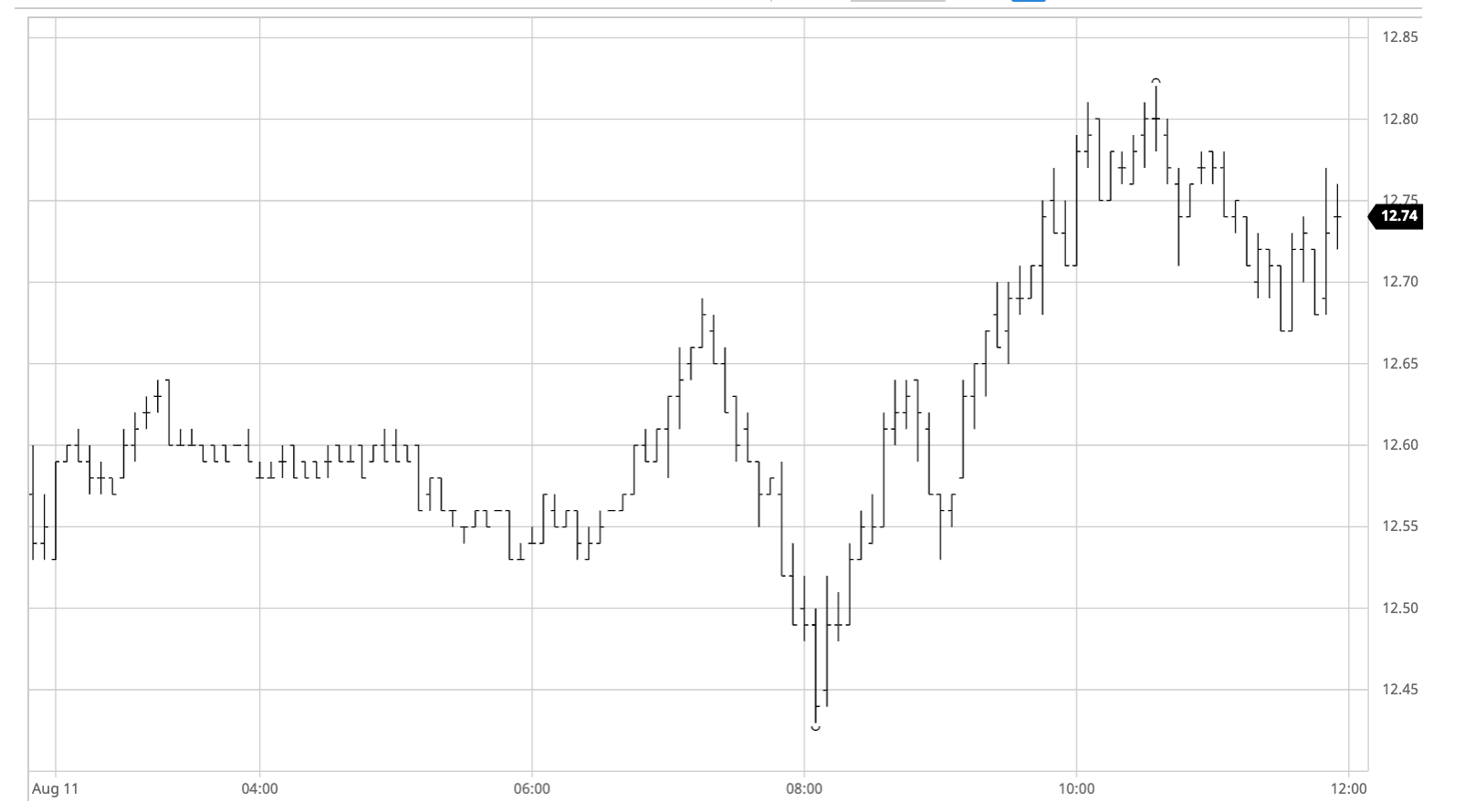

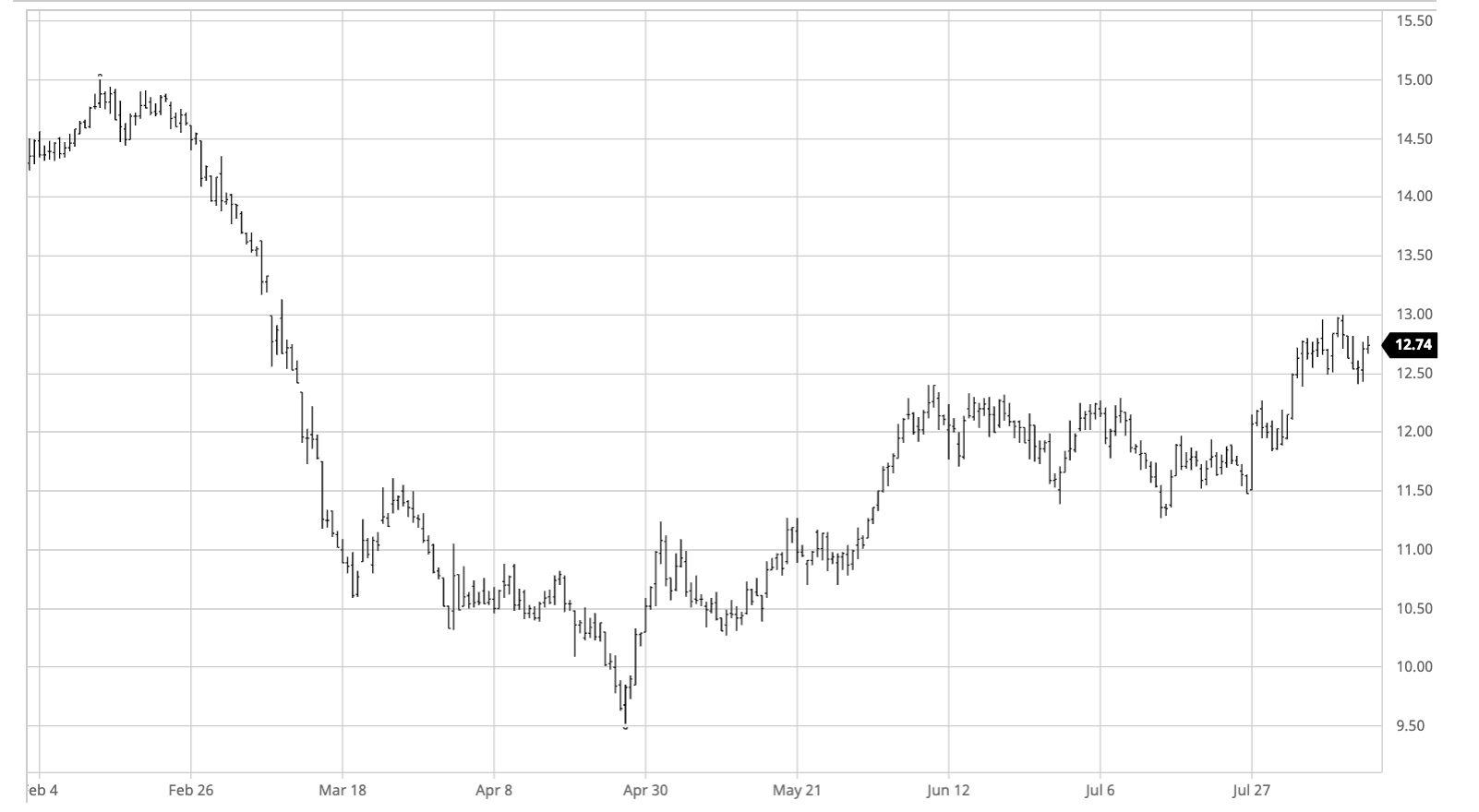

The day was marked by little liquidity, with small volumes producing a 0.40 c/lb range through the day. It started with the usual pattern of low activity in the morning, trading within a narrow range. After 8 a.m. NY time, new volume appeared and market progressed to 12.68 before the sellers took over in anticipation of UNICAs numbers, which revealed a 1.2% increase in cane crushed in CS Brazil on the second half of July compared to a year earlier . Continued buying action succeeded, however, on the wake of