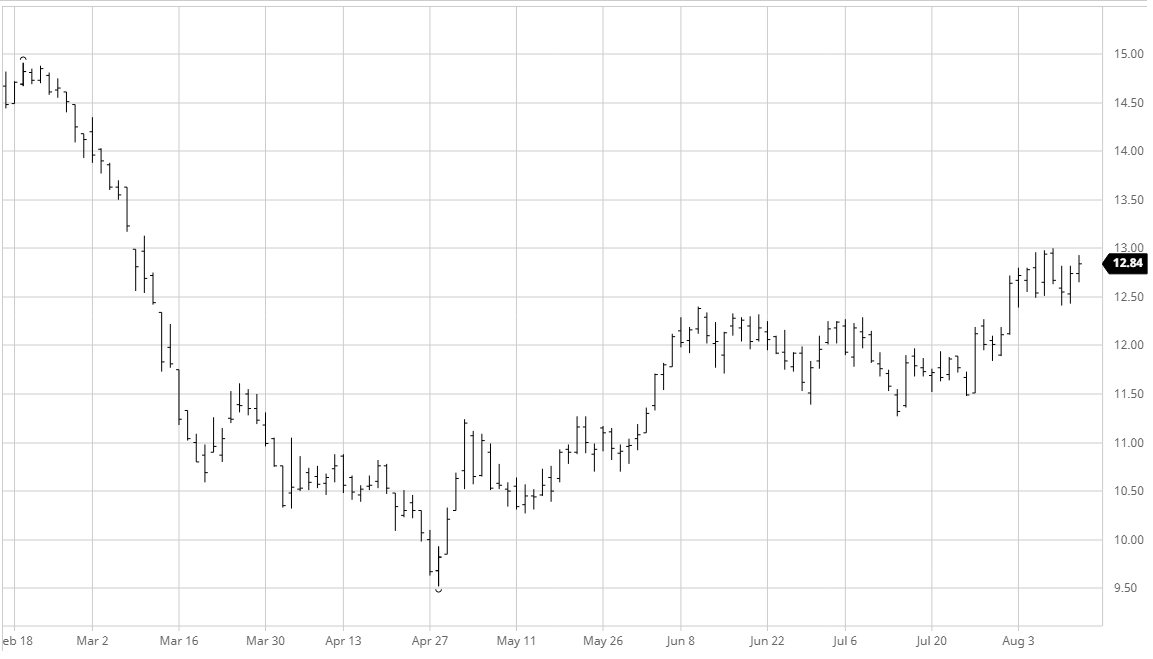

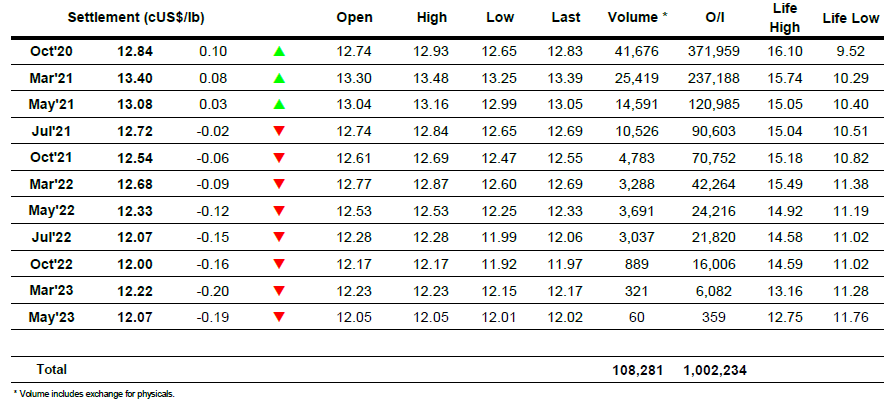

As usual, the day started very low volume and sugar within narrow range. From 9 a.m. onwards, bullish news of high demand and low crop in Thailand, attention to CS Brazil dry weather and a consolidation of oil prices worldwide drove today’s session in the NY Sugar market, with specs trying again to push the first prompt into the 13.00s. Live market chatter estimates a net spec long position of ~150k lots on the #11. BRL weakened further today on the trail of a dovish statement from the Brazilian CenBank yesterday and the resignation of two high profile names in Brazil’s economic agenda. The move created a good pricing opportunity for the Brazilian hedgers, who proceeded with 2021/2022/2022 pricing even with the low liquidity. This drove the back end of the curve down, emphasizing its current state of backwardation.

Oct – Sugar No.11

ICE Futures U.S. Sugar No.11 Contract

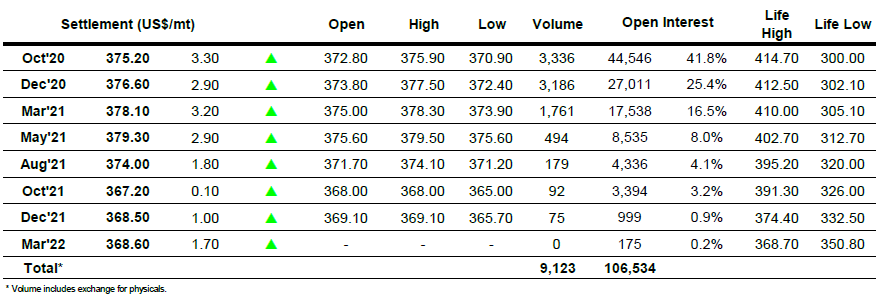

ICE Europe White Sugar Futures Contract