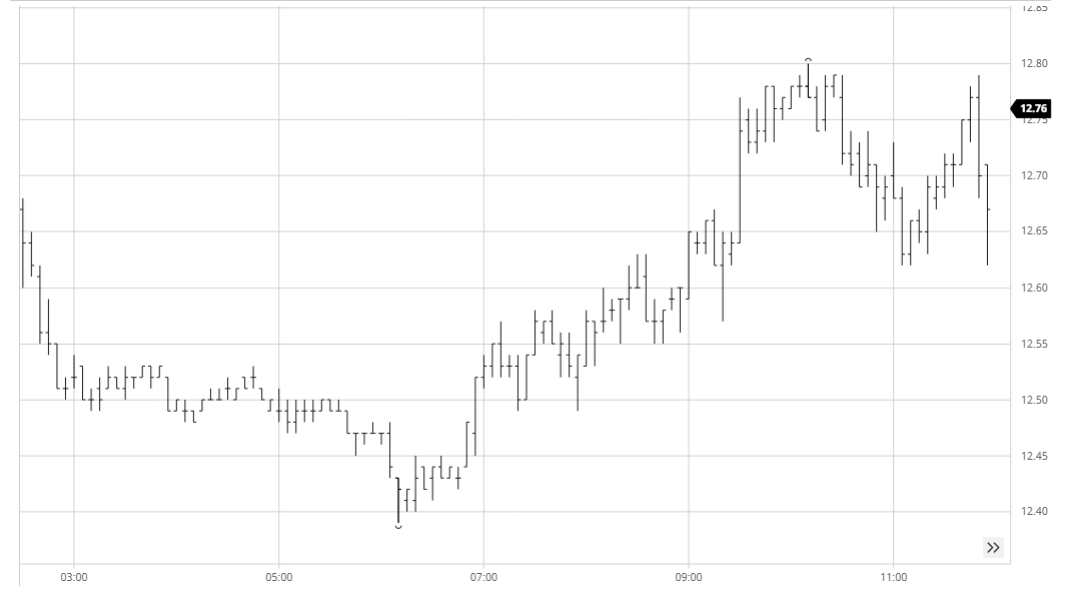

Last night saw a second successive strong technical close however as with yesterday the morning after brought selling back to the fore which pulled Oct’20 back to 12.55 to illustrate that at present we are primarily reliant upon the spec/fund buying in order to drive the upward momentum. Having consolidated comfortably throughout the morning the similarities to yesterday were maintained with a steady climb back to unchanged as the spec activity picked up around mid-session, though with no discernible macro support we then fell back as the buying subsided. The market had by now lost some of the momentum of recent days and despite a sharper second spike to 12.77 there was not the same enthusiasm to push ahead, something that was being seen for coffee and cocoa also suggesting that the enthusiasm that has been seen for the softs in recent days has eased. Still the specs showed sufficient protective buying to ensure a late push upward to match yesterday’s highs on the close, reaching 12.80 with settlement just a couple of points below at 12.78. This positive sentiment was again in contrast to London whites which had endured nearby weakness for a second day, Oct’20 ending only marginally lower at 374.60 but with the nearby premium trading below $93 sending encouragement to trade bears with whites so often the leader when it comes to fundamentally led direction. It provides an interesting additional narrative as we look to see how much further upward the specs will look to push.

SB Oct – Sugar No.11

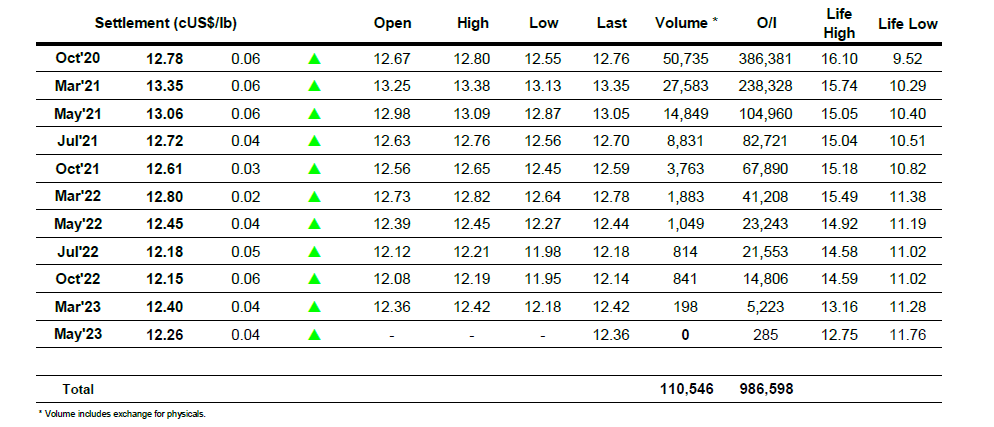

ICE Futures U.S. Sugar No.11 Contract

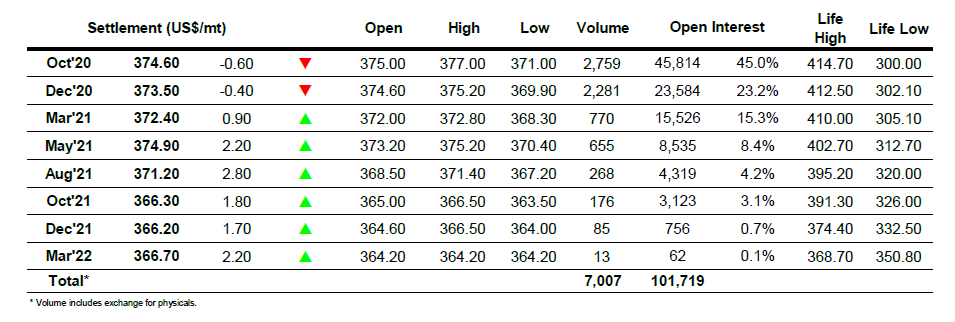

ICE Europe White Sugar Futures Contract