a strong demand, poor expected crop in Thailand and concerns that the drier weather in CS Brazil might present an obstacle to the huge expected crop moving forward. The market reached a high of 12.82 on Oct 20 prompt, which allowed producers particularly in Brazil to proceed with their hedging, taking advantage of the weak BRL and bring the market back a little bit to the low 12.70s, with the V0 closing at 12.74.

Oct – Sugar No.11

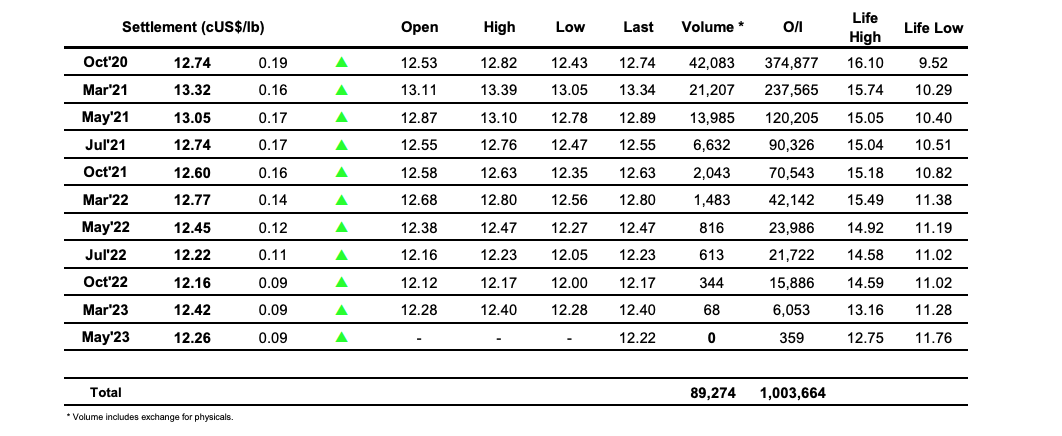

ICE Futures U.S. Sugar No.11 Contract

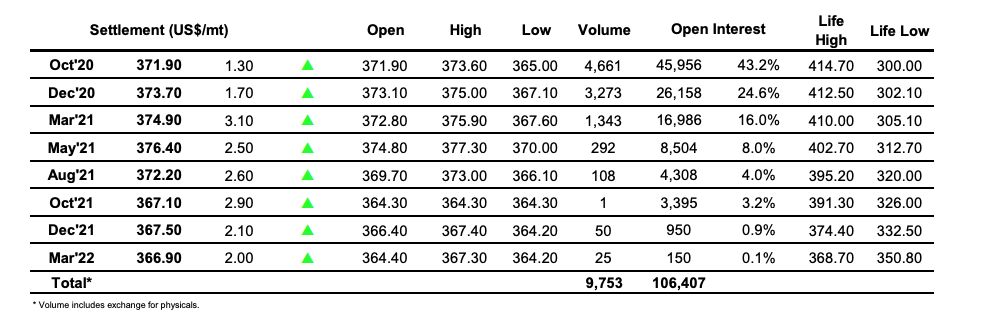

ICE Europe White Sugar Futures Contract