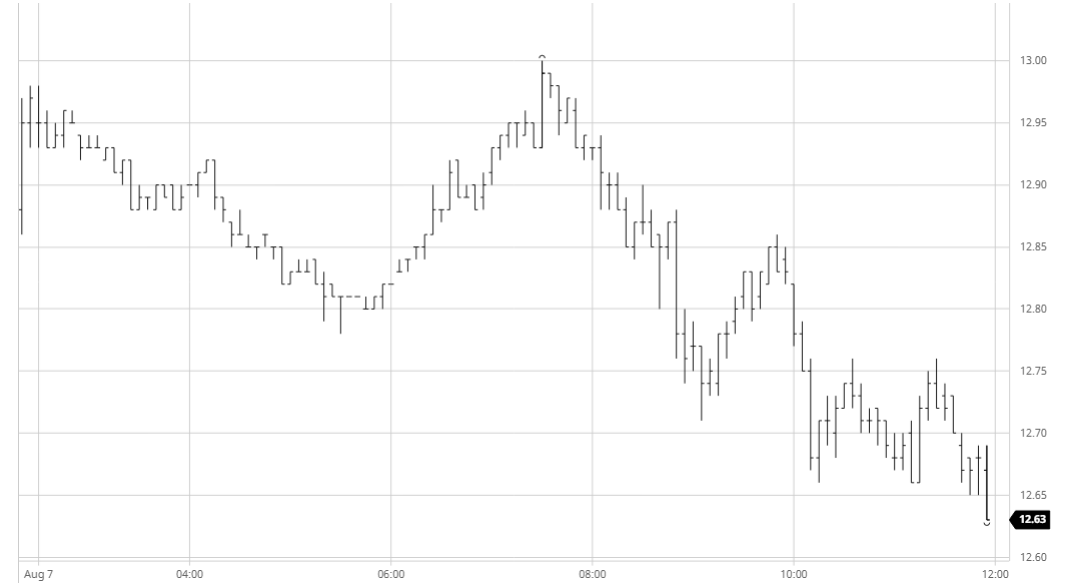

The day commenced with values broadly unchanged and we matched yesterday’s high mark of 12.98 before sliding back a little on light volumes. There remains good scale selling from producers above the market and in the absence of any spec interest prices eased back a little further, awaiting the arrival of US based specs as we looked to see whether the market could continue to build and mount a move beyond 13c for Oct’20. Mid-session saw the spec buying arrive on cue and the market mounted a steady climb back to the morning highs, with a push following to take Oct’20 very briefly to 13.00. The high was short-lived however and prices once again started to decline as specs and day traders endured a torrid time with some long liquidation. Spreads meanwhile continued to be rather firm with Oct/March remaining in between -0.58 and -0.54 despite the weakening outrights, however this was doing little to bring the market back up with further long liquidation leading us toward a disappointing end to the week. Closing activity was played out at the bottom of the day’s range and while by no means terrible it will be perceived as disappointing to the bulls suggesting that we have raised the range higher and the hopes for a full bull run may be somewhat premature.

SB Oct – Sugar No.11

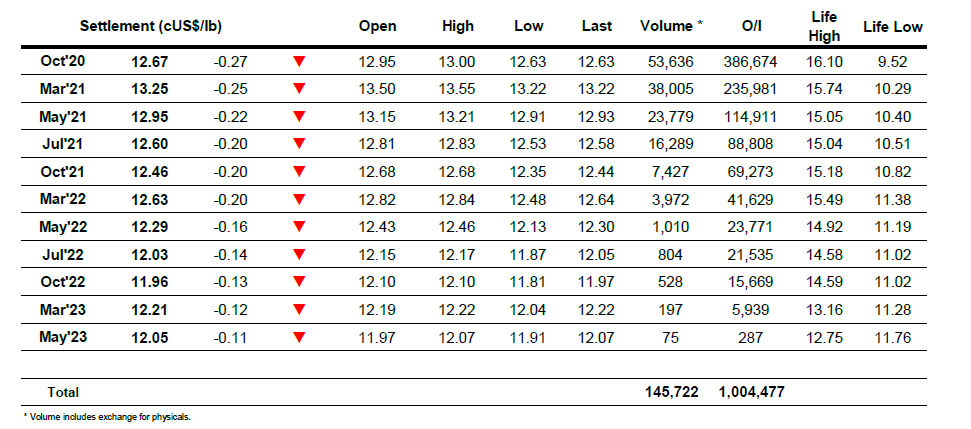

ICE Futures U.S. Sugar No.11 Contract

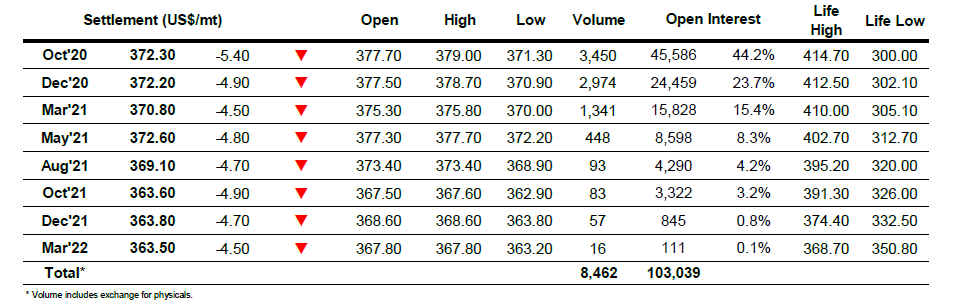

ICE Europe White Sugar Futures Contract